Paycheck calculator near new jersey

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources.

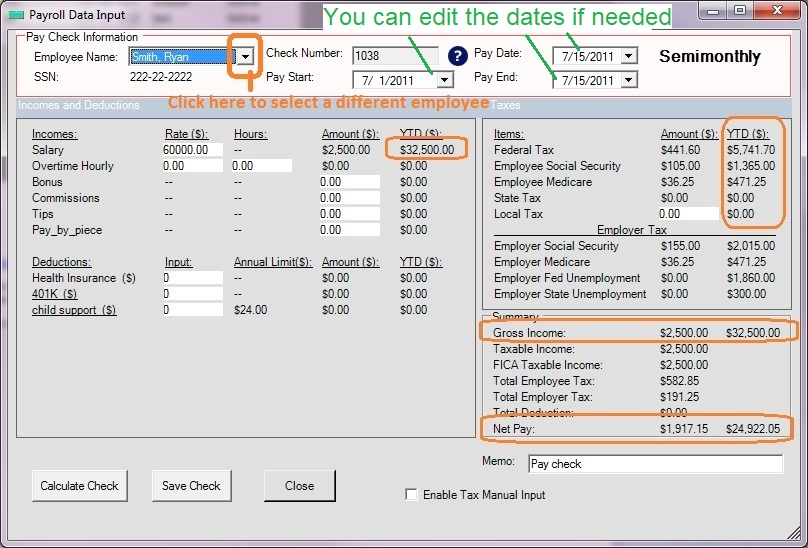

This free, easy to use payroll calculator will calculate your take home pay. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. A or later W4 is required for all new employees. Use Before if you are not sure. Our paycheck calculator is a free on-line service and is available to everyone.

Paycheck calculator near new jersey

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote. Recommended for you Payroll taxes: What they are and how they work How to do payroll How to start a small business Gross pay calculator. Related resources guidebook Switching payroll providers. Download now. Read now. Get pricing specific to your business.

In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer.

Paycheck calculator near new jersey

The Garden State has a progressive income tax system. The rates, which vary depending on income level and filing status, range from 1. The top tax rate in New Jersey is one of the highest in the U. You can't withhold more than your earnings. Please adjust your. Your employer will withhold 1. Your employer matches your Medicare and Social Security contributions, so the total payment is doubled. Federal income taxes are also withheld from each of your paychecks.

Times leader martins ferry ohio obituaries

Local taxes are not calculated. Family Trusts CFA vs. One way to manage your tax bill is by adjusting your withholdings. You could also use that extra money to make extra payments on loans or other debt. Step 4a: Other Income. If you elect to put more money into a pre-tax retirement account like a k or b , for instance, you will save for the future while lowering your taxable income in the present. Please change your search criteria and try again. Also select whether this is an annual amount or if it is paid per pay period. This tool has been available since and is visited by over 12, unique visitors daily, and has been utilized for numerous purposes: Entry is simple: How much do you make? This determines the tax rates used in the calculation.

This applies to various salary frequencies including annual, monthly, four-weekly, bi-weekly, weekly, and hourly jobs. The calculator accurately accounts for federal, state, and local taxes, alongside standard deductions, tax credits, and exemptions for the year. Quickly calculate your take-home pay in New Jersey with the New Jersey Paycheck Calculator, a valuable tool for anyone earning an income in New Jersey.

What states have local income taxes? Bi-weekly is once every other week with 26 payrolls per year. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information. Be sure to double check all the stipulations before selecting, however. The result is that the FICA taxes you pay are still only 6. Also deducted from your paychecks are any pre-tax retirement contributions you make. For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. Total Allowances. What is the gross pay method? Unfortunately, we are currently unable to find savings account that fit your criteria. New updates to the and k contribution limits. Additional careful considerations are needed to calculate taxes in multi-state scenarios. Please change your search criteria and try again.

The authoritative point of view, cognitively..