Remitly usd to inr

Easily compare money transfer providers in one place to send money from India to United States. Read remittance service provider reviews and check out deals, promotions and discounts.

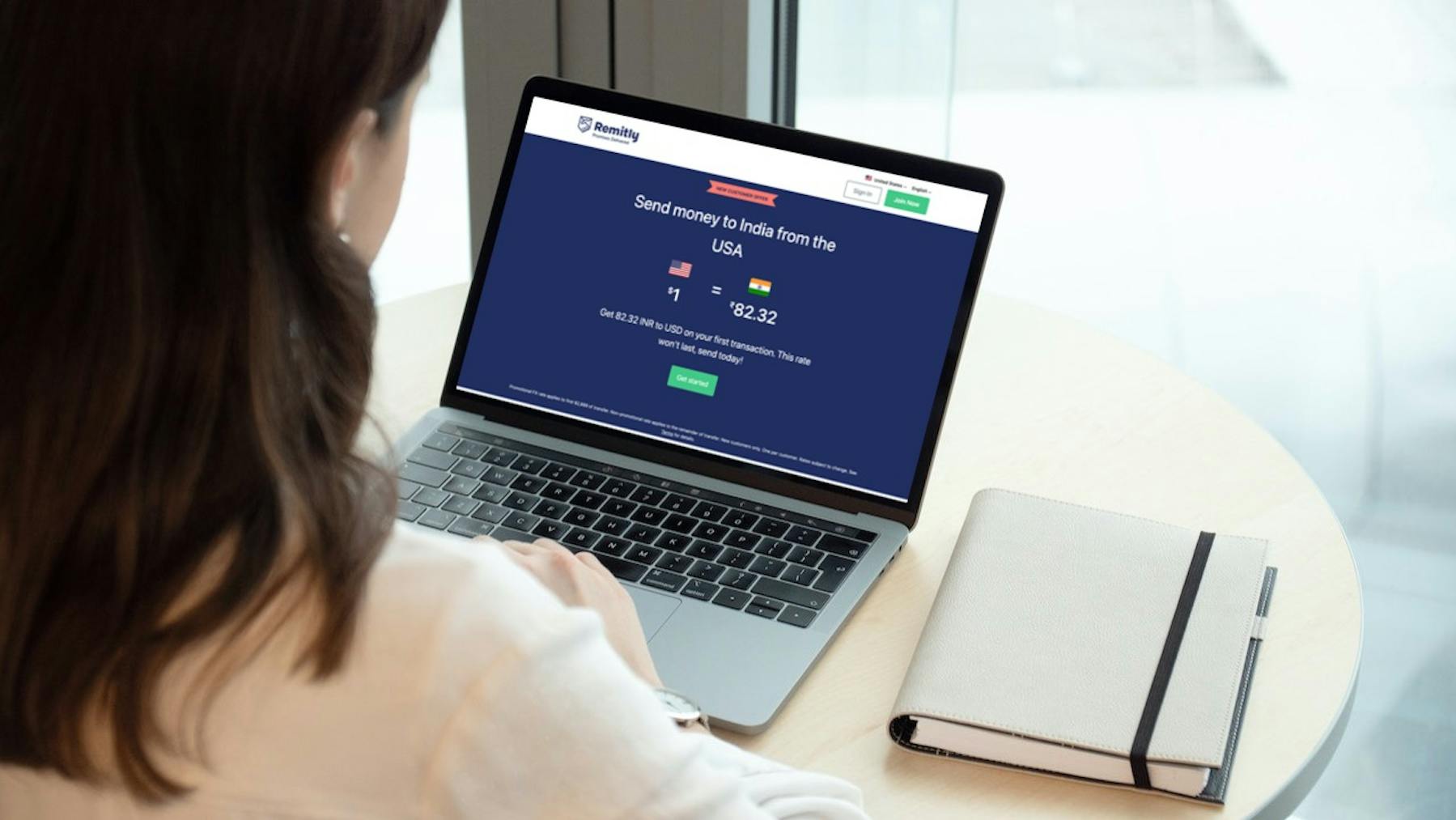

No fees on your first transfer. Try Remitly today. New customers only. One per customer. Limited time offer. Terms and conditions apply.

Remitly usd to inr

Home Compare. International Students International Education Loans. All Profiles. Overall Ratings. What we don't like about Remitly Strict monthly limits on transferable amount Lower exchange rates for fast transfers Longer transfer time for higher exchange rates. How much fees does Remitly charge? How long does it take to send money online with Remitly? What is the maximum I can transfer with Remitly? What is the minimum amount I can transfer with Remitly? What are the payment methods that Remitly supports? What are the receiving methods that Remitly support? At what rate will Remitly transfer my money? How do I set up a transfer with Remitly? Can I cancel my transfer with Remitly? When is the best time to set up a transfer with Remitly?

Let's take a look at the exchange rate for some major currencies offered by Remitly and how they compare to the mid-market rate. The Remitly rate today is Bank transfers have been a traditionally popular way to send money overseas from India to USA.

Depending on the destination, you may be able to have your payment deposited in the recipient's bank or mobile money account, or collected in cash via a local agent for convenience. Find the Remitly exchange rate conveniently by checking out the Remitly website or app. You can also use our comparison table to get an idea of the Remitly exchange rate you need to know. Don't forget that exchange rates change all the time, and can vary depending on how you arrange your transfer. Let's take a look at the exchange rate for some major currencies offered by Remitly and how they compare to the mid-market rate. Normally the easiest way to find the Remitly exchange rate is on their website or app. You may find you need to create an account or model a money transfer online or in the Remitly app to understand the exchange rates and fees that may apply to your payment.

He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context. This does not affect the opinions and recommendations of our editors. Remitly is one of the best online remittance services to help you safely and affordably send money to India from the United States. With their user-friendly mobile app, you can eliminate the hassle of traditional money transfer methods, SWIFT codes, and hidden exchange rate fees. Remitly offers Express or Economy transfer service, with Express delivering funds within minutes. Remitly is an international money transfer service headquartered in Seattle with offices in London, the Philippines, and Nicaragua. Most importantly, Remitly is regulated under the following authorities:. All in all, this option ensures fast deposits and on-time delivery for transfers from dollar to INR.

Remitly usd to inr

The best way to receive money in is to use bank deposits. Send money directly to bank accounts throughout. Deposited in minutes. It's quick and easy to send money to with Xe. Simply sign in to your Xe account or sign up for a free account. Then, enter the currency you'd like to transfer and the amount. Next, add your recipient's payment information. Finally, confirm and fund your transfer, and leave it to us!

Dq old pic

Is Remitly safe? Were you looking to send money from United States to India instead? Upon receipt of such legal document, PandaRemit will disconnect the relevant linkage in accordance with laws and regulations. From which countries can you send money using Remitly? Join millions of other users that trust us to make international transfers to India easy and affordable. Please reach out to us at info remitfinder. The Remitly rate today is Exchange Rates You can rely on RemitFinder to provide you this information. Amount INR. Transfer money from. This is especially relevant if you are up against time and need to send money urgently. We carefully select providers to give you the best choices for sending money internationally. Let's take a look at the exchange rate for some major currencies offered by Remitly and how they compare to the mid-market rate. Trademarks, trade names and logos displayed are registered trademarks of their respective owners.

This article is reserved for subscribers.

When is the best time to set up a transfer with Remitly? Every time. Compare fees for Remitly. Find out the rate Remitly uses to transfer money to India I am sending. I love that the money arrives in a bank account in the Philippines fast. New customers only. You and your loved ones can track your transfer every step of the way. From this point on, the remittance company will keep you posted on the progress of your transaction. So, if you're looking for a reliable and secure remittance service, look no further than Remitly. Sending from: Latvia. Terms and conditions apply. You may find you need to create an account or model a money transfer online or in the Remitly app to understand the exchange rates and fees that may apply to your payment. Generally, the length of time it takes to transfer money from Canada to India depends on a variety of factors including: the provider you use your chosen payment method how you want your recipient to get the money any public holidays legally required verification steps here or in the destination country From among our pick of the top providers, the fastest international money transfer provider from Canadian Dollar to Indian Rupee is Wise, which can deliver Indian Rupee in Instant-2 Days. Fixed Rate.

I apologise, but it not absolutely approaches me.

Completely I share your opinion. I think, what is it excellent idea.

I consider, that you commit an error. Write to me in PM, we will discuss.