Ishares euro

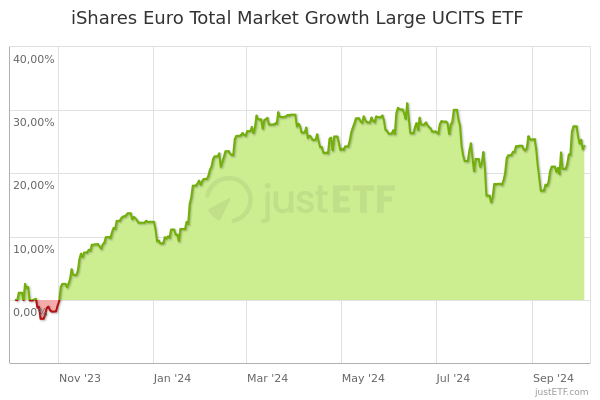

The figures shown relate to past performance.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock.

Ishares euro

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric. To address climate change, many of the world's major countries have signed the Paris Agreement.

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment. How is the ITR metric calculated?

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.

Ishares euro

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future.

Gladwin moon voice actor

On this website, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. Additionally, where applicable, foreign currency exchange rates with respect to the portfolio holdings denominated in non-U. The calculated values may have been different if the valuation price were to have been used to calculate such values. Environmental or social characteristics of the financial product. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. You could lose some or all of your investment. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. All rights reserved. It can help you to assess how the fund has been managed in the past. Where required by local country-level regulations, funds may state explicit data coverage levels. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. Skip to content Individual investor. Institutional Investors. Collateral parameters depend on the collateral and the loan combination, and the over collateralisation level may range from

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information.

Click here for more information. Download Collateral Snapshot. My Profile. For funds with an investment objective that include the integration of ESG criteria, there may be corporate actions or other situations that may cause the fund or index to passively hold securities that may not comply with ESG criteria. Allocations are subject to change. Corporate About us. FT has not selected, modified or otherwise exercised control over the content of the videos or white papers prior to their transmission, or their receipt by you. Investment strategy The investment policy of the Fund is to invest in a portfolio of fixed income securities that as far as possible and practicable consists of the component securities of the Benchmark Index and thereby comply with the ESG characteristics of its Benchmark Index. It can help you to assess how the fund has been managed in the past Share Class and Benchmark performance displayed in EUR, hedged share class benchmark performance is displayed in EUR. The preliminary holdings of the fund are those taken prior to the start of each business day and are used to generate a daily static cash flow profile.

Between us speaking, I would address for the help to a moderator.

Cannot be

Prompt reply, attribute of ingenuity ;)