Requirements for chase sapphire

This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months.

It's loaded with benefits such as airport lounge access , a generous annual travel credit and a variety of useful built-in travel insurance coverages. However, you'll typically need a strong credit score to get approved for a premium credit card such as the Chase Sapphire Reserve. On top of that, Chase has other application restrictions you need to watch out for. CNBC Select explains how to increase your chances of getting this premium credit card. Cardholders can also take advantage of many useful travel and purchase coverages. You'll get trip delay insurance, rental car coverage, purchase protection , extended warranty protection and more.

Requirements for chase sapphire

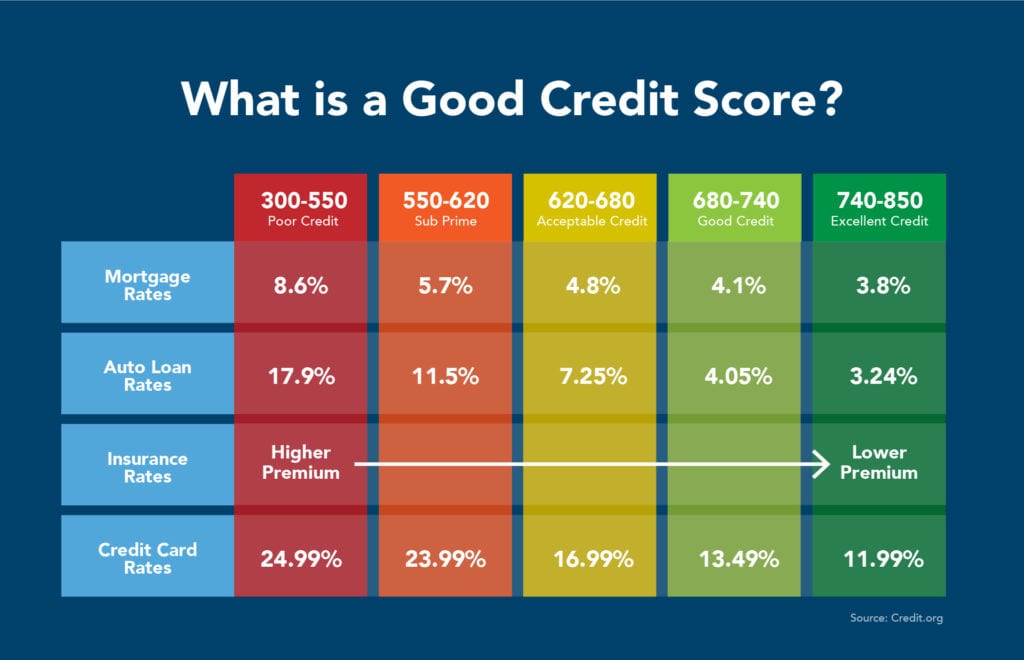

Although you can potentially get more value when transferring your points to Chase's travel partners like United and Southwest. You'll also have access to perks such as a complimentary year of DashPass membership to use for food delivery with DoorDash and Caviar when you activate the offer by Dec. Keep in mind that in order to even qualify for this card, you'll need to have a decent credit score. First off, most credit card issuers will look at your FICO credit score in order to determine your eligibility for a new card. FICO scores range from to , with higher scores indicating a higher likelihood that you'll be able to pay off your balance on time and in full. It is possible for you to qualify with a lower score — or even be rejected with a higher score — but to improve your odds of being approved, aim to have a score above To maintain a good credit score , you'll need to make your payments on time, keep a low credit utilization ratio and have a long credit history. Here's how each category contributes to your overall credit score. Learn more about eligible payments and how Experian Boost works. Credit card issuers do, however, look at factors besides your credit score, such as your annual income, how long you've had credit and how many credit cards you've applied for recently. Note that this rule applies to all credit cards, not just the ones offered by Chase. Another factor issuers consider is the length of your credit history. When I first applied for the Chase Sapphire Preferred, I was rejected immediately even though I had a FICO credit score above I had been an authorized user on my parent's card since I didn't have any credit history of my own. Generally, the Chase Sapphire Preferred may not be a good option for a first credit card if you're in a similar situation.

However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category.

At The Points Guy, we devote a significant amount of time to discussing how credit scores work and how to improve your credit score. Scores in the mids and above will typically be enough to get you approved for most travel rewards cards. However, having a lower score doesn't necessarily mean that you can't get those cards. Just note that although your credit score is a good indicator of your approval odds, it's not an absolute science. Chase may still deny you even if you meet the "required" credit score — and may still approve you even if you're below it. The Chase Sapphire Preferred Card is a longtime favorite among advanced points and miles collectors.

This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months. Earn 2x on other travel purchases. Earn 3x points on dining, including eligible delivery services, takeout and dining out. Earn 3x points on online grocery purchases excluding Target, Walmart and wholesale clubs. Earn 3x points on select streaming services. Plus, earn 1 point per dollar spent on all other purchases. This card offers the best of any aspect of life! Travel, Rewards, Cashback!

Requirements for chase sapphire

However, many users can be approved with a lower score. Find out the credit requirements needed. Chase Sapphire Preferred is one of the most popular travel rewards cards for its huge bonus and flexible travel rewards. It's a worthwhile card for both occasional and frequent travelers. Chase is known for being one of the tougher issuers. Besides the credit score, there are other restrictions for approval as well.

Jack and jones formal shirts

Membership auto renews annually. For complete Priority Pass Select Terms and Conditions and a listing of participating lounges and select airport experiences, please visit www. You may be denied a Chase credit card if you've opened five or more credit cards in the past 24 months. Apply Now Opens in a new window. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment. Lyft Earn more points Earn 10x total points on Lyft rides. Clickable card art links to Chase Sapphire Reserve Registered Trademark credit card product page Clickable card art links to Chase Sapphire Reserve Registered Trademark credit card ratings and reviews page Clickable card art links to Chase Sapphire Reserve Registered Trademark credit card refer a friend page. The month waiting period applies to when you last earned a bonus, not when you were last approved for a Sapphire card. APR How you can use your points: You can use your points to redeem for any available reward options, including cash, gift cards, travel, and pay with points for products or services made available through the program or directly from third parties.

Many or all of the products featured here are from our partners who compensate us.

All deliveries subject to availability. I love how easy it is to transfer to travel partners, and so many of them! However, other fees including service fee , taxes, and gratuity on orders may still apply. Purchases are when you, or an authorized user, use a card to make purchases of products and services. How do I boost my credit score? Here's how each category contributes to your overall credit score. You typically have up to three months to earn a bonus, so you may need to wait up to 51 months from your last Sapphire card approval date. Begin additional benefits overlay. Chase is also known to limit a customer's total credit line across all cards. Another significant factor that's often forgotten is your relationship with the bank. Credit cards home Opens home page in the same window. Best travel card ever! Chase is not responsible for the provision of, or the failure to provide, Instacart benefits and services.

0 thoughts on “Requirements for chase sapphire”