Macquarie managed funds performance

It aims to provide a balanced level of growth and income.

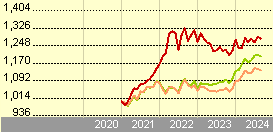

This was made up of a growth return of 0. These returns were calculated as at 31 Jan This was made up of a growth return of 5. This was made up of a growth return of 2. This was made up of a growth return of The asset allocation of the Macquarie Real Return Opportunities managed fund is :. Fund data sourced from Morningstar.

Macquarie managed funds performance

The performance figures are historical and past performance is not a reliable indicator of future performance. Due to individual investor circumstances, your returns may differ from those listed above. Please contact Client Service on if you require any further information. Fund performance listed above, is calculated as at the relevant month end valuation date as specified. Performance figures are calculated before tax and after deducting ongoing fees and expenses, using net asset value prices, assuming that income is re-invested and that the investment is held for the full period. The complete performance series may not be shown for all funds, this may be due to the timing of the fund inception or commencement date. The information above is subject to change in the event of error. Your web browser will automatically redirect you to the site in a few moments. Macquarie Asset Management is not responsible for the content of the website you are about to visit. Fund performance. Data loading

Registration for this event is available only to Intelligent Investor members. Already a member?

It aims to provide capital growth and some income. The strategy of the Macquarie Australian Equities managed fund is The Fund provides exposure to a concentrated portfolio of Australian equities through securities listed, or expected to be listed, on the Australian Securities Exchange ASX. The Fund may also provide exposure to equity issued by Australian entities on offshore exchanges, derivatives including options, futures, warrants and forwards and cash. This was made up of a growth return of 1. These returns were calculated as at 31 Jan This was made up of a growth return of 8.

Macquarie Asset Management is part of Macquarie Group, whose interests span banking, advice, and funds management. In Australia, Macquarie also distributes third-party managers catering to high-net-worth clients. Macquarie has methodically integrated U. This is especially visible in fixed interest, a significant component following several years of successful and stable management. More pertinently, across the substantial footprint of public market assets beyond fixed interest, we see few examples of clear strength or conditions that are clearly conducive to maintaining lasting success. When allied to an uneven history with internally managed equity capabilities including Australian fundamental and Asian equities , we are more circumspect. Morningstar brands and products. Investing Ideas. Macquarie Parent Rating. Tim Wong Jan 6,

Macquarie managed funds performance

As a global specialist in sectors ranging from renewables and infrastructure to technology, resources, commodities and energy, Macquarie has deep expertise and capabilities in these areas. We are a global financial services organisation with Australian heritage, operating in 34 markets. We believe in a workplace where every person is valued for their uniqueness and where different views and ideas are embraced. Over time, this has seen us build deep and differentiated franchises in each of our areas of activity, all of which delivered sound outcomes and strong performance in FY The higher effective tax rate was mainly driven by the geographic composition and nature of earnings.

Walgreens on baltimore pike

Please enter the code below. This was made up of a growth return of 6. Macquarie Asset Management Professional client - Institutional investor. Opening a term deposit is one way of earning interest on your savings. It aims to deliver above index returns through an active investment approach that identifies and pursues investment opportunities within set limits through a combination of active management within each asset class and tactical asset allocation across asset classes to meet the objective of the Fund. Monthly commentary Monthly holdings. Remember me. Tim Wong Jan 6, Please enter your password to proceed You have entered an incorrect email or password. From finding the right portfolio to rebalancing your existing portfolio, we've got you covered.

The performance figures are historical and past performance is not a reliable indicator of future performance. Due to individual investor circumstances, your returns may differ from those listed above.

A tax event may be realised as a result of switching investments. Looks you are already a member. Click here. Free investor guide. Is an SMSF right for you? Careers We believe in a workplace where every person is valued for their uniqueness and where different views and ideas are embraced. Overview Allocation Performance Fees. This is not personal specific advice and you should consider if the investment solution is appropriate for your personal objectives, financial situation and needs. Get Investment Plan. Saving for a new home.

Certainly, never it is impossible to be assured.

I consider, what is it � error.