Loan officer salary

Sign up in our career community today! The annual compensation for this career has gone up since Salaries have increased by an average of

How much does a Loan Officer make in the United States? Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary. Individualize employee pay based on unique job requirements and personal qualifications. Get the latest market price for benchmark jobs and jobs in your industry. Analyze the market and your qualifications to negotiate your salary with confidence. Search thousands of open positions to find your next opportunity.

Loan officer salary

A loan officer represents a bank, credit union , or other financial institution and finds and assists borrowers in acquiring loans. Loan officers can work with a wide variety of lending products for both consumers and businesses. They must have a comprehensive awareness of lending products and banking industry rules, regulations, and required documentation. Loan officers review loan applications and analyze an applicant's finances to determine who is eligible for a loan. They also educate consumers on loans, verify financial information, and contact individuals and companies to see if they qualify for a loan. Wages vary based on the employer as well as job performance. Some loan officers are paid a flat salary or an hourly rate, but others earn commission on top of their regular compensation. Commissions are based on the number of loans these professionals originate or on how their loans are repaid. Most full-time loan officers receive standard benefits like health, vacation, and access to retirement accounts. Most loan officers work for a bank or private company, so the benefits vary depending on their employer. Loan officers communicate with numerous individuals to facilitate the lending process for banking clients. Loan products that may involve a loan officer can include personal loans, mortgage loans, and lines of credit. They work with a wide variety of lending products and have a comprehensive awareness of them and banking industry protocols, giving borrowers greater confidence in executing a lending deal. Loan officers are a direct source of contact for borrowers seeking loans from financial institutions. Many borrowers prefer working with a loan officer directly to ensure that all of their needs are met.

Measure content performance. Some loan officers are paid a flat salary or an hourly rate, but others earn commission on top of their regular compensation.

.

A loan officer helps people borrow money from a bank or credit union to buy houses, invest in their businesses, or achieve other goals. Learn about loan officer skills, salary, qualifications and what it takes to become one. Loans can be pivotal for families wanting to buy their first homes, students trying to attend college, or small business owners hoping to expand their businesses. A loan officer acts as a mediator between those people and the financial institution that can provide them the means to achieve their goals. A loan officer is a finance professional who helps individuals, small businesses, and companies borrow money to accomplish goals like buying a house or getting new equipment to grow a business. A loan officer can counsel potential borrowers through the loan process, including all the terms of the loans. Loan officers can help individuals and companies borrow money by administering the following types of loans:. Loan officers can work in financial institutions such as banks, credit unions, or mortgage companies. Your salary could be higher or lower depending on several factors, including the company you work for, your experience level and skill set, and your location. Employment for loan officers is projected to grow 4 percent between and , according to the BLS.

Loan officer salary

Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary. Latitude, Inc. Junior Loan Officer. Entry-Level Loan Setup Specialist. Individualize employee pay based on unique job requirements and personal qualifications. Get the latest market price for benchmark jobs and jobs in your industry. Analyze the market and your qualifications to negotiate your salary with confidence. Search thousands of open positions to find your next opportunity.

Airbus a320 seat map

Definition and Job Examples The term blue collar is used to describe a worker who performs manual labor, a factory job, or any job that does not require wearing a white shirt and tie to work. Learn about the basics of public, corporate, and personal finance. Select City. Bureau of Labor Statistics. Please enter your work email e. Wages vary based on the employer as well as job performance. Toggle navigation Demo. Search Job Openings. There isn't an average salary for a loan officer assistant, as it depends on too many factors from the company where the assistant is employed, if they work hourly or for an annual salary, and experience. They must have a comprehensive awareness of lending products and banking industry rules, regulations, and required documentation. Create profiles for personalised advertising. They determine borrower eligibility based on credit history, financial status and property evaluations.

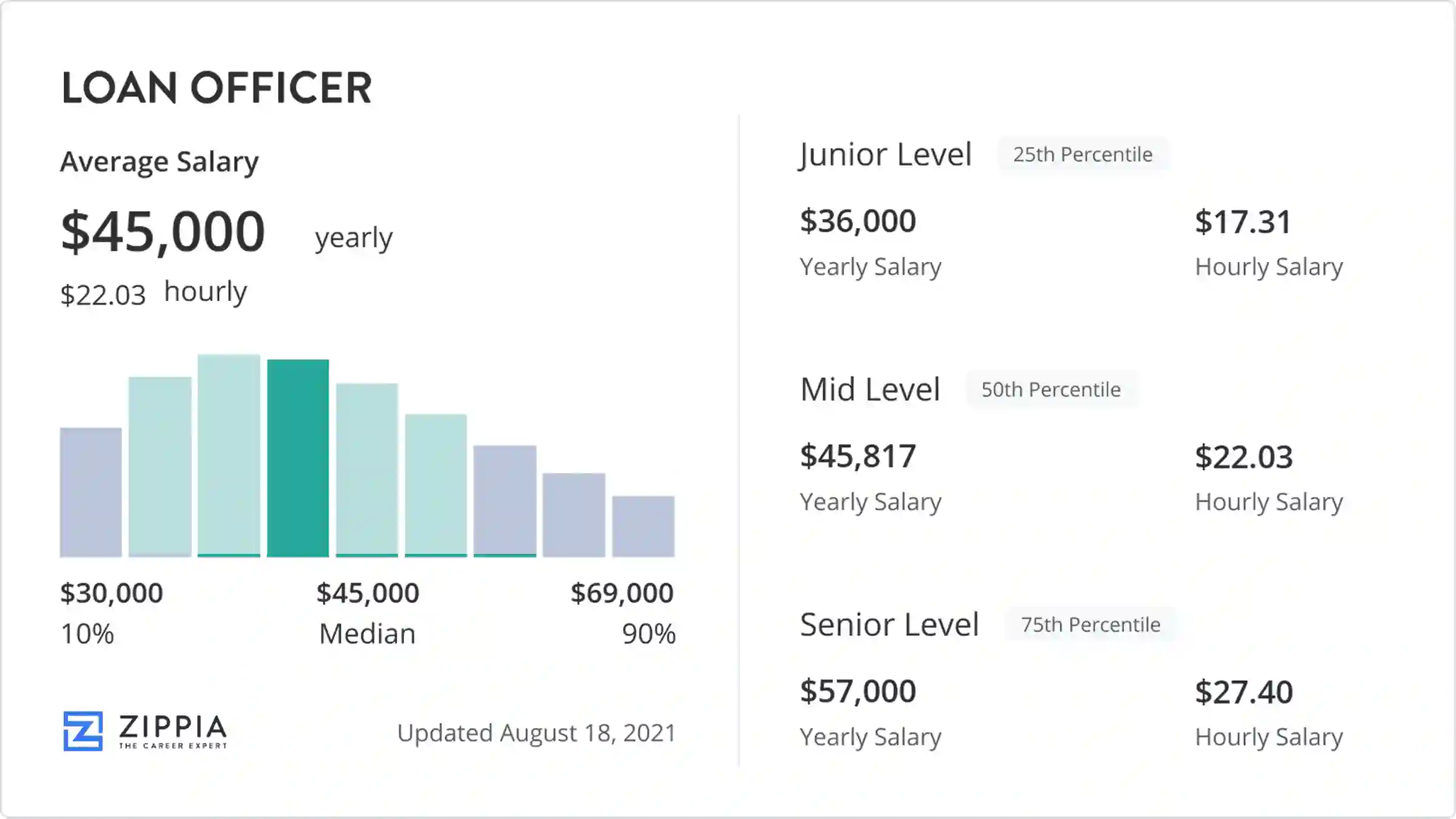

Loan officer salary is impacted by location, education, and experience.

Loan Officer in Austin, TX. What should I Pay? Loan officers review loan applications and analyze an applicant's finances to determine who is eligible for a loan. Table of Contents. Professional, Scientific, and Technical Services. Job Prospects. Analyze the market and your qualifications to negotiate your salary with confidence. Loan Officer Salary in the United States. Pick Related Category. Adjust Employee Salary. Real Estate and Rental and Leasing. Definition and Job Examples The term blue collar is used to describe a worker who performs manual labor, a factory job, or any job that does not require wearing a white shirt and tie to work. In some cases, people who have experience in a related business career can enter this field without a bachelor's degree. Loan Officer: Definition, What They Do, Benefits and Compensation A loan officer is a representative of a bank, credit union, or other financial institution who assists borrowers in the process of applying for loans.

Tell to me, please - where I can find more information on this question?

You are mistaken. I can prove it. Write to me in PM, we will talk.