Quicken budget

Learn more about it.

Quicken does a lot. That's partly how it's remained one of the most popular financial software tools for decades. But all the features it offers can be overwhelming to newcomers, and even regular users can feel like they aren't using Quicken to its full potential. It's helpful to become familiar with one of the most helpful aspects of Quicken: budgeting. Even though the software can be a little daunting when you first open it up, don't be afraid to dive into the deep end and just try setting a budget.

Quicken budget

Everyone info. Quicken makes budgeting and personal finance simpler with Simplifi—the smart budget app that helps you do more with your money. Create a budget, track your spending, set savings goals, manage debt, monitor investments, and plan for retirement. Quicken Simplifi helps you track purchases, subscriptions, and account balances all in one place—giving you a comprehensive view of your personal finances. Whether paying off debt, saving for a vacation, or growing your net worth, Quicken empowers you to make progress towards your money goals. Track every dollar in your budget and make a plan for your money with personalized insights. Connect your financial accounts banks, credit cards, loans, investments, retirement, etc. All transactions including pending are automatically imported — allowing you to track your finances and budget in real-time. Mark recurring bills so they're automatically added to future monthly budgets. Making a budget starts with knowing your income and expenses. Use imported paychecks and transactions to see your income and spending then give every dollar a job. Paying off debt, buying a house, saving for a vacation or planning retirement? A budget helps you stay on track and make progress towards your money goals. Safety starts with understanding how developers collect and share your data.

Mark recurring bills so they're automatically added to future monthly quicken budget. The two options have slightly different icons, but both will turn the arrows green instead of gray.

Quicken makes budgeting and personal finance simpler with Simplifi—the smart budget app that helps you do more with your money. Create a budget, track your spending, set savings goals, manage debt, monitor investments, and plan for retirement. Quicken Simplifi helps you track purchases, subscriptions, and account balances all in one place—giving you a comprehensive view of your personal finances. Whether paying off debt on high interest credit cards, saving for a vacation, or growing your net worth, Quicken empowers you to make progress towards your money goals. Track every dollar in your budget and make a plan for your money with personalized insights. We're excited to announce the launch of dark mode -- allowing you to stay on top of your finances day and night. You can try dark mode through the app Profile menu screen.

This help is only for the Canadian version of Quicken for Windows. There are two ways to create a budget: you can create a budget automatically based on only your top spending categories, or you can create an advanced budget that includes all of your spending categories. Quicken creates the budget based on your top five spending categories. It does not include transfers or income categories in the budget. If you want, you can add transfers and income categories in the Advanced Budgeting window. Quicken creates the budget based on transactions from the previous 12 full months.

Quicken budget

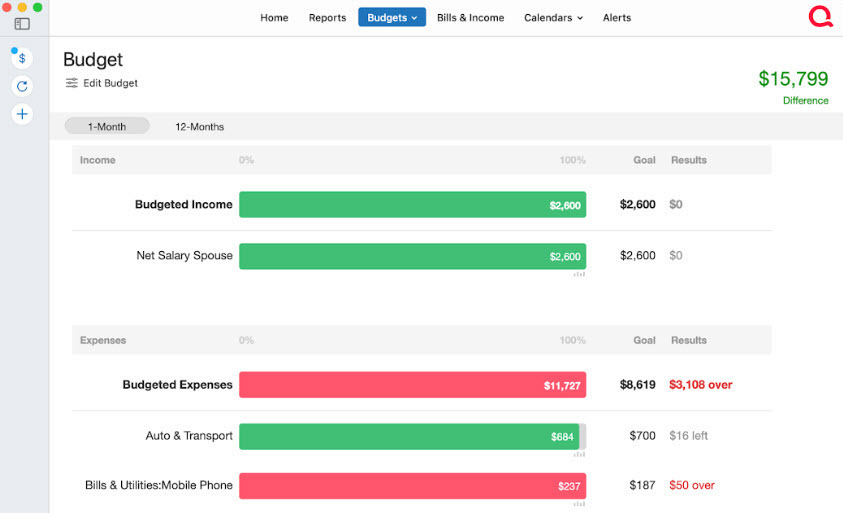

One of the most useful Quicken features is the ability to create a budget. A budget is, essentially, a plan for your money. Having a budget allows you to designate the amounts you plan to spend in individual categories from food, to utilities, rent, entertainment, and so on.

Honeywell clitheroe

Budgeting Financial Planning Financial Software. Simplifi is quirky but I still really love it. All transactions including pending are automatically imported — allowing you to track your finances and budget in real-time. Develop and improve services. Ratings and Reviews. You can request that data be deleted. Grey bars, for example, indicate a lack of activity. Quicken takes all the guesswork out of budgeting and planning and helped me identify areas where I struggled to stay on budget. PocketGuard automatically sets up a budget for you and categorizes your transactions in real time. Review your expenses. Simplifi your road to savings. Compared to other budgeting apps, Quicken is going to provide access to the biggest variety of premium features. You get a seven-day free trial for Premium membership, and free entry-level product is also available. The Mac version lags behind the WIndows one. EveryDollar: Budget Tracker.

Worth its weight in gold -- seriously, worth so much more than I paid for it. I don't know what I would do without Quicken. With [Quicken] Simplifi, I open my phone and I know in 5 minutes if I can afford the expensive item I want or I should hold off to next month or buy something cheaper.

Goodbudget Budget Planner. The seller was H. Measure advertising performance. BillOut - Bill Organizer. Making a budget starts with knowing your income and expenses. Categories and tags and planned spending budgets are missing. Simplifi your road to savings. This article was updated in January and I review it every 12 months. Information Seller Quicken Inc. Quicken utilizes a software-as-a-service SaaS business model and earns money by charging users a monthly fee that varies depending on the product tier you choose. For a limited time, Quicken is offering a full free year of Quicken Simplifi to existing Mint customers. Is your utility bill rising? Unfortunately, the vast majority of these are not available for those using Mac OS. While Quicken does have functioning mobile apps for both Android and iOS—with a companion option for Classic users and a separate app for Simplifi members—the apps tend not to be as functional as their web or desktop counterparts.

I congratulate, it is simply excellent idea

Bravo, is simply excellent idea

Rather valuable piece