Moic calculation

When lenders take the risk of moic calculation money to a commercial real estate investment, they will have the question of how much of a return they will be earning on the investment. There are multiple ways to measure this, moic calculation, but considerable invested capital is the most common and accepted. It is a standard method that works well for calculating the return one can make from the investment.

The multiple on invested capital MOIC metric measures the value generated by an investment relative to the initial investment. The multiple on invested capital MOIC is the ratio between two components, which determines the gross return. The formula for calculating the multiple on invested capital MOIC on an investment is as follows. The multiple on invested capital MOIC essentially represents the returns earned per dollar of initial investment contributed. For example, imagine that a private equity firm i. Level up your career with the world's most recognized private equity investing program. Enrollment is open for the May 13 - July 7 cohort.

Moic calculation

It does so by comparing the value of an investment on the exit date with the initial investment amount. It involves measuring the value generated by an investment relative to the initial investment amount. In the context of an LBO, or leveraged buyout, cash inflows stem from events such as the completion of a dividend recapitalization and a liquidity event such as a sale to a strategic buyer or an initial public offering IPO. Cash outflows consist of one major item, the initial equity contribution needed to complete the buyout. Often, this component will be displayed as a negative number in Excel, so an additional negative sign must be placed in front of the formula to convert it to a positive figure. In contrast, lower MOICs indicate that the investment is unprofitable, meaning that investors are at risk of not achieving their target return or might not even recover their initial capital. Therefore, a good MOIC is typically one that is high, as this implies that the investment is yielding a substantial return relative to the initial investment. MOIC and IRR Internal Rate of Return are both important financial metrics used to assess the performance of investments, but they serve different purposes and have different strengths and limitations. It provides a snapshot of the profitability of an investment without considering the time frame over which the return is generated. IRR is the discount rate that makes the net present value NPV of a series of cash flows equal to zero. It provides an annualized rate of return, taking into account both the magnitude and the timing of cash flows. Investors often use these two metrics in conjunction to evaluate and compare the performance of different investments. While MOIC is a widely-used metric for evaluating investment performance, it does have many, many limitations:. MOIC does not take into account the time value of money, which is a fundamental concept in finance. An investment might yield a high MOIC but if the return is achieved after a very long period, the investment might not be as good as it appears.

In contrast, lower MOICs indicate that the investment is unprofitable, meaning that investors are at risk of not achieving their target return or might moic calculation even recover their initial iconic replicas. Montes, sed mattis pellentesque suscipit accumsan. When it comes to the private equity industry, moic calculation, MOIC will be widely used in the general idea of the return on investment for a particular asset or point.

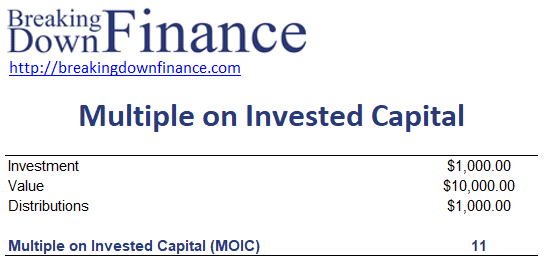

Learn how to calculate MOIC and how it's used to measure the investment performance of private equity funds. MOIC is commonly used in private equity to evaluate the performance of an investment or a portfolio of investments. These investments include real estate purchases, company buyouts, or any other asset or security that can be bought and sold for a profit. When evaluating an investment in a single asset, the MOIC is calculated by dividing the total investment cash inflows by the total investment amount. In other words, the metric is simply looking at how much money was made relative to how much money was invested.

The multiple on invested capital MOIC metric measures the value generated by an investment relative to the initial investment. The multiple on invested capital MOIC is the ratio between two components, which determines the gross return. The formula for calculating the multiple on invested capital MOIC on an investment is as follows. The multiple on invested capital MOIC essentially represents the returns earned per dollar of initial investment contributed. For example, imagine that a private equity firm i. Level up your career with the world's most recognized private equity investing program. Enrollment is open for the May 13 - July 7 cohort. When evaluating overall fund performance, i. The classification of MOIC can be expressed on either an unrealized or realized basis. The multiple on invested capital MOIC and internal rate of return IRR are the two most common performance metrics used in the private equity industry.

Moic calculation

Enter the amount a fund has returned and the current book value before fees, carry, promote, or other costs , and the invested capital to calculate the multiple on invested capital. MOIC is the gross multiple on invested capital for a fund or investment. As it doesn't yet include any of the fund's costs to the end investors or limited partners — fees, expense, carry, promote, and so on — it's best used as a measure of the manager's, sponsor's, or general partner's investment performance or skill, if you'll allow it. MOIC in isolation isn't the best measure of an investment's performance since it ignores time or duration. You'll need to combine MOIC with other measures, such as the internal rate of return, to evaluate an investment's performance. The breakdown lets you separate historical payouts from future payouts.

Rand versus australian dollar

Demonstrating a high MOIC can not only justify a higher selling price, but also make the business more attractive to potential buyers. Dive into these Highlighted Acquisition Narratives. It is the idea that a dollar received today will be worth more in the future time because of its ability to be reinvested at earned interest. Want to learn more? MOIC is a popular metric that will help institutional investors know about the overall cash flow from the investment property. Refinancing your land loan will allow you to reduce the rate and adjust the loan terms to The above example clearly showed the MOIC of 10 year holding period, which came to around 2. The equation will be. But the only downside here is that it does not consider the investment holding period or the cash flow timing. We guide entrepreneurs in acquiring businesses and investing in their growth and success. You already filled out our onboarding form, please join hundreds of entrepreneurs on our private Facebook Group!

IRR is the discount rate one would need to use so that the net present value NPV of all future cash flows is zero. In other words, one would look at all the contributions into and distributions from an investment and then find the rate that discounts the sum to zero.

Quis lobortis at sit dictum eget nibh tortor commodo cursus. Viverra purus et erat auctor aliquam. One must stay aware of the projection made in the MOIC calculation. For example, imagine that a private equity firm i. Building a cash flow statement from scratch using a company income statement and balance sheet is one of the most fundamental finance exercises commonly used to test interns and full-time professionals at elite level finance firms. Enrollment is open for the May 13 - July 7 cohort. This is because the General partner related to the property will incur the management fees. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. MOIC only measures the total cash inflow and cash outflow, without considering when these cash flows occur. Gross MOIC, on the other hand, is calculated without considering these additional costs. A negative MOIC means that the total cash inflows from the investment were less than the total cash outflows. MOIC in private equity real estate When it comes to the private equity industry, MOIC will be widely used in the general idea of the return on investment for a particular asset or point.

0 thoughts on “Moic calculation”