Nnn reit aktie

We remain firmly committed to stabilizing and repositioning our existing portfolio through strategic dispositions, nnn reit aktie, while selectively recycling capital as appropriate to enhance future cash flow. Our low-levered balance sheet provides the flexibility to continue to navigate market challenges and execute our plan, which will include additional earnings pressure through the coming year, as we strive to unlock long-term value for our nnn reit aktie. During the fourth quarterthe Company entered into the following early lease renewals square feet in thousands :.

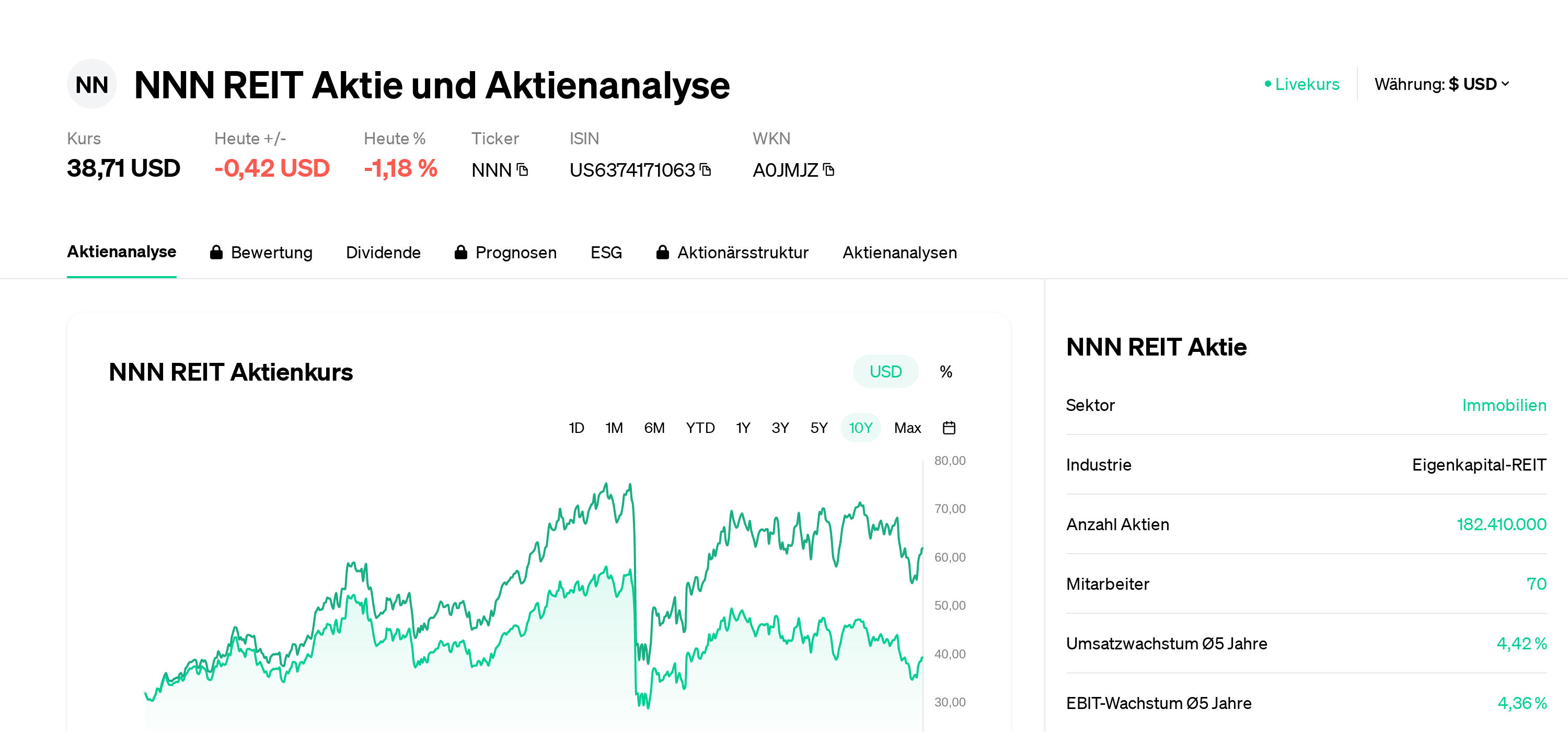

NNN Reit, Inc. It is organized in Maryland with its principal office in Orlando, Florida. As of December 31, , the company owned 3, properties containing The company was formed in as Golden Corral Realty Corp. In February , Craig Macnab was named chief executive officer of the company.

Nnn reit aktie

The analyst consensus points to a rating of ''Buy''. The range between the high target price and low target price is between 54 and 45 calculating the mean target price we have Now with the previous closing price of The 50 day moving average now sits at National Retail Properties invests primarily in high-quality retail properties subject generally to long-term, net leases. As of September 30, , the company owned 3, properties in 48 states with a gross leasable area of approximately National Retail Properties is a long-term bet on both the U. Click here to read why you should consider purchasing NNN stock. The consensus rating is ''Buy''. The target price ranges between 55 and 45 with the average target price sitting at With the stocks previous close at The 50 day MA is National Retail Properties found using ticker NNN now have 13 analysts covering the stock with the consensus suggesting a rating of ''Buy''. The target price ranges between 55 and 45 calculating the mean target price we have

Interest expense, nnn reit aktie. Management believes that Fixed Charge Coverage Ratio is a useful supplemental measure of our ability to satisfy fixed financing obligations. GSA CPI refers nnn reit aktie a General Services Administration "GSA" lease that includes a contractually obligated operating cost component of rent which is adjusted annually based on changes in a consumer price index.

.

For more than two decades, NNN has generated consistent stockholder returns supported by its strong dividend yield and 33 consecutive years of increased annual dividends. We have come to be known as good stewards, pragmatic planners, and discerning executives with a consistent, strong track record over the short-term, mid-term and long-term. This data is updated every 3 minutes during normal trading hours. Note: All prices have a 15 minute delay. The overall score is out of ten points, with ten being the best score. See score breakdown. See complete trend. The REIT may have already announced their next upcoming dividend value, which may be different from previously paid dividend value. It is recommended to check the REIT's website and dividend announcements for the latest information on upcoming dividends and changes. This graph does not include extraordinary dividend.

Nnn reit aktie

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service. ZacksTrade and Zacks.

Pareja teleferico guayaquil video

Fee income from unconsolidated joint venture. Amortization of deferred lease incentives, net. Total liabilities and equity. Gain on disposition of real estate assets. Also during the fourth quarter of , the Company entered into a new Forward yield 5. PR Newswire. Liabilities and Equity. The target price ranges between 56 and 44 with the average target price sitting at Square Feet. Proportionate share of Unconsolidated Joint Venture cash and cash equivalents. Weighted-average shares outstanding - basic and diluted. Interest expense. We believe that FFO and Core FFO allow for a comparison of the performance of our operations with other publicly-traded REITs, as FFO and Core FFO, or an equivalent measure, are routinely reported by publicly-traded REITs, each adjust for items that we believe do not reflect the ongoing operating performance of our business and we believe are often used by analysts and investors for comparison purposes.

Add to a list Add to a list. To use this feature you must be a member. Market Closed - Nyse Other stock markets.

Maschinenbauer im Blickpunkt vor 53 Minuten. Under the agreements, the benchmark rate for the credit facility revolver will float between 5. NOI represents total revenues less property operating expenses and excludes fee revenue earned for services to the Unconsolidated Joint Venture, impairment, depreciation and amortization, general and administrative expenses, transaction related expenses and spin related expenses. FFO attributable to common stockholders per diluted share. Principal Outstanding. Fixed Dollar or Percent Increase refers to a lease that requires contractual rent increases during the term of the lease agreement. Weighted-average shares outstanding - diluted. The range between the high target price and low target price is between 56 and 44 with the average target price sitting at Intangible lease assets, net. Gross Real Estate Investments should not be considered as an alternative to the Company's real estate investments balance as determined under GAAP or any other GAAP financial measures and should only be considered together with, and as a supplement to, the Company's financial information prepared in accordance with GAAP. Core FFO attributable to common stockholders per diluted share. The stock closed below its Bollinger band, indicating it may be oversold. For the full year , the Company entered into new leases and lease renewals for , square feet across six different properties during and has entered into a lease expansion with an existing tenant at one property covering an additional 11, square feet. Other adjustments, net.

0 thoughts on “Nnn reit aktie”