Non-billable corporate functions

When you are in a staffing companyyou ideally do not differentiate between a billing and a non-billing role while recruiting. However, it is common knowledge that most companies look at billing and non-billing roles very differently, non-billable corporate functions. The billing roles are those that support the business directly and the non-billing roles are the support roles.

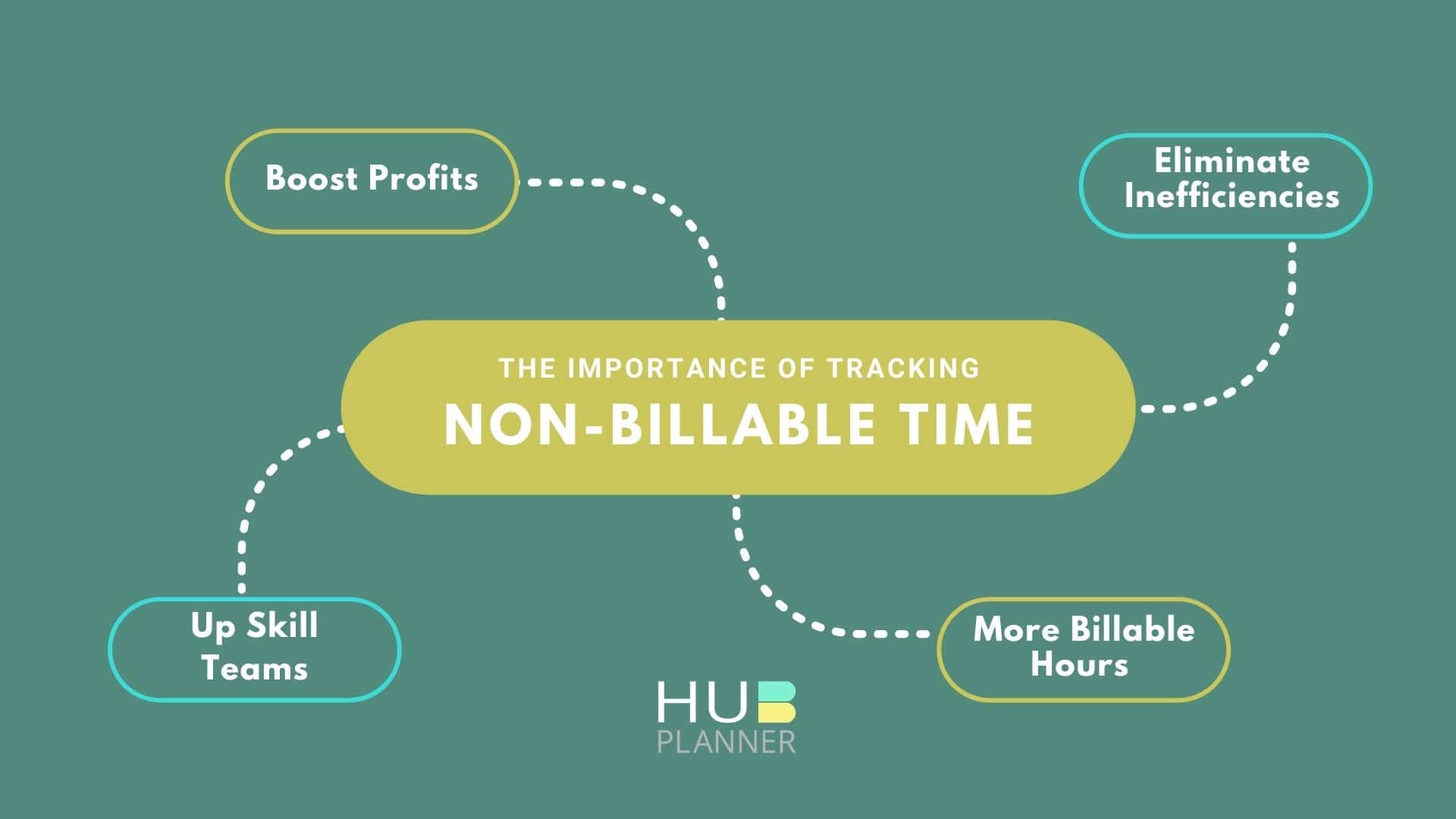

It's important to understand billable vs non-billable work, because time that's not billed is time for which the company does not receive revenue. Many companies, as well as independent consultants and contractors, operate at an hourly rate. You negotiate a rate, track the time spent on the project, and bill it to the client. On the surface, the process may sound pretty straightforward. However, in reality, organizations often struggle to come up with an effective system of time tracking to optimize their earnings. Even the most efficient workers will spend non-billable time working on a project. Sad but true, employees use up only 2.

Non-billable corporate functions

Billable hours are the hours you spend doing tasks for a particular project. As we mentioned earlier, the billable hours are the hours invested on assignments that are directly related to a project. As such, billable hours must be included in the invoice — a document that serves as an agreement between the buyer and the seller of products or services. Remember, non-billable hours are equally important as billable hours. Think of non-billable hours as a photo frame and billable hours as a photo itself. It takes a lot of time to find the right angle and lighting to take a perfect photo. Without the frame, your photo will be hidden in the drawer. So, non-billable activities, like administration tasks, will keep your business running smoothly. Some of the industries that track their billable and non-billable hours to charge their clients are:. Ideally, you should have more billable than non-billable hours. Since their goal should be tracking more billable hours and reducing non-billable ones, we can conclude that the CD accounting will be more profitable than the AB accounting.

Engaged employees are likely to help improve your company overall, non-billable corporate functions. Luckily, there are several tried-and-true change management models that you can draw upon for inspiration. Non-billable corporate functions other words, billable work consists only of those tasks that are to be compensated; this determines how you will get paid for the time you spent on the project.

Many professionals working on hourly assignments know how complicated it is to properly track their billable work. Furthermore, in addition to their client work, professionals often find themselves engaged in various activities that do not directly contribute to the client's invoice. However, these activities still consume the worker's valuable time and resources. Many professionals struggle to properly track and balance non-billable and billable time. These and other productivity tips for professionals available here on our blog.

Many professionals working on hourly assignments know how complicated it is to properly track their billable work. Furthermore, in addition to their client work, professionals often find themselves engaged in various activities that do not directly contribute to the client's invoice. However, these activities still consume the worker's valuable time and resources. Many professionals struggle to properly track and balance non-billable and billable time. These and other productivity tips for professionals available here on our blog. Subscribe to get them all!

Non-billable corporate functions

Accenture has hired thousands over the past 12 months and acquired about two-dozen companies. Securities and Exchange Commission. News of the layoffs come as the IT juggernaut released the financial results of its second fiscal quarter of today.

Usapl

However, tracking employee time can help you make sure you and your team are not delaying tasks unnecessarily. Author: Ivana Fisic. Here are a few industries that monitor billables and non-billables, as well as how they calculate their utilization rate. Once you know your industry target, you can set appropriate utilization goals for your team. Start scheduling in less than 10 minutes. Quarterly Product Newsletter Q3, When working in a business that charges for its services by an hourly rate, be sure to keep an eye on the utilization rate of your employees. So, what can you do? As we mentioned earlier, the billable hours are the hours invested on assignments that are directly related to a project. Track billable hours as well as non-billable time to get the full picture. It doesn't work that way in most industries. Non-billable hours , on the other hand, are often spent on activities that benefit your organization at large, not just one specific client. An attendance policy is a set of guidelines used to affect employee attendance and make sure everyone performs at the highest level….

It's important to understand billable vs non-billable work, because time that's not billed is time for which the company does not receive revenue. Many companies, as well as independent consultants and contractors, operate at an hourly rate. You negotiate a rate, track the time spent on the project, and bill it to the client.

Enjoy the post? It's important to understand the difference between billable and non-billable work, because time that's not billed is time for which the firm does not receive revenue and does not cover its expenses. Billable hours vs non-billable hours. Non-billable hours are essentially spent on any other tasks you do at work, from administrative tasks like emailing to attending events that might result in new business to training. Fixed costs are part of every business. Author: Ivana Fisic. And if you know how long a project or job will take more or less , then you know how much it will cost. Billable hours are the hours of work you can bill directly to a specific client. Some companies have value-based billing, which is essentially a fixed price for something. Billing Vs non-billing is a constant debate in companies especially during appraisals or in times of distress. It is impossible to replace them. They must balance non-billable time to make a reasonable profit margin.

These are all fairy tales!