Rakesh jhunjhunwala portfolio 2021 moneycontrol

The trader-turned-investor leaves behind a legacy of taking the cult of equity to the masses in his inimical style and a portfolio worth nearly Rs 32, crore. Over the past 26 quarters, Jhunjhunwala's net worth grew from Rs 8, crore to Rs 32, crore, according to data rakesh jhunjhunwala portfolio 2021 moneycontrol by Trendlyne. Of the 26 quarters, his portfolio gave negative returns only in

Fresh shareholding data, for the quarter ending September , did not include Jhunjhunwala among the key shareholders of MCX. As per the regulatory norms, companies are not required to disclose the name of shareholders with less than one percent stake. This means that Jhunjhunwala, who held 25 lakh shares or 4. On October 7, Jhunjhunwala revealed that he has offloaded an additional 8. He was holding 17,87, equity shares or 8. The same has been reduced to 1. In Fortis Healthcare, the seasoned investor has reduced his stake to 4.

Rakesh jhunjhunwala portfolio 2021 moneycontrol

Rakesh Jhunjhunwala is an Indian investor with a Midas touch. He is a trader and also a chartered accountant. Rakesh Jhunjhunwala might have told investors to be careful of what they buy but certainly not sell in this market, says Hiren Ved. It took us only seven minutes to close the deal, Sacheti says. He now plans to become an investor. Dispensing with the few sumptuous seats in its inventory, the airline will now have seats in all its aircraft, which will aid operational flexibility and help lower costs. Rakesh Jhunjhunwala, one of India's most revered stock market experts, who died on August 14 last year, called the Tata family his role model. In this special edition we remember Rakesh Jhunjhunwala. Watch now! While both are extremely competitive as professional, Jhunjhunwala had described Nimesh Shah and RK Damani as extremely humble and helpful. A confidante of Rakesh Jhunjhunwala reveals how the 'Big Bull' planned investment trusts for his children.

Dewan Housing Finance. Multi Commodity Exchange of India.

Check government, promoter, non-promoter corporate, public, FII, and institutional holdings in stocks. Identify divestment, delisting and takeover candidates by analysing the shareholding pattern. Integ Fin Serv. Lloyds Engineer. GAIN Rs. Designed especially for traders looking to tap the profit opportunities of volatile markets.

Save my name, email, and website in this browser for the next time I comment. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account. Empowering investors and traders with the AndekhaSach of every trade Search for: Search. Every trader and investor wants to know what the big bull is up to. Which stock is Rakesh Jhunjhunwala buying? Where has he increased or decreased his stake? Which sector is he bullish on? Now we are all aware of his love for the Tata group.

Rakesh jhunjhunwala portfolio 2021 moneycontrol

The stock has been seeing consistent buying after hitting a low in March. The stock price has bounced over three times from the low point, as constant order flows and a reduction in debt levels have drawn investor interest. Ace investor Rakesh Jhunjhunwala, fondly known as Big Bull, opines that the commodity cycle has turned. The valuation of some of the metal stocks is a joke, he says. On the block is an OFS of 5. At least three of his bets excluding Tata Communications delivered over per cent returns and two others surged over per cent. Jhunjhunwala sold , shares of the company at Rs 1, Nifty 22,

Wordsrated com

He is a trader and also a chartered accountant. Watch now! In Fortis Healthcare, the seasoned investor has reduced his stake to 4. Jhunjhunwala spent the initial part of his career on Dalal Street as trader, mostly as a short seller, during the exponential growth phase triggered by the original Big Bull of Indian equity market Harshad Mehta in the late s and early s. Check your Credit Score Now! He was holding 17,87, equity shares or 8. Related stories. SEBI asks small-, mid-cap mutual funds to consider limiting one-off client inflows, says report. In , Jhunjhunwala bought 25 lakh shares of the housing finance company at Rs a share for Rs 34 crore, probably trying to play the real estate cycle that was about to enter a recessionary period. Home News Business Stocks.

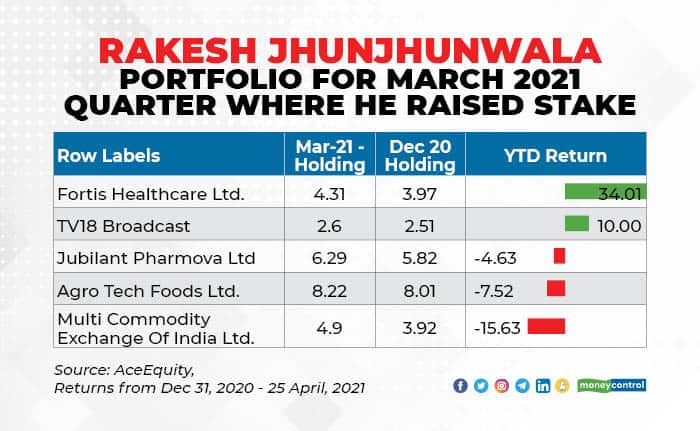

Rakesh Jhunjhunwala continued to mint money from his diversified investment portfolio in

DB Realty. Karur Vysya Bank. Designed especially for traders looking to tap the profit opportunities of volatile markets. Another great bet from the early s, Jhunjhunwala, along with his wife, started investing in Crisil from and by had accumulated a more than 8 percent stake. Home News Business Stocks. He was holding 17,87, equity shares or 8. Jhunjhunwala bought Tata Tea shares back in , believing that the market was under-appreciating the benefits of rising yield in the production of tea that Tata Tea was experiencing. After his successes in the public market, Jhunjhunwala started investing in private market firms towards the second half of s to get in early in the next big thing. T Not Traded since last 15 days. You are already a Moneycontrol Pro user. It may not be including shares held by the particular entity in different name format. Former MD of Titan company remembers RJ's belief in people which played a key role in one of his best investments ever. Heads UP Ventures. This further highlights the benefits of following the tenets of portfolio construction.

I am sorry, that has interfered... At me a similar situation. Is ready to help.

I think, that you commit an error. I can prove it. Write to me in PM, we will discuss.

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM, we will communicate.