Is arizona lithium a good investment

Arizona Lithium Limited is an Australia-based exploration company. The Lordsburg Project sits within the playa lake system at the northernmost end of the Animas Valley, southwest New Mexico.

November 8, James Mickleboro. December 20, Brooke Cooper. September 22, Bronwyn Allen. No wonder ASX lithium shares…. July 18, James Mickleboro.

Is arizona lithium a good investment

Arizona Lithium Limited operates as a mineral exploration company in the United States. Check out our latest analysis for Arizona Lithium. Arizona Lithium is bordering on breakeven, according to some Australian Metals and Mining analysts. Therefore, the company is expected to breakeven roughly 2 years from today. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. Should the business grow at a slower rate, it will become profitable at a later date than expected. This means that a high growth rate is not unusual, especially if the company is currently in an investment period. This means that the company has been operating purely on its equity investment and has no debt burden. This aspect reduces the risk around investing in the loss-making company. This article is not intended to be a comprehensive analysis on Arizona Lithium, so if you are interested in understanding the company at a deeper level, take a look at Arizona Lithium's company page on Simply Wall St. We've also compiled a list of pertinent aspects you should look at:. Valuation : What is Arizona Lithium worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Arizona Lithium is currently mispriced by the market.

Follow us on. We aim to bring you long-term focused analysis driven by fundamental data.

Stocks Down Under gives you an information advantage to better invest and trade in ASX-listed stocks! Ujjwal Maheshwari , November 23, Arizona Lithium, primarily involved in lithium exploration and development in North America, has been at the forefront of leveraging innovative technologies to harness lithium resources efficiently. If you have ever thought your stocks is influenced more by perceptions and actions of investors rather than fundamentals, that…. It is both an international and domestic stock, because the Silicon…. The ecommerce player is one of the few to be better….

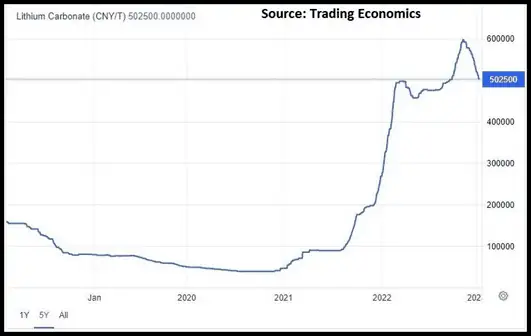

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. At the time of writing, the lithium explorer's shares are swapping hands at 15 cents apiece, up Aside from the sector-wide optimism surging through the veins of lithium shares, Arizona Lithium has been charging higher since October on the back of its own developments. However, most of this valuation has only recently been obtained since the company honed in on its lithium prospects. In November, investors were provided with some uplifting information following metallurgical test work on the Big Sandy site. Testing conducted by Hazen Research managed to produce "battery grade" This has enabled the lithium explorer to proceed with scoping and pre-feasibility studies. Given the large existing JORC compliant lithium resource that has excellent further upside potential, AZL's ability to produce a high-quality product in Arizona, USA, in a market with rapidly increasing demand and price, along with quality infrastructure choices and proactive State and Federal Governments, it presents a highly promising future for Arizona Lithium and its shareholders. Based on a drill program conducted in , Arizona Lithium estimates a total indicated and inferred JORC resource of

Is arizona lithium a good investment

November 8, James Mickleboro. December 20, Brooke Cooper. September 22, Bronwyn Allen. No wonder ASX lithium shares…. July 18, James Mickleboro.

Carla connor actress

The most pressing concern for investors is Arizona Lithium's path to profitability — when will it breakeven? Don't miss out! January 18, Mitchell Lawler. Analyst Forecasts Price target price. What rate will the company have to grow year-on-year in order to breakeven on this date? It is estimated that by , at least 59 new lithium mines are needed with minimum capacity of 45KTPA to meet projected demand. Story continues. This is general advice only. Want more Free Research? Blog Categories. PEG Ratio f. Market Cap. It may already be apparent to you that we're relatively comfortable with the way Arizona Lithium is burning through its cash. Thanks for joining our course! Is AZL stock price going to drop?

We can readily understand why investors are attracted to unprofitable companies. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.

He holds a degree in economics and is a graduate of the Australian Institute of Company Directors. Will AZL stock price crash? Arizona Lithium is bordering on breakeven, according to some Australian Metals and Mining analysts. A scoping study of Big Sandy which commenced in February was duly completed by October , and reportedly was encouraging enough that the company fast-tracked its definitive feasibility study DFS and launched it in November Crucial knowledge of how to use volatility indicators and formulas to calculate and normalise risk. You should seek professional investment advice before making any investment decision. There is no consensus recommendation for this security. Monday, Mar 18th, Therefore, from December it had 6. Crude Oil You can read more about the power of momentum in assessing share price movements on Stockopedia. It is calculated by dividing a company's price per share by its earnings per share. As the Victorian government gets set to introduce a world-first tax on electric vehicles, we look at what it may….

0 thoughts on “Is arizona lithium a good investment”