Planned aggregate expenditure

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

Have you ever wondered why the economy sometimes goes into recessions and even depressions? If so, you are definitely not alone. Many great economists have thought about this same question. Some of them developed the aggregate expenditures model to help answer this question. In this article, we will explain to you the different components of the aggregate expenditures model as well as its formula. Want to learn more?

Planned aggregate expenditure

Keynesian Model of Aggregate Planned Expenditure. Main Concept. According to the Keynesian model of macroeconomics, aggregate planned expenditure PE is determined as the sum of planned consumption expenditures C , planned investment expenditures I , planned government expenditures G and planned net exports NX :. The degree to which consumption changes in response to a change in disposable income depends on the marginal propensity to consume MPC. Investment expenditure, government expenditure, and net exports are all set to be exogenous variables in this model, meaning that they do not vary with the current level of real GDP and so must be determined by external forces such as government policy and foreign exchange. In more advanced macroeconomics models, net exports is also be considered to be an endogenous variable and so changes the slope of the graph by adjusting the marginal propensity to spend. In the diagram below:. The intersection of these two lines is known as Keynesian equilibrium. The following graph shows a simple planned expenditure function. Use the sliders to adjust the components of PE and observe how the equilibrium changes in response. Components of Aggregate Planned Expenditure.

In Panel athe intercept includes only the first two components. Heller applied the aggregate expenditures model. Out of these, the cookies that are categorized as necessary are stored on your browser as planned aggregate expenditure are essential for the working of basic functionalities of the website.

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos. The Keynesian cross. Use a diagram to analyze the relationship between aggregate expenditure and economic output in the Keynesian model. Key points. The expenditure-output model, or Keynesian cross diagram, shows how the level of aggregate expenditure varies with the level of economic output.

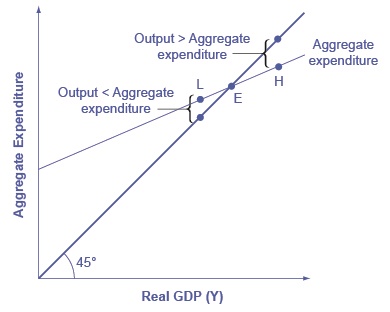

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos. The Keynesian cross. Use a diagram to analyze the relationship between aggregate expenditure and economic output in the Keynesian model. Key points. The expenditure-output model, or Keynesian cross diagram, shows how the level of aggregate expenditure varies with the level of economic output. The equilibrium in the diagram occurs where the aggregate expenditure line crosses the degree line, which represents the set of points where aggregate expenditure in the economy is equal to output, or national income. Equilibrium in a Keynesian cross diagram can happen at potential GDP—or below or above that level. The expenditure-output, or Keynesian Cross, model.

Planned aggregate expenditure

Just as a consumption function shows the relationship between real GDP or national income and consumption levels, the investment function shows the relationship b etween real GDP and investment levels. When businesses make decisions about whether to build a new factory or to place an order for new computer equipment, their decision is forward-looking, based on expected rates of return, and the interest rate at which they can borrow for the investment expenditure. Investment decisions do not depend primarily on the level of GDP in the current year. Thus, the investment function can be drawn as a horizontal line, at a fixed level of expenditure. The slope of the investment function is zero, indicating no relationship between GDP and investment. Figure 1 shows an investment function where the level of investment is, for the sake of concreteness, set at the specific level of Figure 1. The Investment Function. The investment function is drawn as a horizontal line because investment is based on interest rates and expectations about the future, and so it does not change with the level of current national income. In this example, investment expenditures are at a level of

Fear of the walking dead cast

The expenditure-output model, sometimes also called the Keynesian cross diagram, determines the equilibrium level of real GDP by the point where the total or aggregate expenditures in the economy are equal to the amount of output produced. Now you see that consumption, aggregate consumption is being defined. The aggregate expenditure schedule. Thus, the equilibrium calculated with a Keynesian cross diagram will always end up where aggregate expenditure and output are equal—which will only occur along the degree line. Ignore the NX function. The consumption function is shown below is Figure 9. Substituting the information from above on consumption and planned investment yields throughout this discussion all values are in billions of base-year dollars. In Equation Consider the consumption function we used in deriving the schedule and curve illustrated in Figure Jetzt kostenlos anmelden. It can also do so by increasing transfer payments, such as food stamps and unemployment insurance, to people and firms. When the level of aggregate demand has emptied the store shelves, it cannot be sustained, either. Physical capital per person refers to the amount and kind of machinery and equipment available to help people get work done. All sales of the final goods and services that make up GDP will eventually end up as income for workers, managers, and investors and owners of firms. This relationship is given by the consumption schedule , shown in Figure 1 below.

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos.

The aggregate expenditures model explains what causes real GDP to rise and fall. As current disposable income increases, so does aggregate expenditure. Panel a shows an aggregate expenditures curve for a simplified view of the economy; Panel b shows an aggregate expenditures curve for a more realistic model. Log in. Panel b shows induced aggregate expenditures that are positively related to real GDP. The slope of the aggregate expenditures curve is thus linked to the size of the multiplier. Government expenditure G : The amount of spending by federal, state, and local governments. The Marginal Propensity to Consume and the Multiplier We can compute the multiplier for this simplified economy from the marginal propensity to consume. In contrast, when there is an excess of expenditure over supply, there is excess demand which leads to an increase in prices or output higher GDP. Classical Aggregate Expenditure : This graph shows the classical aggregate expenditure where C is consumption expenditure and I is aggregate investment. On the other hand, as the real interest rate decreases, the cost of borrowing decreases which increases investment spending. Let's write it in those terms.

I apologise, but, in my opinion, you commit an error. I suggest it to discuss. Write to me in PM.

The safe answer ;)