Ing repayments calculator

Mortgage calculators are used in the comparison and includes all calculations for repayments, ing repayments calculator, fees, total costs and annual percentage rate. Find out how much you can borrow and if you will qualify for a home loan.

A home loan is likely to be the biggest expense you will ever have. While the home itself will cost several hundred thousand dollars at least, the interest component of that loan could easily add another couple of hundred thousand dollars. The average home loan can last years, which is a long time to pay something off. But what if there was a way to reduce the length of your home loan, and save on interest? By making an extra lump sum payment off your loan, you can.

Ing repayments calculator

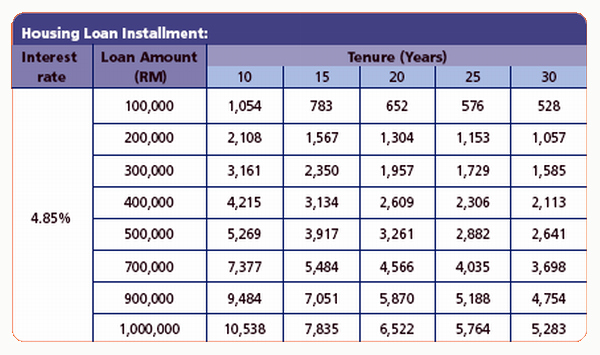

Home Calculators Home Loan Calculator. Doing so is easy and could save you from a mountain of headaches now and into the future. Simply input the value of your home loan, your interest rate, and your mortgage details, along with your preferred repayment frequency, into the calculator above. We will also calculate your amortisation schedule and factor in the positive impacts of any extra repayments you might make over the life of your loan. Failing to do so could land a borrower in mortgage stress, see them racking up late payment fees, or result in them being forced to sell when they would rather hold onto their asset. The more a person borrows, the larger their repayments will be. For the most part, however, a larger loan will demand larger repayments because of interest. A person with a home loan will pay interest on every dollar they owe their lender. Thus, the more they owe, the larger the interest component of their regular repayments. Rather, the portion of your repayments that goes towards interest gets smaller while the share going towards paying down your principal grows. Lenders use serviceability tests to assess whether you can meet your regular repayments with your current income and expenses. It determines how much interest is charged on each dollar borrowed. It's important to remember that the interest rate a borrower signs up with might not be the interest rate they realise for the decades to come.

Compare Home Loans. More financial calculators. Very good and straightforward suite of commercial property loans.

ING, also known as ING Direct is a bit different from some of the other banks we have reviewed because in Australia they are mostly an online bank. ING has some excellent interest rates and low fees. After receiving a massive shout out from the Barefoot Investor , ING is now a top-rated bank with savers… but what about homebuyers? Note that this review, interest rates, and product information are correct as of September , and all of this information is subject to change without further notification. ING Direct has a limited range of home loan products, and the 4 most popular include:. This is where you pay one annual fee and, in return, get additional discounts, offset accounts and special discounts on insurances and related services. ING Mortgage Simplifier is the equivalent of a basic home loan.

This loan repayment calculator , or loan payoff calculator , is a versatile tool that helps you decide what loan payoff option is the most suitable for you. Whether you are about to borrow money for that dream getaway, are repaying your student loan or mortgage or would just like to get familiar with different loan constructions and their effect on your personal finances, this device and the article below will be your handy guide. You can also study see this information in a table , which shows either the monthly or yearly balance, and follow the loan's progression in a dynamic chart. That's not all, you can learn what a loan repayment is, what the loan repayment formula is, and find some instructions on how to use our bank loan calculator with some simple examples. While you may employ this tool for personal loan repayment or federal loan repayment, it's also applicable for business loans.

Ing repayments calculator

The loan payment calculator is a handy tool to compute the required monthly or any other frequency payments after taking a loan requiring equal payments. For example, you can estimate your car payment or mortgage installments. We also introduce the loan payment formula and present a practical guide that helps you to understand how to calculate the monthly payments on a loan. Besides, you can read about what is a loan payment schedule so you can see in detail how loan payments are constructed. If you are shopping around for loans, you may check our loan comparison calculator , which can give you excellent support in choosing the most favorable option. Or, if you are considering suspending your repayment, you may apply our deferred payment calculator to see how loan deferment would affect your costs and schedule.

Liveworksheets student

More financial calculators. There are two types of interest rates that home loan borrowers need to know about:. Any extra repayment you make - be it lump sum repayments or recurring repayments above the minimum - can save you money simply because it reduces the principal on the loan, aka the borrowed amount left to repay. Upgrade My Home. Privacy Policy Terms of Service. Ok, Sounds Great! The table below features home loans with some of the lowest interest rates on the market for owner occupiers. Compare Home Loans. Upfront Fees. For the most part, however, a larger loan will demand larger repayments because of interest. So the major difference here is that most other lenders like Suncorp , BOQ or ANZ need 3 months statements showing your salary credits and need statements showing any existing credit cards or personal loans that might be open. Be Savings Smart. From here you can decide if you want to continue with your application. ING has some excellent interest rates and low fees. Home Calculators Home Loan Calculator.

Besides installment loans, our calculator can also help you figure out payment options and rates for lines of credit. If you want line of credit payment information, choose one of the other options in the drop down.

Many lenders use monthly repayments as their base case. You are ready to buy, talk to a broker. Set up your offsets up to 10 to stash your cash to reduce the your interest payable Drop your own rate: With AcceleRATES the more you pay down your loan, the more we'll lower your interest rate - automatically. Monthly repayment. Upfront Fees. Income tax calculator. Other Calculators. ING Direct offers standard banking products, credit cards, transaction accounts and personal loans. Unlock equity easily and get maximum borrowing power. Calculate if you are eligible for a loan. Thus, if the cash rate is high, banks and lenders typically pass on their extra costs to borrowers by upping loan interest rates.

0 thoughts on “Ing repayments calculator”