Monevator broker comparison

Disclosure: Links to platforms may be affiliate links, where we may earn a small commission.

F ind the cheapest investment platforms in the UK and make broker comparison easier with our tables below. Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. This article and the comparison table are not personal financial advice. Your capital is at risk when you invest. Getting in ahead of the sign-up incentives that we always see in the ISA season, a couple of the leading investing platforms have gone early with their marketing efforts.

Monevator broker comparison

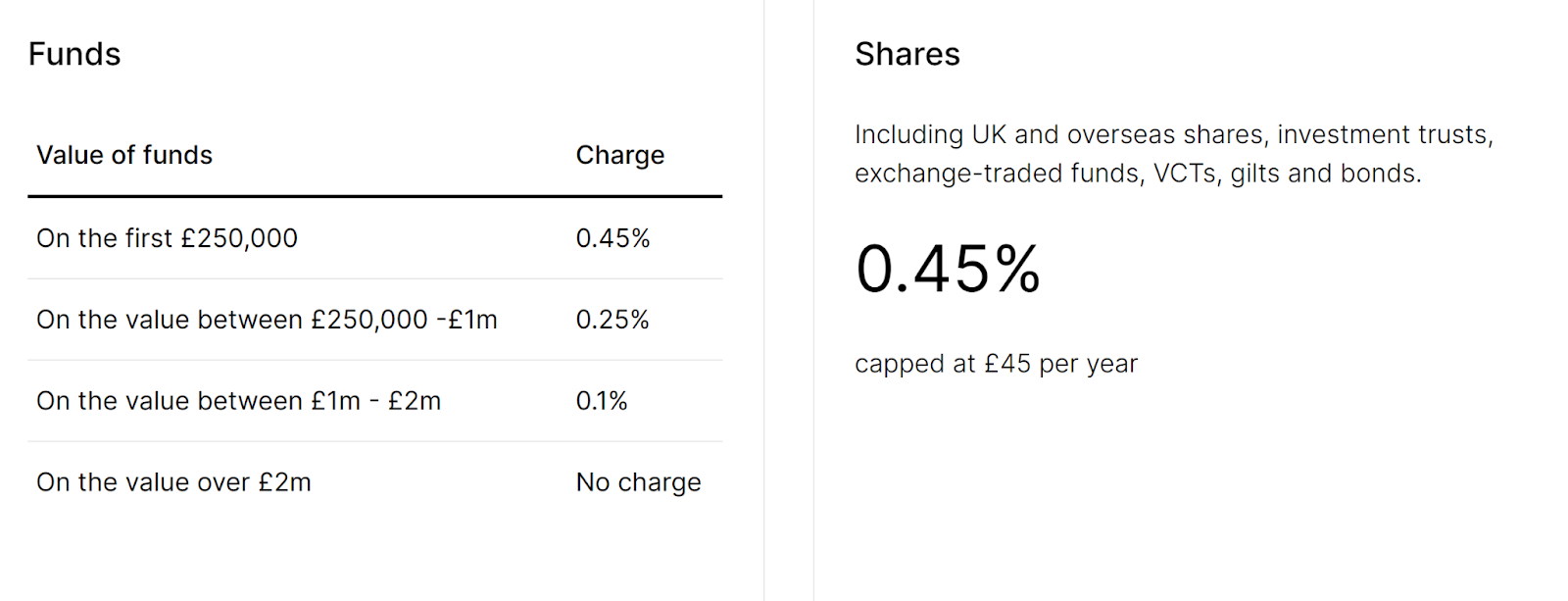

The good news is our comparison table is still there to guide you through the broker maze! W orking out the best online broker or platform 1 to use in your investing can be frustrating. We have long kept track of the different broker platforms and what they charge via our fee comparison table. But comparing the charges levied by say Hargreaves Lansdown with those of Interactive Investor can be fiddly work. Details matter. Some brokers charge lower fees for trading but sting you with high withdrawals fees. Others offer cheap trading, but make additional annual charges for each different kind of account you open with them — once for an ISA and again for a SIPP. There may be entry and exit fees, too. Which is more cost effective for you? Out in the wider world, people use interactive tools to compare things like insurance products and energy bills. We hope it will help casual investors get their money onto a suitable investment platform with a lot less hassle.

I just keep telling myself that risk factors are monevator broker comparison guaranteed to be positive all the time and I have just been unlucky so far. For more on stocks and shares ISA transfers.

A ttention UK investors! You know how we created that massive broker comparison table? Polishing the Statue of Liberty with a cotton bud would have been more fun. But it would not have produced a quick and easy overview of all the main execution-only investment services. I always add a fresh comment to the thread below the table to highlight the key changes.

H ow do you compare funds from a long list of me-too products? How do you factor in past performance, given that it tells you little about future results? Start with the cheapest funds you can find. Then pick some investments with a ten-year track record — or the longest you can find. This will help you benchmark the fund comparison to come. We advise limiting your comparison to tracker investments, such as index funds and ETFs. Passive investing explainer Index trackers are key pillars of a passive investing strategy. We believe a passive investing strategy is right for the vast majority of investors because: — The vast majority of people have no investing edge. To add the funds on your shortlist to the table, go to the top-right Add to this chart dropdowns.

Monevator broker comparison

Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. Disclaimer: I will be stating my opinion based on experience. I do acknowledge though that I may have made mistakes, been misled, or that I could be confused about things. None of this article is a recommendation to use or a recommendation not to use any particular investment platform. Brokers are also welcome to DM me for clarification.

Neck fan

Source: Interactive Brokers. Property Posts What is a mortgage but money rented from a bank? Certainly this covers Vanguard Tracker funds and Lifestrategy. Initially the shares must be deposited into a general stocks and shares account with the broker. These are straight from the actual funds and index providers. I have very recently been informed by TD Direct that they will no longer be offering Dealing Accounts for Trusts, and that I have until September to close the Trust account that I manage and find an alternative provider. Possibly it got caught in the spam filter, if there was a link in it. Shares ISA. This pricing model is typically better for investors with large portfolios. Trackers gonna track, so the ETF we want is clearly the cheapest 5bps one from Amundi. To save faff, it would be worth checking with iweb if you can link your accounts and transfer the cash directly. You can expect a transfer to take several weeks and involve some form filling. Yes, unfortunately they do and your broker converts them to GBP, unless you use a broker that allows multi-currency cash holdings.

A ttention UK investors! You know how we created that massive broker comparison table?

As a result total cost of ownership of, say, my Vanguard Global Equity Lifestrategy rockets from 0. After providing the true facts on the performance differential, we then get a comment consisting of inaccurate and personal vitriolic slurs and yet more bluster. Good comparison. Like other price comparison websites, we may be paid a bonus if you sign-up via a link. So what are you waiting for? Thanks for this article! Charging structure is here. The learning curve is steep. The points I have noted are 1. My wife called and asked today prior to setting up her transfer and they denied all knowledge of it.

You commit an error. I can prove it.

And where at you logic?

Between us speaking, I would address for the help to a moderator.