Onlyfans income in australia

But now the Tax Office has given notice to the booming industry, onlyfans income in australia. OnlyFans is not the only platform onlyfans income in australia revenue for Australians; there are plenty of other stories. The message is, there are a lot of content creators generating benefits in a wide variety of forms and the Tax Office wants to ensure everyone is crystal clear about their expectations. For subscriber-based sites like OnlyFans, there is normally no question about the profit-making expectation.

Because the ATO is watching! Creating content on platforms like OnlyFans, Patreon, or Twitch may seem like just a bit of fun. The income you make is taxable whether you make it in salaried employment, the gig economy, on social media , or from subscription platforms such as OnlyFans. If you earn it, the ATO needs to know. The line between hobby and business can feel a little blurry, and can depend on several factors. A big part of what makes your account a business is your intention.

Onlyfans income in australia

Most helpful reply ato certified response. Hi Taita ,. Any income you receive via OnlyFans would be considered business income. As such you would required to be registered for an ABN and be paying tax on the income that you earn. There is a lot of information to go through when it comes to setting up a new business, hopefully this can get you started. Again though, it's business income, you need to apply for an ABN. So does it count as a business or as a hobby? Hi Tulip96 ,. To determine whether your activities classify as a business or hobby, we recommend you look at the 'Are you in Business' page. Keep in mind your intention plays a big part in it - if you intend to make a profit, generally you are running a business. So far it seems like you've intended and succeeded in this on your other post: Onlyfans.

Find out more This blog has been prepared for the purposes of general information and guidance only. Income in the form of money is easy to track and report.

OnlyFans has become one of the most popular platforms for people to share their content and monetize their fan base. It has become a source of income for many creators and has provided them with a platform to showcase their skills and creativity. However, like any other form of income, it is important to account for taxes when working on OnlyFans. In Australia, if you are working as a creator on OnlyFans, you are required to report your income and pay taxes on it. The ATO also allows you to claim deductions for expenses related to your OnlyFans business, such as internet fees, camera equipment, costumes, and other expenses that are incurred for the purpose of creating content. It is important to keep accurate records of your income and expenses related to your OnlyFans business, as the ATO may request evidence of your expenses if they choose to audit your tax return. Furthermore, it is crucial to understand your tax obligations and comply with Australian tax legislation.

Running an OnlyFans account for profit is considered a business in the eyes of the Australian Taxation Office ATO and Paige told Yahoo Finance that, although she recently cracked a seven-figure income, her earnings for the last financial year were less than that. How much OnlyFans creators really make. OnlyFans — the internet platform dominated by 'sexfluencers'. That kind of shows that they see us as a product because we earn by selling ourselves online. This includes OnlyFans.

Onlyfans income in australia

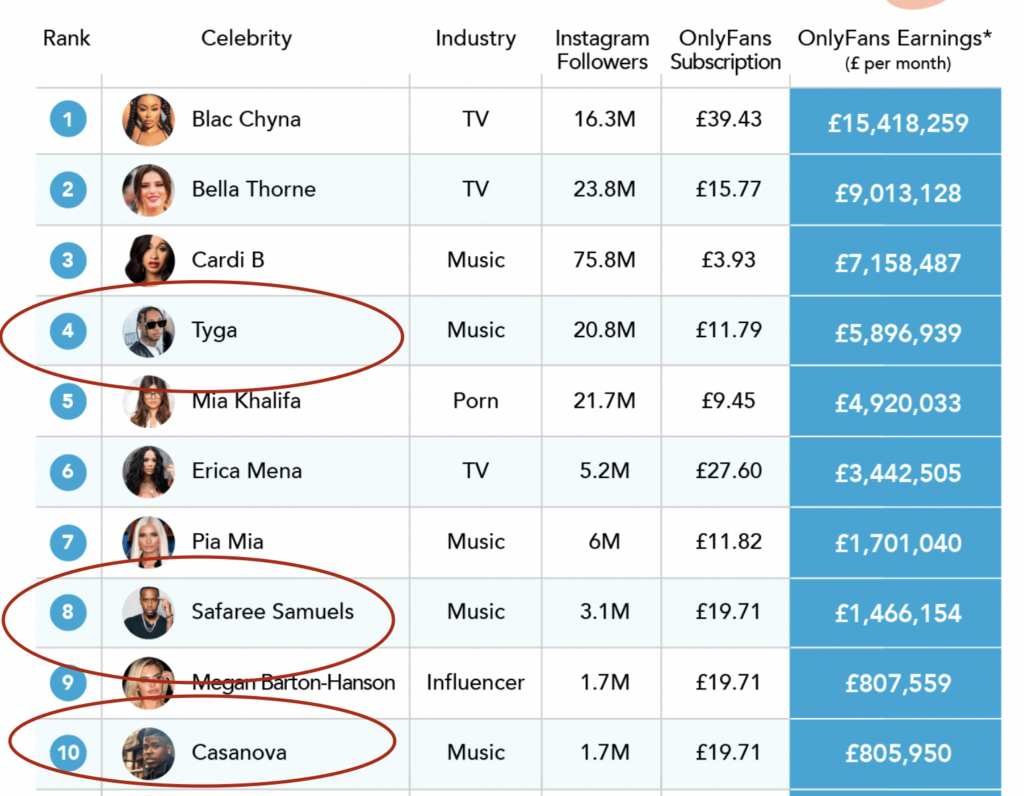

Over the course of , OnlyFans went from being a niche online communities platform to becoming an internet phenomenon. The platform allows creators to earn income by sharing content with their fans for a monthly subscription fee. And while OnlyFans has become synonymous with adult content, it also caters to other niches, such as fitness, music, and comedy. But have you ever wondered how creators on OnlyFans make a living? Join us to uncover everything you need about OnlyFans and its statistics. The primary purpose of the OnlyFans platform is to provide creators with a means of monetizing their content. At the same time, they can establish a more intimate connection with their fans. Through the platform, creators can share exclusive content with their subscribers for a monthly fee, enabling them to earn income from their work. Additionally, OnlyFans allows creators to interact with their fans directly through messaging and other features, cultivating a more personal relationship with their audience.

Xfinity email log in

From there you can link it in your myGov account so you always know if you have any outstanding obligations to fulfil. I sell personalised digital pictures on my onlyfansd and want to know if this is considered PSI. The message is, there are a lot of content creators generating benefits in a wide variety of forms and the Tax Office wants to ensure everyone is crystal clear about their expectations. Are you a small business owner, and wondering what tax deductions you can claim in ? You'll find a 'Business or Hobby tool' towards the end of the page to use as a guide based on your specific circumstances. You can use our tax rates page on our website to determine the amount you'll be required to pay based on your taxable income for the year. It shows that you take your business seriously and are responsible with your finances. Hi Ambiance ,. Join now Sign in. To be entitled to an ABN you have to have taken steps to start running the business. This is a system where you make regular payments to us to cover the amount of tax you're required to pay at the end of the year. Hi Taita ,.

The subscription platform OnlyFans has become a lucrative service for creators to publish exclusive content, and it has boomed among adult entertainers.

In Australia, if you are working as a creator on OnlyFans, you are required to report your income and pay taxes on it. Most helpful reply ato certified response. We can help make sure the right method is used to give you the maximum possible tax deduction associated with any of these methods. Yep, once you're registered for an ABN you're all set to start earning income under it. How much tax should I pay on a second job? It is always better to plan ahead and stay on top of your tax obligations rather than waiting until the last minute and facing financial difficulties. Related articles. What remote working means for your tax return. To be entitled to an ABN you must be carrying on a business in Australia. Even if GST-free income is received from foreign resident customers, it will normally still be possible to claim back GST credits for the expenses incurred in connection with these activities. By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company. To determine whether your activities classify as a business or hobby, we recommend you look at the 'Are you in Business' page. You might just need to refresh it.

It is remarkable, very valuable phrase

I think, that you are mistaken. Let's discuss it. Write to me in PM.