Maximum withdrawal from td atm

Follow these steps to set up a Favourite Withdrawal as a fast and convenient, one-step way to save time at each Green Machine ATM visit.

Phone banking. Drop by a branch to take care of your everyday banking needs or book an appointment to chat with an advisor. Plus, the ATM will automatically tally your total deposit amount for you. These ATMs also have audio capability for the visually impaired. Simply plug a headset into the ATM before inserting your card. Keypad assistance If the touchscreen is not easily accessible, all you need to do is press the wheelchair icon located at the bottom of the ATM screen — and you will be able to use the keypad or the touchscreen to make your selections.

Maximum withdrawal from td atm

Picture this: you lose your wallet with your TD Access Card tucked inside. You panic, worried that someone could be using it for unauthorized purchases, draining your bank account by the minute. You think about heading to your TD branch to report the incident and immediately request a replacement card. But before you leave, you feel a sense of relief as you remember that your debit card has safety features — safety features that are designed to help protect you in the event of a misplaced, lost or stolen card. Here are the top five security features included with a TD Access Card, which are designed to help keep your account safe. Daily spending limits can help stop the wrong people from spending or withdrawing money over your spending limit. TD Access Cards have three different daily spending limits — one for ATM withdrawals, one for point-of-sale purchases and one for card-not-present transactions, like when you buy something online or over the phone — which can be managed separately in-branch or via EasyLine. You can request a limit increase or decrease in each of these categories at a TD branch or by calling EasyLine. Once you request a limit change, it remains at this new level until you request to change it again. When your card is locked, only pre-authorized charges, like bill payments and transfers, will be processed. No new transactions will go through.

Bank and Wells Fargo.

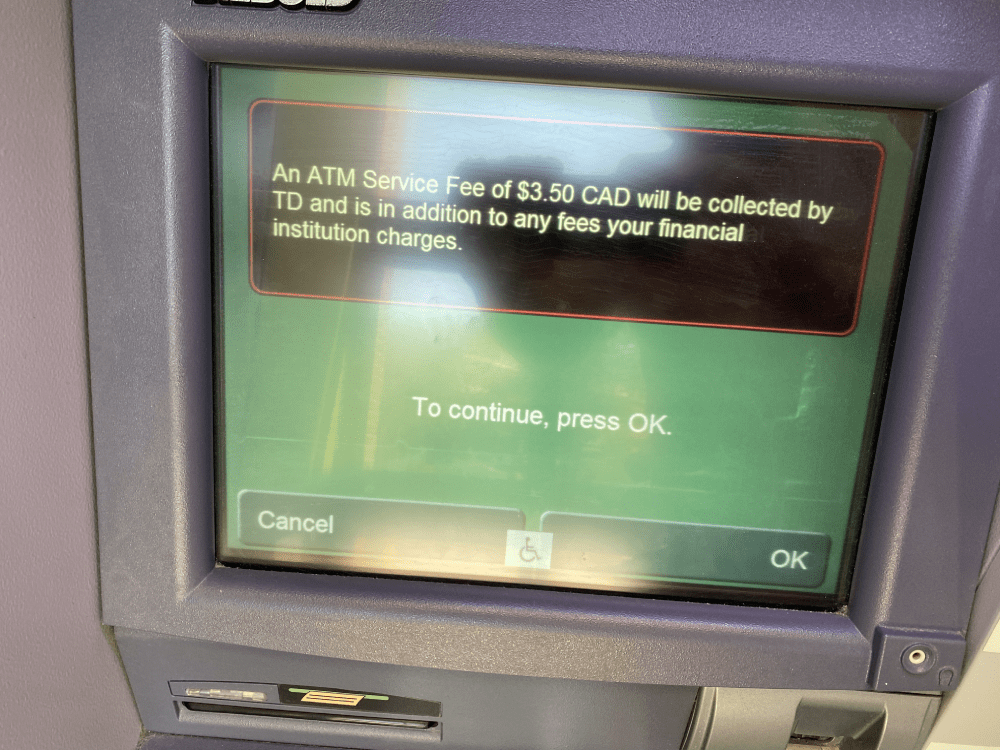

For your protection, daily withdrawal and spending limits are applied to your TD Access Card. Please note that the answers to the questions are for information purposes only for the products discussed. Individual circumstances may vary. In case of discrepancy, the documentation prevails. How can we help you?

E ven people who pride themselves on being cashless might need to withdraw money once in a while. Generally, a bank will set the same default daily ATM limits for all of its customers, but the amount can vary from bank to bank. These limits are typically on a per-day basis. There are opportunities to request an increase, however, if needed. Customers who might seek such increases include truck drivers, who are on the road often, as well as families going on vacation, says DeAnna Tittel, chief operating officer at Bank of Luxemburg. Talk with your bank to see if it will accommodate your cash withdrawal needs. Some individual ATMs might have their own limits on cash withdrawals. Though not time efficient, you may be able to go to more than one ATM for a cash withdrawal in this situation.

Maximum withdrawal from td atm

Even people who pride themselves on being cashless might need to withdraw money once in a while. Generally, a bank will set the same default daily ATM limits for all of its customers, but the amount can vary from bank to bank. These limits are typically on a per-day basis.

Vados chochox

Our goal is to give you the best advice to help you make smart personal finance decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Once you locate your TD Access Card, you can simply go back into the TD app and unlock it so you can continue using it as usual. Picture this: you lose your wallet with your TD Access Card tucked inside. Step 2. Secure microchip Your TD Access Card has a secure microchip that stores information in an encrypted format. Should your TD Access Card become compromised, you will not be held liable as long as you have met your obligations as outlined in the Access Agreement, including your responsibility to protect your PIN. How could we improve this response? While we adhere to strict editorial integrity , this post may contain references to products from our partners. Select a pre-set dollar amount as your Favourite Withdrawal amount, or select Another Amount to type in a different amount using the ATM keypad. Contact Us Apply. Daily spending limits can help stop the wrong people from spending or withdrawing money over your spending limit. Switching banks might be another option if you find yourself frequently wanting more cash than is allowed from the ATM in a day. Set receipt preference Set your preference for whether or not you would like a printed receipt each time you use the My Favourite Withdrawal feature.

Money Market Accounts.

Your Welcome screen will now reflect My Favourite Withdrawal, showing your account, amount and receipt preference. Follow these steps to set up a Favourite Withdrawal as a fast and convenient, one-step way to save time at each Green Machine ATM visit. Secure microchip Your TD Access Card has a secure microchip that stores information in an encrypted format. These ATMs also have audio capability for the visually impaired. You can generally also withdraw more money than what is allowed at the ATM by making the transaction with a teller at a bank branch. Simply plug a headset into the ATM before inserting your card. Find answers here. Would you leave us a comment about your search? Did you find what you were looking for? Phone banking. Our goal is to give you the best advice to help you make smart personal finance decisions. Service not available with the TD U.

I am very grateful to you. Many thanks.

I thank for the information.

Here there can not be a mistake?