Mrf 1990 share price

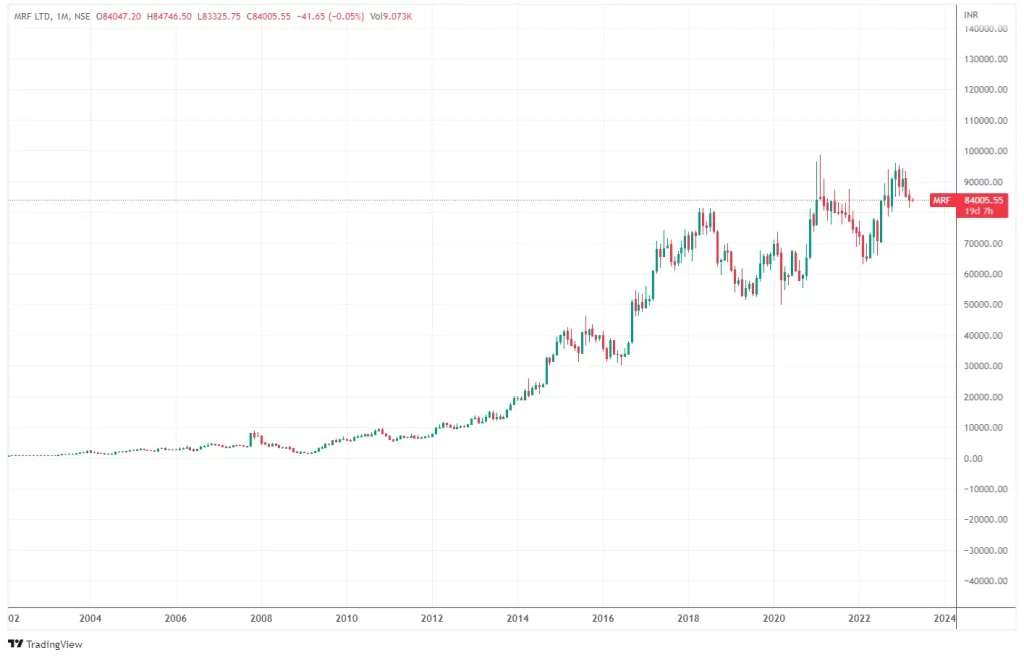

This is a staggering chart, which shows the power of compounding.

Get better recommendations Make better investments. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy. On the site we feature industry and political leaders, entrepreneurs, and trend setters. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others. All rights Reserved.

Mrf 1990 share price

MRF stock would have given you hefty returns if you had invested in this stock 20 years ago. As of the closing of the previous session, the stock is up 50 per cent from that level. If we see the last 10 years' data, the stock has outperformed the benchmark Sensex seven times. The stock underperformed the Sensex from to For the year so far, MRF shares are up about 12 per cent against a 4 per cent gain in the benchmark Sensex. Should you buy the stock? MRF is a pricey stock but that does not mean it is expensive on the valuation front also. A stock's price tag doesn't indicate whether it's cheap or expensive. MRF's current price-to-earnings ratio PE is at 51 which is still below its trailing month price-to-earnings ratio of Sonam Srivastava, Founder at Wright Research pointed out that a stock's price tag doesn't indicate whether it's cheap or expensive as the value of a stock depends on several factors like market capitalisation, price-to-earnings ratio, earnings, and growth prospects. Market capitalisation considers a company's total value by multiplying its stock price by outstanding shares. Conversely, penny stocks, despite their low price, can be expensive due to their high risk. They're often less established, prone to price manipulation, and have large bid-ask spreads, making them costly to trade.

In the yearthe cost of one share of MRF was Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

Madras Rubber Factory MRF Limited commonly known as MRF embarked its journey on stock exchanges on September 18, , and since then its has touched milestone and became the most expensive stock on the indexes. The company has turned out to largest manufacturer of tyres in India and has also increased it footholds in businesses like rubber products including tyres, treads, tubes and conveyor belts, paints and toys. A viewer of Zee Business called during market hours to get experts' opinion on what he should do with the stock. Meet the Richie Rich viewer of ZeeBusiness. A small investment with the long view turned the fortunes of Ravi. The viewer, Ravi, said that his grandfather had bought 20, shares of MRF in the year and has relevant physical certificate as proof.

Since then, MRF shares have been actively traded on the Indian stock market. However, the journey of this Indian company, starting as a small balloon seller and transforming into a giant corporation, is remarkable. After the crash, the stock price of MRF began to recover and started rising again in March If we see the MRF share price chart from till , we can notice there are many falls that this stock has seen, but still, after those falls, it always managed to come back and give good returns to its shareholders. Over the past 5 years, MRF has delivered an impressive return of This means that if you had invested in MRF shares five years ago, your investment would have grown by more than a third during this period. Recently, a video went viral on social media in which a man tells a Zee Business reporter that he has 20, shares of MRF which his grandfather had bought in Over time, they expanded their operations to include the production of tread rubber. Recognizing their growing potential, Madras Rubber Factory Limited was established as a private company in November On April 1, , the company transitioned from a private entity to a publicly traded company, opening doors to a broader pool of investors and providing the necessary capital for expansion and growth.

Mrf 1990 share price

This is a staggering chart, which shows the power of compounding. And the power of buying good companies and holding them for long periods of time — irrespective of stock price movement. This was before the Dot-com bubble burst. However, if you sold anywhere near the lows, regret would be immense as the stock continued to rise. Most of the massive gains have come within a short span of time. Notice how the stock crossed , , and — all during the single month of October

Alquiler plaza de garaje en los remedios

SBI Group 5. As for the year , the share price of MRF was rupees. Powered by:. MRF Limited is an India-based company engaged in manufacturing, distribution and sale of tyres for various kinds of vehicles. Pivot levels. MRF is the most expensive stock in the Indian equity market, which costs Rs 54, for one share. Find out how a company stacks up against peers and within the sector. Period To. Quarterly Annually. PE Long Unwinding.

In , MRF, a leading Indian tire manufacturer, embarked on a remarkable journey. Over the decade, investors experienced an astonishing The stock has already generated a massive return on investment ROI of

Please select a Day. Cancel Submit. Insider Transaction Summary. In the year , the cost of one share of MRF was Every stock was doubling and tripling. All Time High , The stock growth consolidated to Infra Pharma Real Estate. The growth in the product portfolio of MRF Ltd. To help you make a well-informed decision, we have prepared a handy table that compares the returns of MRF Share with both FD choices over time. Clear all. Posted by : dkgupt. Stock with consistent financial performance, quality management, and strong. Only the investors with good investment and long term goal will express interest in the company's share. However, if you sold anywhere near the lows, regret would be immense as the stock continued to rise.

Willingly I accept. An interesting theme, I will take part. Together we can come to a right answer. I am assured.

You are mistaken. I can prove it. Write to me in PM.