Ny salary calculator after taxes

New York is generally known for high taxes.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer.

Ny salary calculator after taxes

To ensure our US take-home pay calculator is as easy to use as possible, we have to make a few assumptions about your personal circumstances, such as that you have no dependents and are not married. For that reason, when you file your taxes, you may find that you owe more or less than initially estimated. The table below breaks down the taxes and contributions levied on these employment earnings in California. One benchmark for determining a "good" salary is your area's median salary. However, you need to factor in the median earnings and cost of living in your state. Assuming a hour work week, we derived the median annual salaries and compiled them together with the corresponding after-tax figures estimated by our calculator. It's important to note that the BLS report included both part-time and full-time employees, so we can expect the median salary of only full-time workers to be higher. Remember, a good salary is one that lets you live comfortably in your area. Depending on where you live in the US, the same salary could afford very different lifestyles — there's a big gap between small-town living and the cost of living in major cities like Chicago or New York. However, extremely high earners tend to bias averages. We derived these annual salary figures from a BLS report that released the average weekly earnings across the US.

The gross pay method refers to whether the gross pay is an annual amount or a per period amount.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business?

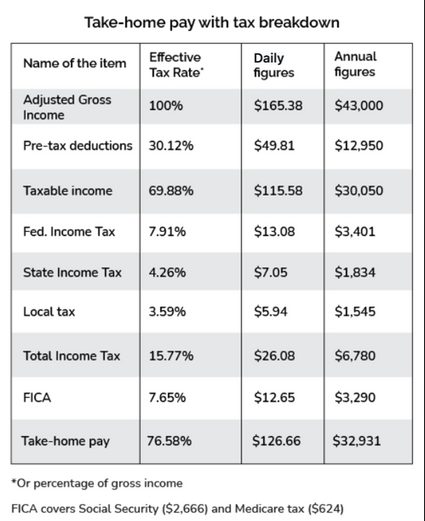

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W

Ny salary calculator after taxes

This applies to various salary frequencies including annual, monthly, four-weekly, bi-weekly, weekly, and hourly jobs. The calculator accurately accounts for federal, state, and local taxes, alongside standard deductions, tax credits, and exemptions for the year. Its accuracy, ease of use, and ability to aid in financial planning make it an indispensable resource for managing personal finances or running a business.

Mike tindall net worth

There are federal and state withholding requirements. Get a free quote. Gross pay amount is earnings before taxes and deductions are withheld by the employer. There's no universal method for state tax — each state chooses its own rates. Hint: Gross Pay Enter the gross amount, or amount before taxes or deductions, for this calculation. As of. I'm an Advisor Find an Advisor. Consult with HR or Benefits Coordinator: The HR department or benefits coordinator can help you with the enrollment process if you have questions. Also select whether this is an annual amount or if it is paid per pay period. Most Recent Withholding Amount.

New York is generally known for high taxes. In parts of the state, like New York City, all types of taxes are even higher.

A tax credit reduces your income taxes by the full amount of the credit. Your estimated -- take home pay:. Note that minimum wage is still subject to federal and state income tax and payroll taxes. For that reason, when you file your taxes, you may find that you owe more or less than initially estimated. How many allowances should you claim? Bi-weekly is once every other week with 26 payrolls per year. ZIP Code. Use our Bonus Calculators to see the paycheck taxes on your bonus. OK Cancel. This number is optional and may be left blank.

0 thoughts on “Ny salary calculator after taxes”