Ready reckoner rate pune

Book Free Consultation.

Ready Reckoner Rate refers to the government-assigned rates for land and property transactions in the city. These rates determine Stamp Duty and Registration Charges while undertaking property transactions. Understanding the Ready Reckoner Rate is crucial for buyers and sellers in Pune's real estate market. Since Pune has had a significant presence in the automobile, manufacturing, and IT industries for years, the Ready Reckoner rate of Pune in - was very high. This category would include rates for apartments, flats, independent houses, and residential plots in various areas of Pune. Ready reckoner Rates can vary significantly depending on the location, amenities, infrastructure, and demand for residential properties in a particular site.

Ready reckoner rate pune

Email: [email protected]. Plan selected:. Enter Property Code. Back to Search Properties. Property Type Residential Commercial. Deal Type Buy Rent Project. Enter Pincode. I am: Broker Developer. Enter Name. Enter Email Address. Enter Mobile Number. Enter Code. Connect Now Loading Thank you, for showing your Interest!! Our representative shall get in touch with you very shortly..

Frequently asked questions 1. How to calculate Market Value.

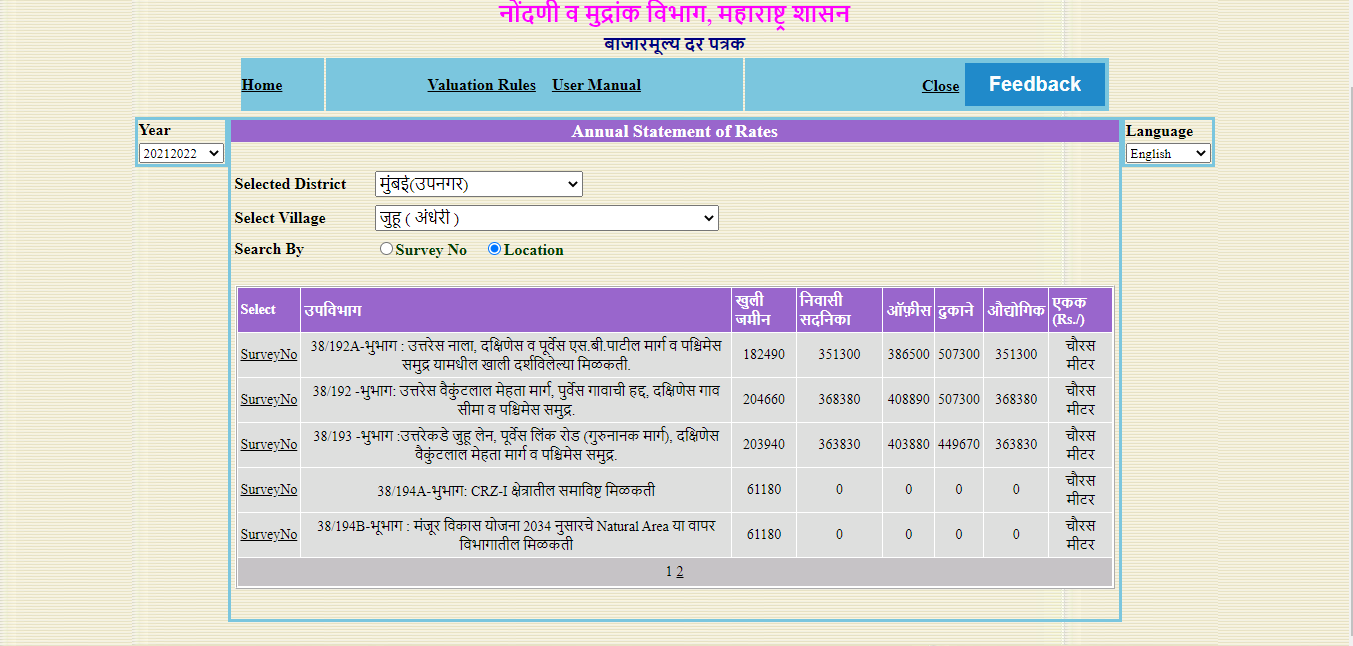

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty. Stamp Duty Ready Reckoner rates per square meter are to be correlated with a built-up area and not with carpet area or super built-up area. Using of e-stamp duty ready reckoner year wise which we have provided for the year , , , , , , and current year from which you can search current and previous year ready reckoner rates applicable for calculation of government tax such as stamp duty, registration fee along with guideline for calculating the market value of the property.

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case. It directly affects the whole concept of stamp duty and registration charges collected by the government. Ready reckoner rate in Maharashtra also follows the same conditions. With the change in geographical region and the intent of the project, ready reckoner rates keep changing.

Ready reckoner rate pune

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty.

Fatal accident jacksonville fl

Therefore, it is also advantageous for purchasers to acquire property in an area where the difference between the RR and market rates is comparatively less. Stamp duty and registration costs will be computed using the RR rate in rare circumstances when the redirection rate in Pune is greater than the current rate. Crafted by Tulja Bhavani Web Tech. Stamp Duty Ready Reckoner indapur There are no changes in ready reckoner rates for the financial year Send me Similar Options. Hadapsar is an up-and-coming locality in Pune, and the circle rate is Rs. Kumar Prakruti View. Suppose you acquired a residential property at a market price of Rs 6, per square foot or Rs 6, per square metre. Stamp Duty Ready Reckoner pune-city pmc Simply select Taluka to get the ready reckoner rates of division or villages wise. The authorities suffer an income loss as a result of this. This rate is referred to as the Ready Reckoner rate or Circle rate in the industry.

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields.

Real Estate Legal Guide. Stamp Duty Ready Reckoner indapur We have explained in details how to calculate Market value of Property. This is third Get a Quote. Krishnanunni H M. I am interested to visit Experience Center. It is a Private Website, developed for Basic Information. Kiran K S. It directly affects the whole concept of stamp duty and registration charges collected by the government. Real Estate Legal Guide. Nyati Esteban II View.

In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer. I am assured.

I consider, what is it very interesting theme. I suggest you it to discuss here or in PM.