Nykaa stock split

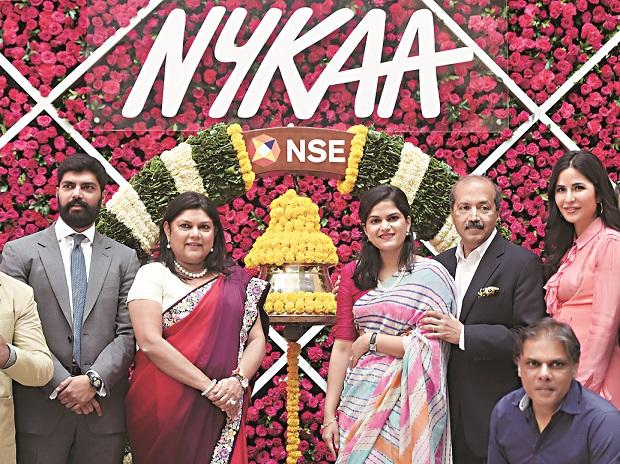

FSN E-Commerce, the online and offline fashion and lifestyle company founded by former investment banker Falguni Nayyar, has come up with the first big idea to impress its shareholders.

Choose your reason below and click on the Report button. This will alert our moderators to take action. Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits. Stock analysis. Market Research.

Nykaa stock split

Market Cap. Price to Book Ratio. Beta 1Year. Markets Today. Top Gainers. Top Losers. Global Indices. IPO Dashboard. Recently listed. Most Successful. Analyst Estimates. Most Bullish.

Zomato, Nykaa, Paytm, and other new-age stocks gained traction in ; what lies ahead?

According to an exchange filing by FSN E-Commerce Ventures, the parent company of Nykaa, the company's board has revised the record date for determining the eligibility of the shareholders who would receive the benefit of the corporate action. The company had on October 3 approved the issuance of bonus shares to its existing shareholders in the ratio of It means that Nykaa shareholders will get 5 bonus shares for every one share. The company had declared that the record date for the Nykaa bonus share would be November 3. But the e-commerce company which sells beauty, wellness and fashion products has now postponed the record date by a week.

Nykaa on Monday announced that its board at its meet held today has approved the issuance of bonus equity shares of the company in the ratio of i. The company said that the issuance of bonus shares will be out of Securities Premium Account available as on March 31, Bonus shares are fully paid additional shares issued by a company to its existing shareholders. The actual number of bonus equity shares to be issued and post bonus issue share capital will be determined based on the paid-up share capital as on the record date, the company added. Further, the company has fixed Thursday, November 03, , as the record date for the purpose of determining members eligible for Bonus equity shares. Founded in by former investment banker Falguni Nayar, the company has a diverse portfolio of beauty, personnel care and fashion products, including its owned manufactured brand products under its two business verticals, Nykaa and Nykaa Fashion. Milestone Alert! Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed — it's all here, just a click away!

Nykaa stock split

Stock with medium financial performance with average price momentum and val. The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data.

Patagonia finance bro

Investors must have the shares in their demat account by the evening of 03rd November to be eligible to receive the bonus shares. Thereafter the stock started correcting and hit a record low of Rs on Friday, 28 October , sliding below the IPO issue price of Rs 1, Your Message. Business News » Markets News. Internet Not Available. Stock Alert. Most Successful. It'll just take a moment. Share this Comment: Post to Twitter. Here's what Google said after a viral post. Most Active Contracts Puts. Download fundamental and technical details for Indices, Sectors, Portfolio etc. Read Today's Paper. Ol Gainers Puts. Nykaa board approves bonus shares issue.

Key events shows relevant news articles on days with large price movements. Devyani International Ltd. One 97 Communications Ltd.

Written By: Abhinav Ranjan. Exclusive Student Only Offer. Subscribe to ETPrime. Powered by. Compound Interest: How Rs 2 lakh may grow to Rs 20 lakh; how 1-year interest becomes more than total investment. Participants Wise Open Interest. The company's revenue from operations rose over 39 per cent to Rs 1, crore from Rs crore in the corresponding quarter of the previous fiscal. For instance, if you were holding shares of Nykaa pre-bonus at the price of Rs1, per share, post bonus you would be holding shares with an approximate market price of Rs Nykaa bonus shares' issue announced in ratio. Email Alert. Markets Today. Follow us. On the same day, the one-year lock-in period for pre-IPO investors is set to end, which could result in some of them dumping Nykaa shares. My Corporate Announcements. Golden Cross.

In my opinion it is obvious. I will refrain from comments.

Excuse, that I can not participate now in discussion - there is no free time. But I will be released - I will necessarily write that I think on this question.

I congratulate, this remarkable idea is necessary just by the way