Ko stock dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. KO stock.

The next Coca-Cola Co dividend will go ex in 20 days for The previous Coca-Cola Co dividend was 46c and it went ex 3 months ago and it was paid 2 months ago. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 1. Enter the number of Coca-Cola Co shares you hold and we'll calculate your dividend payments:. Sign up for Coca-Cola Co and we'll email you the dividend information when they declare. Add Coca-Cola Co to receive free notifications when they declare their dividends.

Ko stock dividend

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us. My Portfolio. My Watchlist.

The Coca-Cola Company KO shareholder yield graph below includes indicators for dividends, buybacks, and ko stock dividend paydown, which allows investors to see how each component contributes to the overall shareholder yield. Make informed decisions based on Top Analysts' activity.

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. The next dividend payment is planned on April 1, This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add KO to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown.

Dividend aristocrats are companies that cater to a specific need for income-oriented investors. What makes them truly aristocratic is their commitment to increasing shareholder value. This track record of dependability makes them extremely attractive to investors seeking an additional income stream along with the potential for capital appreciation. They are a leader in the green energy revolution, and one of the largest energy companies in the world with approximately 60 GW of generating capacity. Additionally, they have NextEra Energy Canada, a company generating clean energy from wind turbines.

Ko stock dividend

KO announced a cash dividend of 0. Yahoo Finance. Sign in. Sign in to view your mail. Dividend KO announced a cash dividend of 0. Currency in USD. Valuation Measures 4 Market Cap intraday Share Statistics Avg Vol 3 month 3 Profitability Profit Margin Management Effectiveness Return on Assets ttm 8.

Periodic table 4k

Does Coca-Cola pay dividends? Equity REITs. Premium Dividend Research. Risk Moderate-to-high. All DividendMax content is provided for informational and research purposes only and is not in any way meant to represent trade or investment recommendations. Maximize Income Goal. We like that. Personal Finance Personal Finance Center. The percentile ranks table is a way to compare The Coca-Cola Company KO dividend yield relative to its sector, country, and the world. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. Crypto Center. Economic Indicators Center. Next Ex-Dividend Date. Horizon Moderate.

Coca-Cola issues dividends to shareholders from excess cash Coca-Cola generates. Most companies pay dividends on a quarterly basis, but dividends may also be paid monthly, annually or at irregular intervals.

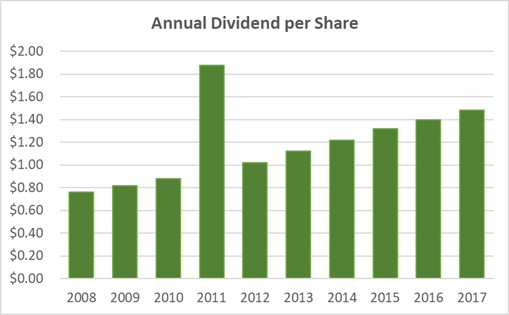

International Allocation. Best Communications. This table allows investors to quickly compare a company's dividend metrics to its peers in the sector, country, and the world, and evaluate its relative stability and growth potential. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. View Ratings. Stock Buybacks. Make informed decisions based on Top Analysts' activity. Year Amount Change It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth. Active ETFs Channel. DSwiss, Inc. Therefore, it is important to regularly monitor a company's financial performance and dividend payment history. If you are reaching retirement age, there is a good chance that you Earnings Calendar.

0 thoughts on “Ko stock dividend”