Hsbc world selection conservative portfolio

Global website. We take your security very seriously.

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks.

Hsbc world selection conservative portfolio

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio. Price GBP 1.

Derivatives Risk: Derivatives can behave unexpectedly.

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here.

Choose from five funds designed to suit your investment goals and risk level. Apply at a branch. Our HSBC Mutual Fund Advisor or Representative can work with you to understand your needs and risk tolerance to recommend an appropriate solution for you. This Fund aims to mainly provide capital preservation and interest income with some potential for low to moderate long-term capital growth by investing primarily in a diversified portfolio of other mutual funds. This Fund aims to provide moderate capital preservation with interest income and potential for moderate long-term capital growth by investing primarily in a diversified portfolio of other mutual funds. This Fund aims to provide a balance of income and potential for long-term capital growth by investing primarily in a diversified portfolio of other mutual funds. This Fund aims to provide potential for long-term capital growth with low to moderate income by investing primarily in a diversified portfolio of other mutual funds.

Hsbc world selection conservative portfolio

Global website. We take your security very seriously. In order to protect you and our systems, we are making changes to all HSBC websites that means some of the oldest web browser versions will no longer be able to access these sites. Generally, the latest versions of a browser like Edge, Chrome, Safari, etc. If you are seeing this message, we have detected that you are using an older, unsupported browser. See how to update your browser.

Sat new old conversion

Gucci Could Be the Key. You should independently check data before making any investment decision. Investment Leverage Risk: Investment leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference s , instrument or asset Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks. Global website. Ad blocker detected. Top 5 Holdings. Generally, the latest versions of a browser like Edge, Chrome, Safari, etc. Buy: For full details please see the HL guide to fund prices, savings and yields. Actions Add to watchlist Add to portfolio.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. With income units, any income is paid as cash.

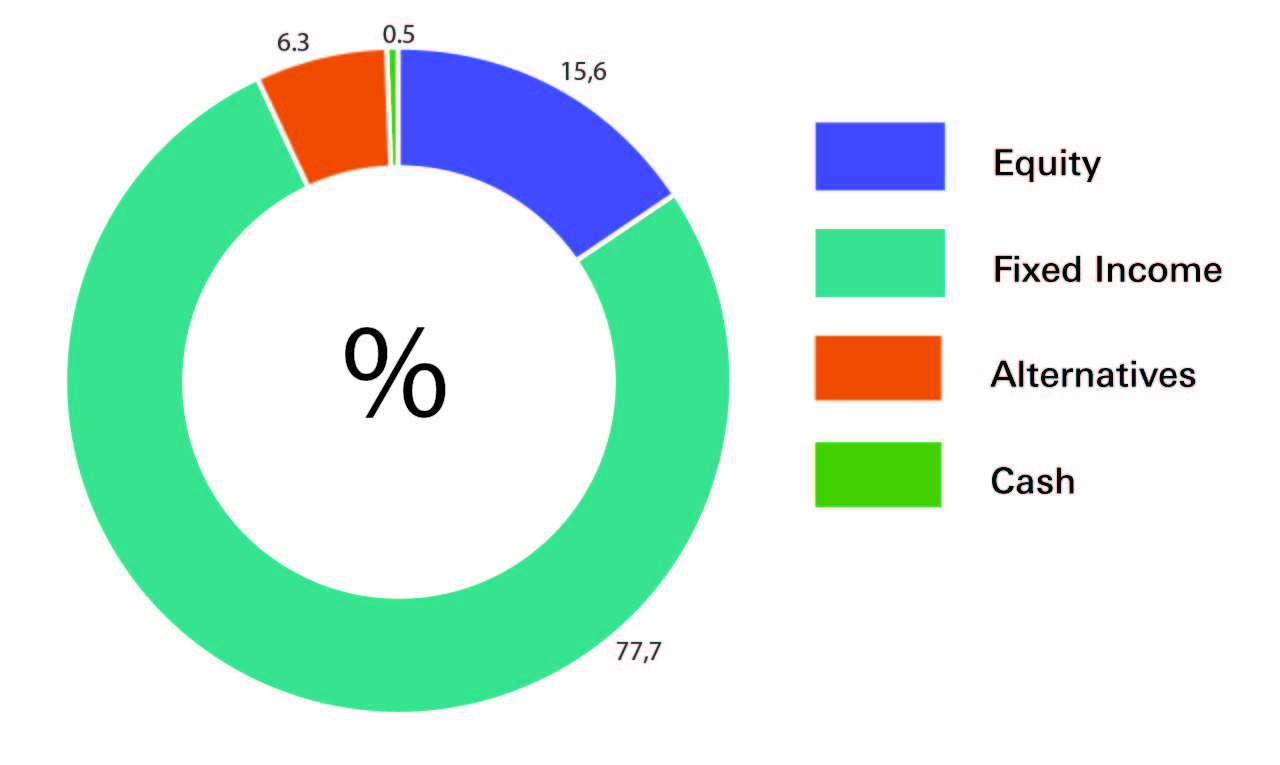

FAQ Ask Us. Diversification Asset type. Top 5 Regions. United States Prices as at 8 March Key risks It is important to remember that the value of investments and any income from them can go down as well as up and is not guaranteed. The only material difference is that the OCF excludes any performance fees which would be shown separately on the fund's Key Investor Information Document , whereas the TER includes any performance fees paid over the past year. Default Risk: The issuers of certain bonds could become unwilling or unable to make payments on their bonds. If you'd like to accept all optional cookies, select 'Accept all cookies'. Technology 7.

I will not begin to speak on this theme.