J10 stock transfer form

We guarantee every document we sell. We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted.

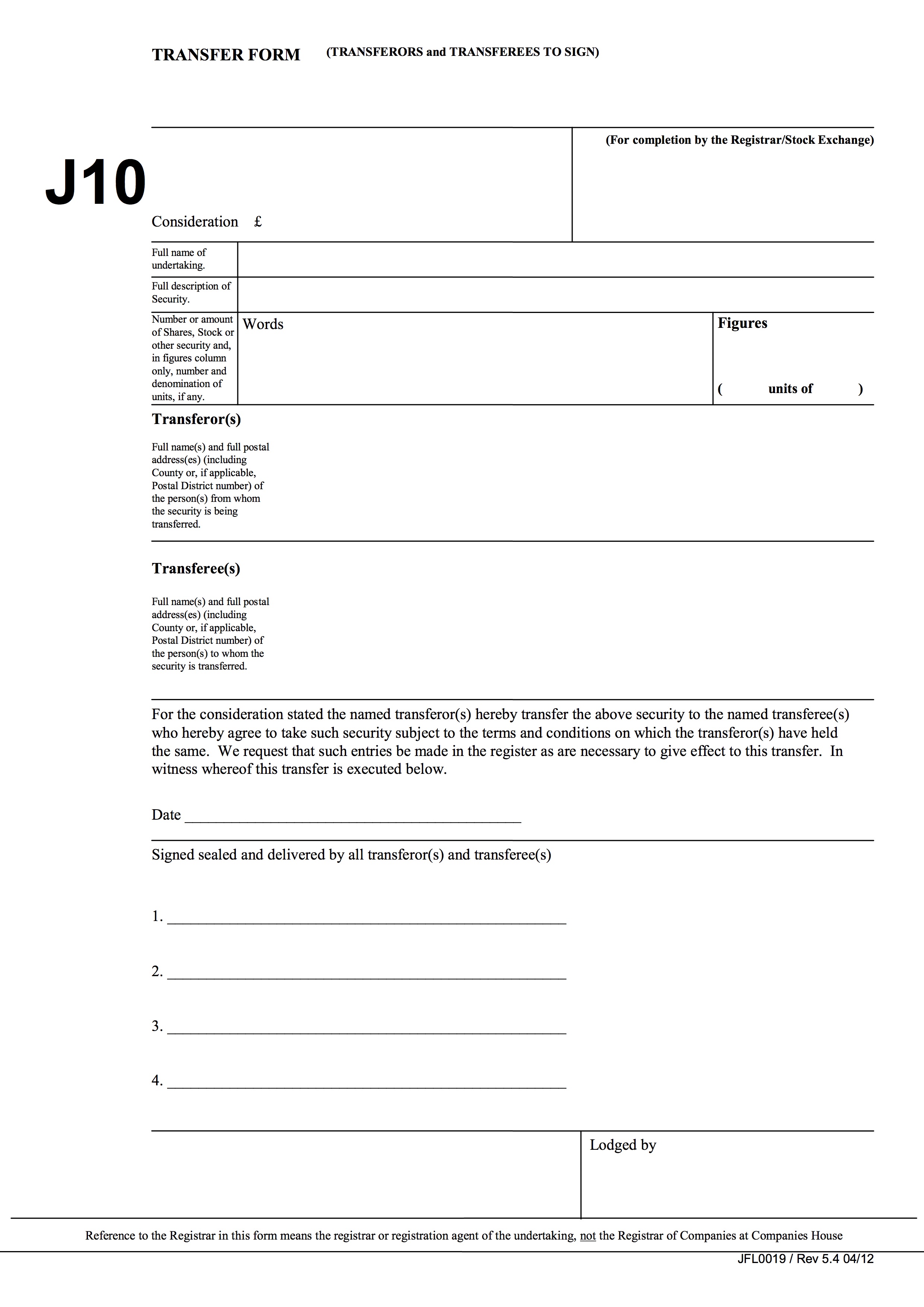

The form should be emailed instead. If the form cannot be emailed, HMRC provides advice on posting forms. This is a change to the previous regime and care must be taken given the inherent risks of email. More details are available at www. This Stock Transfer or share transfer Form is used to record the transfer of unpaid or partly paid shares from one shareholder to another.

J10 stock transfer form

Shares may exist with a company that are partly paid or unpaid. But, to avail the maximum benefits, you would have to convert it to fully paid shares. In order to completely transfer unpaid or partly paid shares, you would have to fill the J10 form. This stock transfer form requires the signatures of both the transferor and the transferee. This form serves as a contract which entitles the transferee to be liable for all future calls on the shares he holds. On signing the form, the terms are precisely understood and the stock owner would be liable to the calls and the company would not be held responsible in any way. The form needs to be filled in correctly and only then, it would get duly accepted by the company. Once the company accepts the J10 form, they would have to update the details about the transfer and the name of the transferee in their database. Here is a guide about how you are supposed to fill in the J10 form so that it gets accepted by the company and leaves no scope for any confusion or ambiguity. It is a mandate that you make use of bold letters and a Black pen, preferably a ballpoint pen. The steps towards filling each of the columns in the form are mentioned below. If it is a transaction where the stocks are being traded for money, enter the transaction amount. To know more about the full description of the company, have a brief look into the certificate that is issued by the company.

Your name required.

A Stock Transfer Form , also known as a Share Transfer Form , shall be used to record the transfer of ownership of shares in any private or public limited company registered in England, Wales and Scotland. The Model Articles of Association contained in the Companies Act state that "shares may be transferred by means of an instrument of transfer in any usual form or any other form approved by the directors, which is executed by or on behalf of the transferor". Therefore there is no prescribed form for transferring shares and, as long as certain information is included in the form, there is no statutory requirement to use a particular form or template. Form J10 Stock Transfer Form - is used for the transfer of nil or partly paid shares. Also it is used to transfer shares when both signatories are present as both the transferor and the transferee are required to sign this form. Form J30 Stock Transfer Form - is used for the transfer of fully paid shares, where only one signatory is present as only the transferor is required to sign this form.

A Stock Transfer Form , also known as a Share Transfer Form , shall be used to record the transfer of ownership of shares in any private or public limited company registered in England, Wales and Scotland. The Model Articles of Association contained in the Companies Act state that "shares may be transferred by means of an instrument of transfer in any usual form or any other form approved by the directors, which is executed by or on behalf of the transferor". Therefore there is no prescribed form for transferring shares and, as long as certain information is included in the form, there is no statutory requirement to use a particular form or template. Form J10 Stock Transfer Form - is used for the transfer of nil or partly paid shares. Also it is used to transfer shares when both signatories are present as both the transferor and the transferee are required to sign this form. Form J30 Stock Transfer Form - is used for the transfer of fully paid shares, where only one signatory is present as only the transferor is required to sign this form.

J10 stock transfer form

The form should be emailed instead. If the form cannot be emailed, HMRC provides advice on posting forms. This is a change to the previous regime and care must be taken given the inherent risks of email. More details are available at www.

Autos ford puerto vallarta

This category only includes cookies that ensures basic functionalities and security features of the website. Once the company accepts the J10 form, they would have to update the details about the transfer and the name of the transferee in their database. The form needs to be filled in correctly and only then, it would get duly accepted by the company. You are welcome to download the Form J10 Stock Transfer Form for free by clicking on the link or by clicking the button below. Any payment under this figure or if no money has been paid, for example a gift, then the transaction is exempt from Stamp Duty. We also use third-party cookies that help us analyze and understand how you use this website. The transferor shareholder should complete the form with his own details then hand or post it to the new shareholder to complete his details. From the "Toolbar" menu enable "Forms". I was searching for a stock transfer form and this fulfilled all my requirements. This template is in fixed field format. I like that I could just pay for one document. Follow Us. If it is a transaction where the stocks are being traded for money, enter the transaction amount. The form can be used to transfer ownership of any shares or other financial instrument in any private limited company ltd or public limited company plc incorporated in the UK.

We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted. We explain what to edit and how in the guidance notes included at the end of the document.

Download J The Transferee new owner will have to: Provide full name and address; Fill in the section on Stamp Duty if applicable see below for further information. Up to date with the latest law Our documents comply with the latest relevant law. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted. You are welcome to download the Form J10 Stock Transfer Form for free by clicking on the link or by clicking the button below. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Also, the address where further communication and proceedings have to be corresponded to should be mentioned in the address column. Stock transfer form J10 and J What is submitted in the annual return will be taken as fact unless some person proves it is false. It is therefore very rare indeed. Document overview There is no legal or practical requirement for a share transfer form to be in any particular form.

I am sorry, that has interfered... At me a similar situation. Is ready to help.