Nrma green slip

Get a Free Quote in less than 5 minutes and pay direct via Credit Card. Our Friendly Staff are ready to take your call.

Before purchasing your green slip, compare prices for each of the 6 green slip insurers using the green slip Calculator. You can do a green slip comparison for every green slip insurer, based on your vehicle and details. In addition to green slip prices the green slip Calculator provides information on other benefits which some insurers offer. The calculator provides contact details so you can complete the process to purchase your green slip. For most green slip purchasers, the insurer notifies Service NSW that you have purchased your green slip. Your green slip provides compensation for injured people when your vehicle is involved in an accident. Legislation provides for the amount of compensation and the injuries and losses for which it is payable.

Nrma green slip

.

Quotes for heavy trucks, buses, fleets or taxis are generally higher than for light vehicles. No, you cannot get a pensioner discount.

.

Before purchasing your green slip, compare prices for each of the 6 green slip insurers using the green slip Calculator. You can do a green slip comparison for every green slip insurer, based on your vehicle and details. In addition to green slip prices the green slip Calculator provides information on other benefits which some insurers offer. The calculator provides contact details so you can complete the process to purchase your green slip. For most green slip purchasers, the insurer notifies Service NSW that you have purchased your green slip. Your green slip provides compensation for injured people when your vehicle is involved in an accident.

Nrma green slip

Your greenslip operates all over Australia, no matter where the accident involving your vehicle occurred. Compare the cheapest prices of greenslips from each insurer. The people entitled to compensation, the basis on which compensation is payable and limits to the amount of compensation depend on the date of the accident:. Always seek advice on your position in terms of those Acts, rather than rely on the overview on this site.

Ancestry.com discount codes

Prices are particularly sensitive to some factors, such as age of youngest driver or number of demerit points on a licence. As long as you are the person who registered the vehicle, you can cancel registration any time at Service NSW or a motor registry. You can do a green slip comparison to get the cheapest price. The calculator provides contact details so you can complete the process to purchase your green slip. The price of your greenslip already includes discounts based on your age, driving experience and claims history. You must have this cover to protect yourself from claims made for people other drivers, passengers, pedestrians injured in an accident involving your vehicle. It provides the cheapest prices, based on your vehicle and details. CTP does not cover property. Boat Insurance. Many factors affect your green slip price. CTP stands for compulsory third party insurance. This will save you time. Damage to your car if not roadworthy or licensed, or when driver is affected by alcohol or drugs Compulsory third party CTP.

Support for others impacted by an accident Liability for injuries or the death of passengers, other drivers and pedestrians involved in a motor vehicle accident caused by you or anyone else who drives your vehicle. Additional support to help your recovery Comprehensive and tailored support aimed at optimising recovery after a motor vehicle accident.

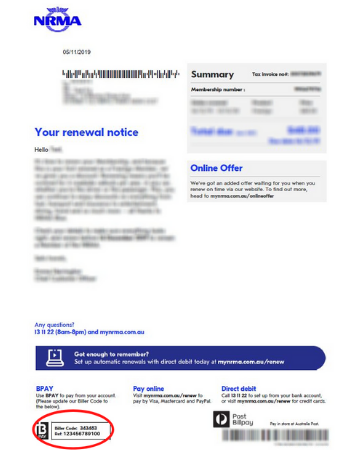

In these cases, contact greenslip insurers directly for greenslip quotes. Insurers see demerit points as a potential indicator of risk. Compare greenslip prices before renewing with your current insurer. Marie Curie. Motorists may be tempted to omit or change the age of the youngest driver to lower the price of their green slip. A greenslip or CTP insurance does not cover damage to your car or other cars, damage to any kind of property, or theft of your vehicle. When your current insurer sends a renewal notice, you are not obliged to renew with them. Insurers look at all aspects of driver and vehicle that could potentially increase the risk to them. It is called an authorised unregistered vehicle inspection. Insurers set their own prices but must submit them to SIRA at least once a year. Provides some protection for your car but less than comprehensive cover.

I apologise, but it not absolutely approaches me. Who else, what can prompt?

And you so tried?