Investment banking analyst salary

Investment Banking Salary Guide: Provides salary information for different positions in the industry, helping individuals understand earning potential and benchmark salaries, investment banking analyst salary. Investment banking IB is a type of banking that offers services related to raising capital to other companies and sometimes even governments. They help plan and manage the financial aspects of sizable projectsand their services include:.

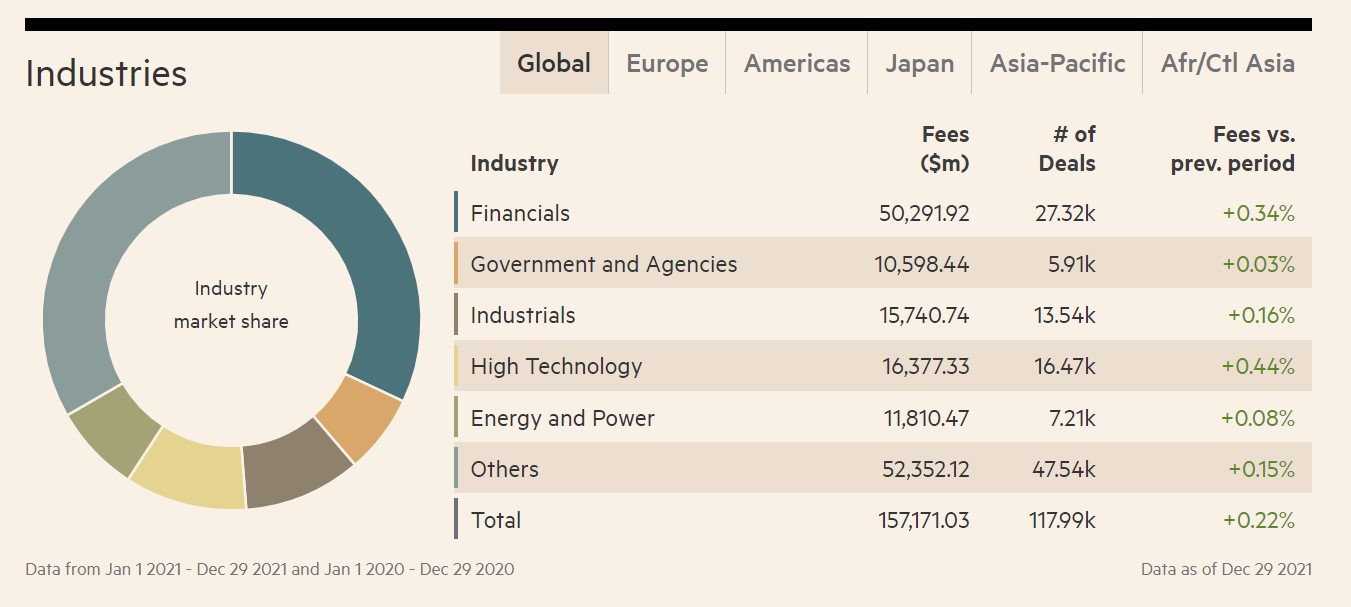

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! The Investment Banking scorecard from Dealogic with deal volume by region spells it out:. And there were a few additional factors this past year, such as the regional banking crisis prompted by the collapse of Silicon Valley Bank and the UBS acquisition of Credit Suisse. The bottom line is that tech and finance companies continued to be quite cautious, which hurt deal activity and hiring across the board.

Investment banking analyst salary

Investment banking analysts are typically hired straight out of college into a two-year program that sometimes extends to a third year. The table below summarizes the average compensation for 1st year, 2nd year, and the increasingly rare 3rd year analyst. Analysts start in the summer after completing undergrad, joining full-time in the middle of the year. At many firms, placing at the bottom of the group is also a not-so-subtle indicator that you will not be promoted to associate down the road. How analysts rank relative to others in the group — as opposed to how they rank relative to other groups or across other firms — is therefore the most important indicator of career prospects within the firm. If an analyst is in an industry group that has closed a lot of deals and brought in a lot of revenue for the bank, the bonus pool for that group will be larger than for less successful groups. Not all investment banks are the same — a select few, known as bulge bracket firms, work on multi-billion dollar deals and exist within a massive global financial institution e. Evercore, Lazard and Guggenheim. Lastly, others are focused on the middle market. According to a recent research study conducted by Johnson Associates , a compensation consultant based in New York, investment banking bonuses for are projected to be either down or flat across related to the prior year.

If you go back years, the percentage difference between each level was not necessarily massive. Most of the bulge bracket banksex-BofA, were in the middle of this range: down from last year, but not a complete disaster the same applies to middle-market banks and firms like RBC. Meanwhile, it is easy investment banking analyst salary find yourself stagnant with a high salary and close to no exit opportunities in other cities.

If you're interested in breaking into finance, check out our Private Equity Course and Investment Banking Course , which help thousands of candidates land top jobs every year. Investment banking is an extremely lucrative career. The Investment Banking Analyst position, which is the most junior position at the firm, is perhaps the most consistently high-paying job that a business student can get out of school. Investment banks make money from advising on extremely large financial transactions. Analysts support this goal by working on financial models, preparing marketing materials, and helping organize the deal process. You will do a lot of Excel- and Powerpoint-based tasks. In addition to the sheer salary, the Investment Banking Analyst position is also extremely coveted because it tends to be a streamlined path to the best paid buyside jobs in the world.

Investment banking analyst salary is impacted by location, education, and experience. The lowest average investment banking analyst salary states are Alaska, Oklahoma, and Nebraska. The highest paying types of investment banking analysts are investment associate, equity analyst, and senior finance consultant. Investment banking analyst salaries at The Citadel and AGC Partners are the highest-paying according to our most recent salary estimates. Compare investment banking analyst salaries for cities or states with the national average over time. Compare investment banking analyst salaries for individual cities or states with the national average.

Investment banking analyst salary

Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary. Analyst, Client Services, Private Banking.

Papa johns tijuana

If an analyst is in an industry group that has closed a lot of deals and brought in a lot of revenue for the bank, the bonus pool for that group will be larger than for less successful groups. X Please check your email. It's going to be "brutal" at Citigroup, but maybe not here. How many data points for the VP numbers? Not all investment banks are the same — a select few, known as bulge bracket firms, work on multi-billion dollar deals and exist within a massive global financial institution e. The career path in IB is relatively standard and does not vary much from bank to bank. Thanks for visiting! The pay can be slightly lower at smaller banks and in other regions. Industry-Specific Modeling. Professional Skills. Facebook Google Linkedin.

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting!

Toulon efinancialcareers. Salaries and bonuses in finance, vs Most anticipate to be yet another challenging environment for corporations and investment banks alike. However, new employees may find it challenging to work comfortably in a team of unknown people without interacting with them in person. Besides, promotions are the key points in IB careers, as base salaries and bonuses get bigger and bigger with each promotion. Investment banks make money from advising on extremely large financial transactions. Hence, there tends to be more concentration on sales and pitch-books-making skills. Inline Feedbacks. As a result, they fast-tracked promotions for Analysts and Associates to incentivize them to stay longer. Login Self-Study Courses. Although high, Singaporean figures are not quite at par with what European and American banks pay their bankers. In addition, they are also a part of more meetings and have more client interactions. However, the titles may differ. Analysts start in the summer after completing undergrad, joining full-time in the middle of the year. Furthermore, after delivering the files to the MD, more modifications ensue.

I consider, that you are mistaken. I can prove it. Write to me in PM.