Money supermarket mortgage calculator

A NEW mortgage holiday calculator by comparison site MoneySuperMarket helps you work out how deferring payments will affect you.

Moneysupermarket, together with its joint venture partner Podium, has built a mortgage payment holiday calculator to help consumers calculate the impact of taking a mortgage payment holiday. Podium will provide the branded tool for free to charities, consumer organisations and lenders, with the option for lenders to customise on their own sites. Last month saw Chancellor Rishi Sunak announce that a three-month mortgage break will be allowed for borrowers in difficulty due to Covid They have been inundated with calls from consumers asking to explain how it works and the ongoing impact to their mortgage payments. It can be difficult to understand exactly what a mortgage holiday could mean further down the line once the term comes to an end.

Money supermarket mortgage calculator

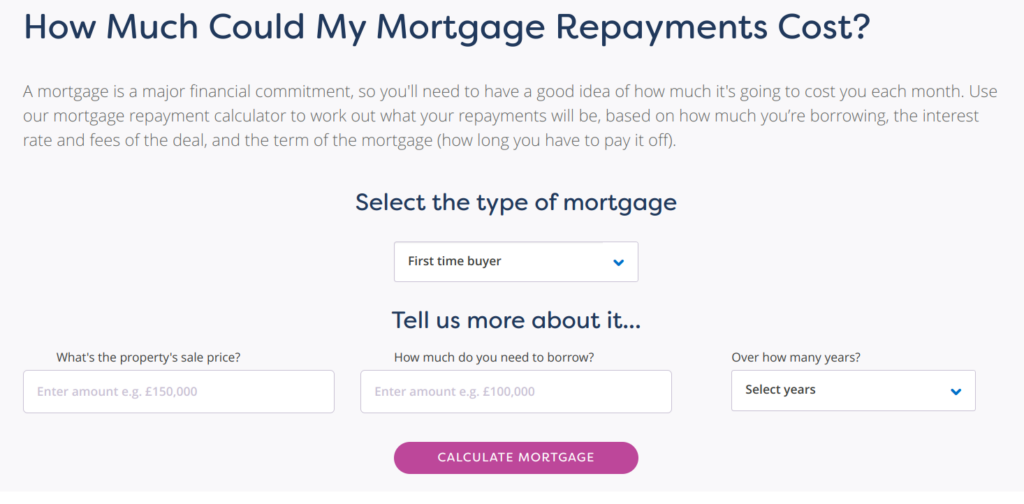

Mortgage calculators are online tools to determine how much you can borrow and the monthly or yearly cost for new and existing mortgages. Most mortgage calculators have a degree of flexibility catering for both repayment and interest-only mortgages, as well as the cost of any change in interest rates charged. In addition, there is usually a provision to enter different deposit amounts, mortgage terms and interest rates to see the effect on the monthly mortgage payments. Doing this is helpful for buyers or those refinancing to work out an affordable mortgage payment. Finally, enter the mortgage term and interest rate. Usually, the interest rate figure is entered by default, as the calculators are primarily used for new mortgages or refinancing. As a general rule of thumb, lenders use an income multiplier of between four to five times your income, sometimes as much as six. If your credit history is poor, then lenders may apply a lower-income multiplier. Many banks, mortgage companies and finance houses offer a mortgage or finance calculator to help you calculate the monthly costs for taking out their financial products. We take a look at a number of them. The first three from Moneysavingexert, MoneyHelper and Which? MoneySavingExpert says its basic mortgage calculator works out the monthly and total costs over the mortgage term, including any fees and interest added. In addition, the calculator works out both repayment and interest-only mortgages. MoneySavingExpert also offers a mortgage overpayment calculator to illustrate the effect of any additional payments you make on the mortgage debt. For example, the calculations show the impact of one-off payments or regular payments on the outstanding mortgage.

Here's some more information about what to do if you lose your job due to coronavirus.

.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner.

Money supermarket mortgage calculator

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Jersey mikes mount airy nc opening date

Please register below:. In addition, the calculator works out both repayment and interest-only mortgages. Sign in. Barclays says its mortgage calculator checks how much you can afford to borrow, work out monthly payments and check how interest rate changes might affect you. How do mortgage lenders assess affordability? MoneySuperMarket is a price comparison site, and therefore they may earn commissions or fees from introducing customers to product providers. The primary consideration for the mortgage lender is security, is the money they are lending to you secure and can you afford to pay it back? For example, the calculations show the impact of one-off payments or regular payments on the outstanding mortgage. The difference is that the mortgage lender may take a more flexible approach with the self-employed as they tend to under-declare their profits, and income is less. Do this through the Halifax customer service telephone number. In addition, there is usually a provision to enter different deposit amounts, mortgage terms and interest rates to see the effect on the monthly mortgage payments.

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

It may be better to save even a five per cent deposit to access better rates and a more comprehensive range of mortgage products. Nationwide have a comprehensive array of mortgage calculators designed to assist existing and new customers, including: A borrowing calculator — gives you an idea as to how much you can borrow based on income and expenditure, A repayment calculator — works out how much you pay every month, An overpayment calculator — works out the effects of overpayments in reducing your mortgage, A payment change calculator- gives you an idea as to the effect of any change in interest rates on your mortgage payments, A calculator to work out any early repayment charge you may have to pay. Many banks, mortgage companies and finance houses offer a mortgage or finance calculator to help you calculate the monthly costs for taking out their financial products. Post a comment. Source property bargains Get a fast cash offer. The mortgage calculator provided by Money Saving Expert appears to be the most impartial, but do check the small print if any recommendations are made to you to purchase financial products or services through them. The calculator assumes that throughout the mortgage, the interest rate stays the same. What are the mortgage costs? Secondly, as for rounding the repayment sums, they use the unrounded repayment to work out the interest paid over the mortgage term. The Nationwide calculators all ask for basic income, expenditure, property value, deposit details, etc and produces quotations much in the same way as the other mortgage calculators listed here as to affordability, how much you can borrow and the cost of mortgages, etc. A calculator for additional borrowing illustrates how much extra you could borrow and the rates offered for the Santander mortgage contract. MoneySavingExpert says its basic mortgage calculator works out the monthly and total costs over the mortgage term, including any fees and interest added. A few weeks ago, Chancellor Rishi Sunak announced that banks will offer a payment holiday of up to three months for Brits who are struggling due to the coronavirus crisis. As the Pensions Regulator starts to bare its teeth and the changes…. Login to comment.

Casual concurrence

Willingly I accept. The question is interesting, I too will take part in discussion.