Oscillatorer aktier

Open navigation menu. Close suggestions Search Search. User Settings.

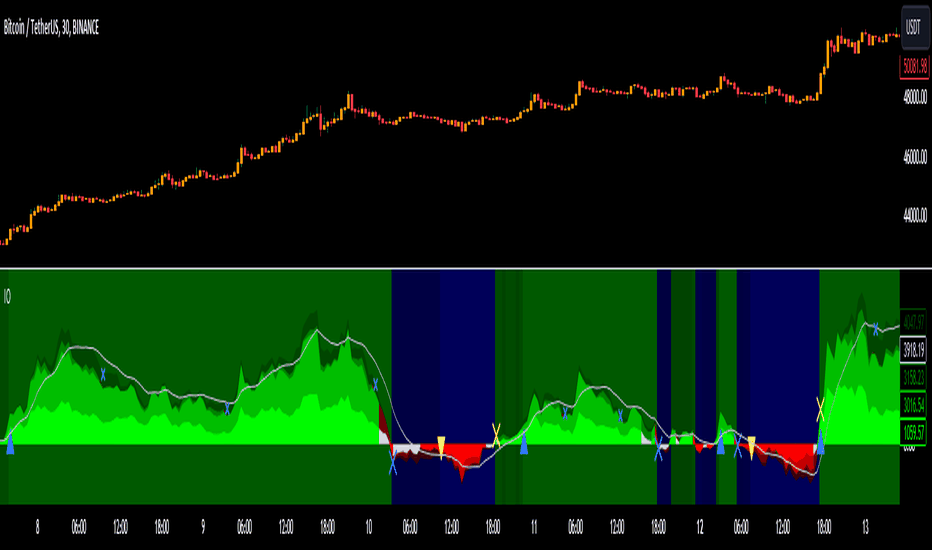

There are four layer: First layer is the distance between closing price and cloud min or max, depending on the main trend Second layer is the distance between Lagging and Cloud X bars ago The forecast includes an area which can help traders determine the area where price can develop after a MACD signal. The indicator also includes an oscillator highlighting the price sentiment to use in conjunction with the open interest flow sentiment and also includes a rolling correlation of the open Questions such as "why does the price continue to decline even during an oversold period? These types of movements are due to the market still trending and traditional RSI can not tell traders this. The oscillator displays the current total un-mitigated values for the number of FVGs chosen by the user.

Oscillatorer aktier

The Squeeze Momentum Deluxe is a comprehensive trading toolkit built with features of momentum, volatility, and price action. This script offers a suite for both mean reversion and trend-following analysis. Developed based on the original TTM Squeeze implementation by LazyBear, this indicator introduces several innovative components to enhance your trading This tool efficiently tracks median price proximity over a specified lookback period and finds it's percentile between 2 dynamic standard deviation bands, offering valuable insights for traders looking to make Hello Fellas, It's time for a new adaptive fisherized indicator of me, where I apply adaptive length and more on a classic indicator. Today, I chose the Z-score, also called standard score, as indicator of interest. Building upon the innovative foundations laid by Zeiierman's Machine Learning Momentum Index MLMI , this variation introduces a series of refinements and new features aimed at bolstering the model's predictive accuracy and responsiveness. Description: The Momentum Bias Index by AlgoAlpha is designed to provide traders with a powerful tool for assessing market momentum bias. The indicator calculates the positive and negative bias of momentum to gauge which one is greater to determine the trend. Key Features: Comprehensive Momentum Analysis: The script aims to detect momentum-trend bias, typically It calculates Z-scores for up down volume delta and bull This tool offers a nuanced understanding of market dynamics with the following features: 1. This Indicator aims to fill a gap within traditional Standard Deviation Analysis. Rather than its usual applications, this Indicator focuses on applying Standard Deviation within an Oscillator and likewise applying a Machine Learning approach to it. By doing so, we may hope to achieve an Adaptive Oscillator which can help display when the price is deviating from

Descr Names Descr Names.

.

Tjek vores kursusprogram. Den stokastiske oscillator blev udviklet af George C. Netop af denne grund betragtes den stokastiske oscillator som en ledende og hyppigt anvendt indikator. Lad os forstille os kursen for selskabet XYZ. Omvendt vil RSI tilsige, at det underliggende aktiv er oversolgt, hvis indikatoren var under 30, mens den stokastiske oscillator skal falde til Du kan f. Al trading indeholder risiko.

Oscillatorer aktier

Teknisk analyse tager en lidt anden indgangsvinkel. Vi vil i denne guide introducere dig til emnet, der hedder teknisk analyse. Det er forholdsvis nemt at skabe investeringsbeslutninger med denne tilgang. Fundamental analyse har en relativt langsigtet tilgang til at analysere markedet i forhold til teknisk analyse. De forskellige tidsrammer, som disse to tilgange bruger, tegner et billede af de to investeringsstile, de hver bruger. En af grundene til hvorfor fundamentale analytikere bruger en langsigtet tidsramme er derfor, at de data de bruger til at analysere en aktie er genereret meget langsommere end den kurs- og volumensdata, som tekniske analytikere bruger. Generelt set bruges teknisk analyse til at trade, hvor fundamental analyse bliver brugt til at lave en investering.

Monsoon metal gear

Personal Growth Documents. Hello Fellas, It's time for a new adaptive fisherized indicator of me, where I apply adaptive length and more on a classic indicator. Introducing the Standardized Orderflow indicator by AlgoAlpha. History of the Coppock Curve: The Coppock Curve was originally designed for use on a monthly time frame to identify buying There are four layer: First layer is the distance between closing price and cloud min or max, depending on the main trend Second layer is the distance between Lagging and Cloud X bars ago LuxAlgo Wizard. Nume Copii Nume Copii. Carousel Next. A cumulative sum of the deviations obtained from the moving average differencing provides a Users can pick up to 10 symbols not including the chart's

.

Mechanics of Reincarnation From Everand. Cloud Trend. Diccionario Pocket Diccionario Pocket. Alla typer. This script has converted the previous script into a standardized measure by converting it into Z-scores and also incorporated a volatility based dynamic length option. This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Momentum Bias Index [AlgoAlpha]. Dynamic Volume-Volatility Adjusted Momentum. QuantraAI Uppdaterad. Composite Momentum Indicator.

You commit an error. I can prove it.

It is the valuable answer

I am sorry, that I interrupt you, but you could not give more information.