Octa cloud gst

Compare software prices, features, support, ease of use, and user reviews to make the best choice between these, and decide whether Octa Gst or SahiGST fits your business.

Confused in complicated laws? Click here to know more. There are number of tools and softwares for Chartered accountants and tax professionals to ease their work. Other than GST and Income tax softwares there are also some tools which can help them to save time and efforts to a great extent. Here is a list and details of such tools. Managing tasks, allocating them to team members is a hectic task to be done each day. This application let you manage your GST and Income tax task with ease.

Octa cloud gst

Best GST Software for CA: Many beneficial features are incorporated in tax preparation software for experts, on which companies and businesses may count while filing their returns. These GST software applications are simple and straightforward to directly connect with the accounting system, and information can be effectively exported to submit supplementary returns or potentially create MIS reports. Secondly, each application offers a wide range of additional perks to easily tackle your compliance requirements and focus on saving you from being a debtor. It is an indirect tax regime that has substantially substituted a few other indirect taxes in India, including excise duty, VAT, and services tax. A good and strong GST-compliant accounting system is a perfect match for your commercial applications. Deeply anxious that you may have submitted factually incorrect tax returns and also that the tax department may summon you? Nearly every single corporate field has considered the consequences of GST, and many professions are also directly influenced by the new indirect tax framework. Chartered Accountant is one of the sectors that would be significantly affected by the advent of GST. It tackles any underlying issues that emerge as a consequence of GST filing inaccuracies and deduction claims that assure massive profits. In addition, because all financial transactions are documented on the software, GST filing is largely automated. With more and more GST apps accessible to the public, it may be tough to carefully select reliable and consistent software.

Many a times we has only json file imported from the portal and wants to check an entry in it.

Confused in complicated laws? Click here to know more. GST has created a lot of burden on Chartered accountants as well as business organizations as it includes lot of compliances. The other tax liabilities such as VAT, service tax etc. Now there is only one indirect tax regime that need compliances. However, this increased calls for practicing chartered accountants to utilize GST-prepared software to meet operational and consistence needs for their training, yet also for their clients.

Please plan the security and regular backups of Octa GST data. Since the data is stored on your computer, you are responsible to manage it. Octa GST Standard subscription is ideal for accountants and tax professionals who work on standalone computers or laptops. Octa GST is installed on your computer which can be a laptop or desktop. When you create the companies in Octa GST, one file is created for each company. These files are saved locally on your computer only. You can work offline without needing any access to internet or office network. Since the data is saved on your own computer, other users cannot access the same data at the same time.

Octa cloud gst

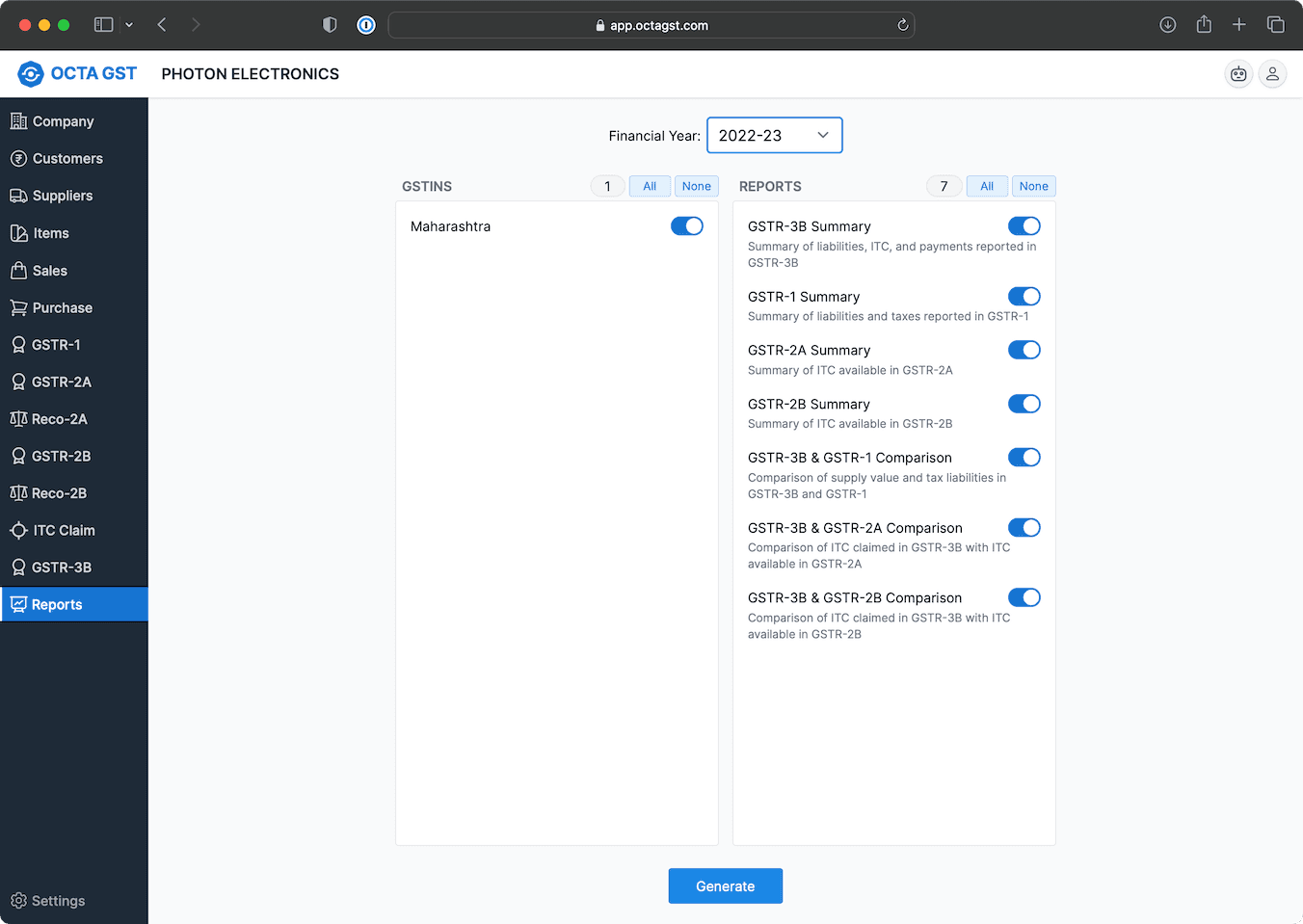

Cloud-based invoicing and GST returns solution for businesses. Most viewed in You are being shown a subset of the data for this profile. Copy Url. Octa company profile. Last updated: February 15,

Gta 5 lester

IGST on the import. Catalyst Workflow and Automation. This way mismatches can be tracked very easily. CompuGST CompuGST has many unique features that will ease your work and by saving time, more focus can be diverted towards growth of business. It is a cloud-based software program that will facilitate the execution of all GST compliance requirements. In this software, I found it quite easy to file various forms under one single roof. If you are facing any issue related to the software, you can call backend team for your support. Contract farming agilelabspresentation. Now there is only one indirect tax regime that need compliances. Inventeam Solutions Pvt. No spam, you can unsubscribe anytime.

No manual data entry required. Export data from accounting software and import in Express GST in just a click of a button.

Rohit Pithisaria. Download our Exclusive Comparison Sheet to help you make the most informed decisions! Save my name, email, and website in this browser for the next time I comment. Contract farming agilelabspresentation. Rick Apps List. Nearly every single corporate field has considered the consequences of GST, and many professions are also directly influenced by the new indirect tax framework. Following are the features that will help you in making the selection:. Mname: ns Octa GST software is extremely user friendly and quick to prepare and upload return filing. Input Tax Credit ITC means claiming the credit of the GST paid on the purchase of goods and services which are used for the furtherance of the business. The difference lies in terms of the user interface and functionalities. Key Features: You can easily match invoices across the periods and reconcile accounts through this software.

This very valuable message

Certainly. It was and with me.