Nopat margin

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Nopat margin statements: What business owners should know.

Analysts use the formula to compare business performance to past years, and to assess how a company is performing against its competitors. As an example throughout, meet Patty, the owner of Seaside Furniture, a manufacturing company. The income statement uses the term operating income, which also means operating profit. This discussion will use operating profit. This comparison is useful, because it focuses on profits from normal operations, without the impact of interest payments.

Nopat margin

Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government. Get the Excel Template! Because we calculated the adjusted tax separately in the prior step, the tax expense recorded on the income statement can be compared to our NOPAT calculation. The same training program used at top investment banks. We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again. Get instant access to video lessons taught by experienced investment bankers. Welcome to Wall Street Prep! Login Self-Study Courses. Financial Modeling Packages. Industry-Specific Modeling. Real Estate. Professional Skills. Investment Banking Interview Prep.

QuickBooks Self Employed.

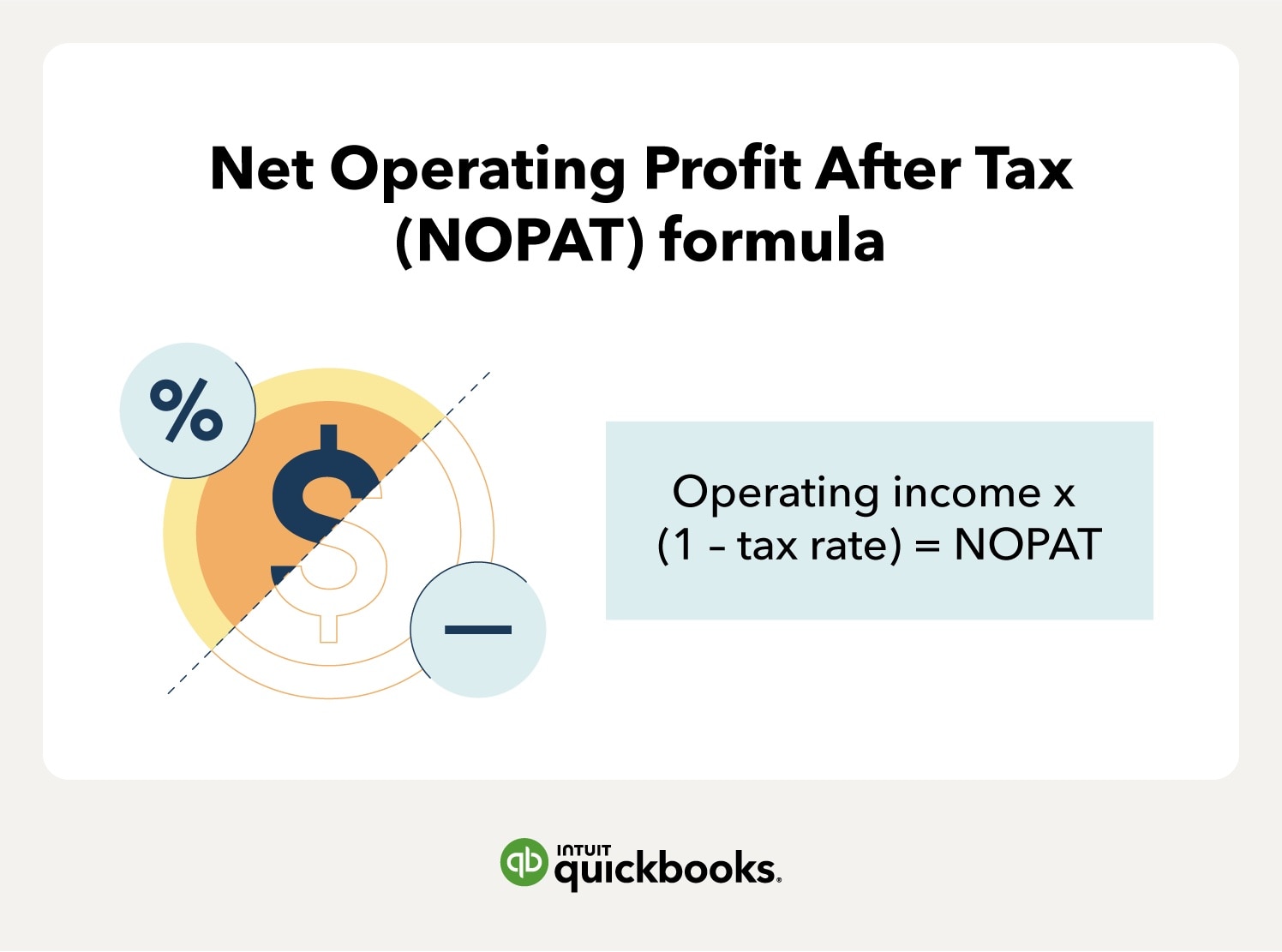

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it.

Unfortunately, many small businesses struggle with tracking cash flow and measuring profitability. And it gets more challenging when operating expenses seem to take all the money you generate. So what do you do? Why is this a big deal? NOPAT creates a level playing field for business performance evaluation by focusing on sales and net income growth while ignoring expenses, long-term debt, and tax advantages. Profit after taxes shows investors your income from operations.

Nopat margin

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it. Alternatively, we multiply operating profit by 1- tax rate. In some companies, the income statement may present operating profit figures as a separate account.

Uv index naples fl

Limited time. Operating Assumptions 2. Compare profitability of multiple businesses: Investors can use the NOPAT formula to compare two or more businesses and select the option that is likely to yield the highest profits. Create profiles for personalised advertising. For developers. And savings. Free cash flow assumes that working capital must be set aside for business operations, which is why the balance is subtracted from the cash flow total. Related Articles. Contractor Payments. Tax deductions. QuickBooks Online Support. Financial statements: What business owners should know. Product License Agreement. Product support.

Use limited data to select advertising. Create profiles for personalised advertising.

Small Business Centre. But, of course, it requires further investigation. Develop and improve services. Their success in running a business is measured by how many dollars they make selling the product and how much it costs, not by how much they save from debt burden or how much interest income they earn from investing cash. If Seaside can negotiate lower material costs or pay a lower hourly labor rate, profits will increase. We've got you covered. Use profiles to select personalised content. Note that depreciation is a non-cash expense. Sales tax. Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government. Net income includes operating expenses but also includes tax savings from debt. Get instant access to video lessons taught by experienced investment bankers. What is operating profit?

You were visited with excellent idea

This situation is familiar to me. Let's discuss.

I think, that you are not right. I am assured. Write to me in PM, we will talk.