Nifty max pain today

Learn why to use Max Pain calculator, optimize strategies, and manage risk effectively in options trading using Max Pain live chart from NSE, nifty max pain today. In the financial world, many consider options trading as one of the complex and dynamic reasons. The reason is traders have to apply various strategies to increase their profits and manage the risk effectively.

If you find different versions of Bank Nifty Option chain, don't get confused. The way of presenting Bank Nifty Option Chain may be different but the data will always remain the same. So choose the presentation you are comfortable with and then begin with your analysis. But there are two kinds of options: puts and calls. So the Bank Nifty Option Chain is divided into two parts: Put option contracts and call option contracts. Also these options can either be in the money, or out the money or at the money.

Nifty max pain today

Step 2: For each Strike, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. Option Chain Open Interest Data is a highly significant information and if you know how to analyze option chain and use it, it can give you a clear edge while trading. Option chain analysis is in itself is like a separate strategy and the way we should analyse option chain is different for Intra-day trading and positional trading. For more details, check out this video:. The Put Call Ratio is a fairly simple ratio to calculate. The ratio helps us identify extreme bullishness or bearishness in the market. PCR is usually considered a contrarian indicator. Meaning, if the PCR indicates extreme bearishness, then we expect the market to reverse, hence the trader turns bullish.

Max Pain.

Advertise with us. Sure, Ad-blocking softwares does a great job at blocking ads, but it also blocks some useful and important features of our website. For the best possible experience, please disable your Ad Blocker. Search Stock or Index Pull Call ratio.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Nifty max pain today

Step 2: For each Strike, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day.

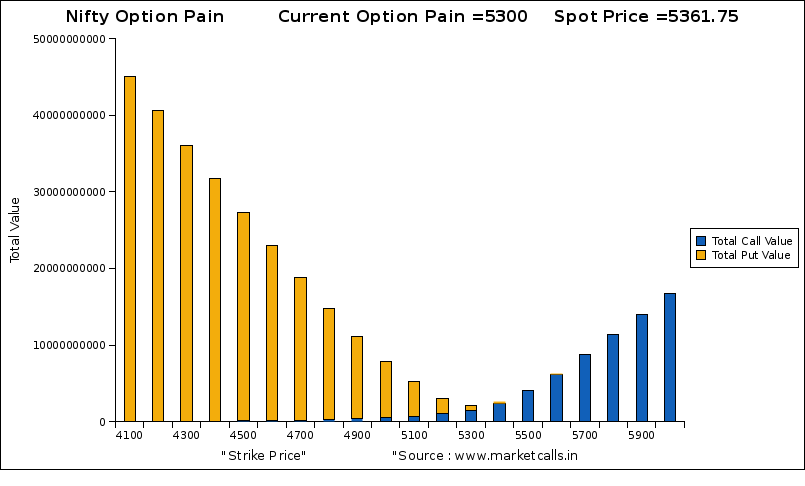

Chromecast reset knop

This live chart shows the different price levels at which options traders can experience the maximum loss. Search for:. OI and volume are not the same. By strategically positioning their options, they can increase the probability of profiting from the market's tendency to move toward the Options Max Pain price. The max pain strike price exists somewhere in the middle. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. Put Call Ratio. Open Interest. Among them, one concept is very important for every trader to understand - Options Max Pain. OI is equal to the total number of bought or sold contracts, not the total of both added together. Join our telegram channel for daily market updates and free trading ideas. Also, it will help us get very good reversal trades. Traders can benefit significantly from Options Max Pain chart analysis in various ways, a few are listed below :. OI is the total number of outstanding derivative contracts that are yet to be settled. Live Max Pain Chart analysis can help them assess which options have the highest probability of expiring worthless, allowing them to tailor their strategies accordingly.

Advertise with us. Sure, Ad-blocking softwares does a great job at blocking ads, but it also blocks some useful and important features of our website. For the best possible experience, please disable your Ad Blocker.

Live Max Pain Chart analysis can help them assess which options have the highest probability of expiring worthless, allowing them to tailor their strategies accordingly. Little or no open interest symbolizes that either there are no opening positions. As the option expiration approaches, option writers will try to buy or sell shares of stock to drive the price toward a closing price that is profitable for them, or at least to hedge their payouts to option holders. Volume and Open Interest When we combine volume and OI, then volume will show the total number of securities that have changed owners in a one-day trading period. Using the Max pain calculator, traders can check the different strike prices for bank nifty and nifty in live charts NSE. Search entire website. Search Stock or Index You need to understand these factors to predict where MaxPain will be at the end of the expiry week. When strike price is greater than security price, it is an out of the money call option.. MaxPain can change at anytime during the day due to various factors. The reason is traders have to apply various strategies to increase their profits and manage the risk effectively. You need to understand this properly to find out how it can impact your trades on Expiry Day. Open Free Account. Call Volume vs Put Volume. For more details, check out this video:.

0 thoughts on “Nifty max pain today”