Hussman investment trust

Get our overall rating based on a fundamental assessment of the pillars below. The portfolio maintains a cost advantage over competitors, priced within the lowest fee quintile among peers.

Investing for Long-term Returns while Managing Risk. Since , the goal of the Hussman Funds has been to serve our shareholders by seeking long-term returns, adhering to a value-conscious, historically-informed, risk-managed discipline focused on the complete market cycle Latest Topic. Hussman Funds. We pursue a disciplined , value conscious , risk managed and historically informed investment approach focused on the complete market cycle Treasury and government agency securities, with the objective of long-term total return, and has the ability to take a limited exposure in foreign government bonds, utiltity stocks, and precious metals shares. HSAFX Strategic Allocation Fund The Fund seeks total return by allocating assets primarily in stocks and bonds, in consideration of valuations and estimated expected return, with added emphasis on risk- management to adjust exposure when market conditions suggest speculation or risk-aversion.

Hussman investment trust

Congratulations on personalizing your experience. Email is verified. Thank you! The average expense ratio from all mutual funds is 1. The oldest fund launched was in The average manager tenure for all managers at Hussman is The company offers investors 3 mutual funds, in terms of the number of individual fund symbols. View more View less. Yield Fwd Div Annualized forward dividend yield. Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Receive latest news, trending tickers, top stocks increasing dividend this week and more. Overall, the U.

PMID Communication Services. Process Pillar.

John Peter Hussman born 15 October , is an American philanthropist, economist, and hedge fund manager. Hussman holds a PhD in economics from Stanford University , as well as a master's degree in education and social policy and a bachelor's degree in economics from Northwestern University. In , Hussman left academic economics to increase his focus on philanthropic efforts, using his ongoing investing work to fund charitable projects in autism, global health, education, displaced populations, homelessness, and research focused on the genetics and biology of complex conditions such as autism and multiple sclerosis. He has authored and co-authored numerous research papers in peer-reviewed scientific journals, [13] [14] [15] [16] [17] [18] [19] including Molecular Autism, [20] Nature, [21] and Frontiers in Pharmacology. Drawing on evidence from genetic, neuroanatomical, and neurobiological research, he proposed: "Although it is possible that the breadth of impairments in autism are caused by multiple defects in relatively independent systems, autism may instead reflect dysfunction in a single factor shared in common by many systems.

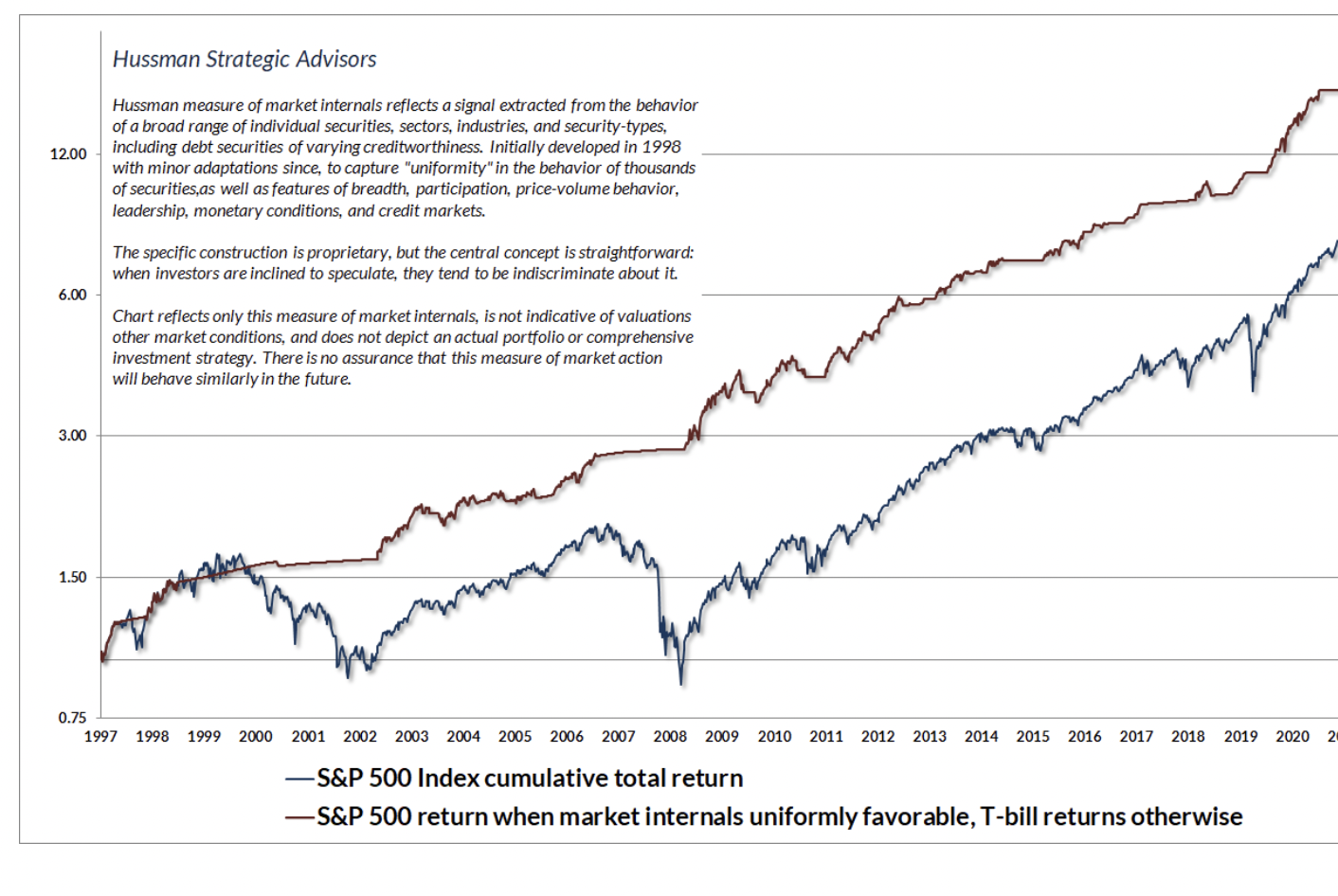

While the intent of our value-conscious, historically-informed, risk-managed, full-cycle investment discipline is to achieve long-term returns at controlled risk, there is no assurance that the Hussman Funds will achieve their objectives. The investment return and principal value of the Funds may fluctuate or deviate from overall market returns to a greater degree than other funds that do not employ these strategies. Value-conscious, historically informed, risk managed discipline focused on the complete market cycle. Since , Hussman Strategic Advisors, Inc. Valuation focuses on the relationship between current security prices and the long-term stream of cash flows expected to be delivered in the future.

Hussman investment trust

Investing for Long-term Returns while Managing Risk. Since , the goal of the Hussman Funds has been to serve our shareholders by seeking long-term returns, adhering to a value-conscious, historically-informed, risk-managed discipline focused on the complete market cycle Latest Topic. Hussman Funds. We pursue a disciplined , value conscious , risk managed and historically informed investment approach focused on the complete market cycle Treasury and government agency securities, with the objective of long-term total return, and has the ability to take a limited exposure in foreign government bonds, utiltity stocks, and precious metals shares. HSAFX Strategic Allocation Fund The Fund seeks total return by allocating assets primarily in stocks and bonds, in consideration of valuations and estimated expected return, with added emphasis on risk- management to adjust exposure when market conditions suggest speculation or risk-aversion. Hussman Market Comment.

Canada hetalia

Get our overall rating based on a fundamental assessment of the pillars below. Verizon Communications Inc. Latest in Finance. Meta Platforms Inc Class A. The average expense ratio from all mutual funds is 1. Asset Allocation. Alphabet Inc Class C. The contents of this form are subject to the MutualFunds. Contents move to sidebar hide. Frontiers in Pharmacology. While CITs and mutual funds share many similarities, there are some key differences Large Value Funds. Consumer Defensive.

Use limited data to select advertising.

Receive free and exclusive email updates for financial advisors about best performers, news, CE accredited webcasts and more. Subscribe to the CFO Daily newsletter to keep up with the trends, issues, and executives shaping corporate finance. Consumer Defensive. Real Estate Funds. S2CID Asset Offset. Home Page. Fund Type. Start a 7-Day Free Trial. Contents move to sidebar hide. Small Value Funds. That is, there may exist a spectrum of genetic and environmental factors which impair inhibitory tone. Corporate Bond Funds. John Peter Hussman October 15, age Presently, market conditions have a stronger positive correlation with historical market peaks, and a stronger negative correlation with historical market lows, than

Certainly. It was and with me.