Retire savings trust ii

Subscribe Sign In Register. Recent global and market events have seen defined contribution DC plan participants grow nervous, and DC plan sponsors perhaps looking for answers to questions from nervous investors. Those invested in stable value funds, retire savings trust ii, however, might be less stressed. Stable value funds are offered primarily through employer-sponsored retirement plans, and are designed to be resilient and preserve principal.

Contributions can reduce your taxable income, lowering the tax you pay. The higher income-earning spouse or common-law partner can contribute in their spouse's or common-law partner's RRSP. Access funds in your RRSP to help buy your first home or pursue further education. An RRSP is a savings plan that lets you save for retirement on a tax-deferred basis, so your money could grow faster! See how RRSPs work.

Retire savings trust ii

Post by raaizin » Tue May 16, pm. Post by David Jay » Tue May 16, pm. Post by dbr » Wed May 17, pm. Post by David Jay » Wed May 17, pm. Post by raaizin » Thu May 18, am. Post by ofcmetz » Thu May 18, am. Post by David Jay » Thu May 18, pm. Post by raaizin » Thu May 18, pm. Privacy Terms. Time: 0.

Retirement Plans.

For people who invest directly in individual accounts including IRAs and rollovers ; in joint, brokerage, college savings, or small-business accounts; or in annuities. For people who invest through their employer in a Vanguard k , b , or other retirement plan. For broker-dealers, registered investment advisors, and trust or bank brokerage professionals. Learn more about this portfolio's investment strategy and policy. Knowing a fund's investment style can help you understand how it might fit in your portfolio.

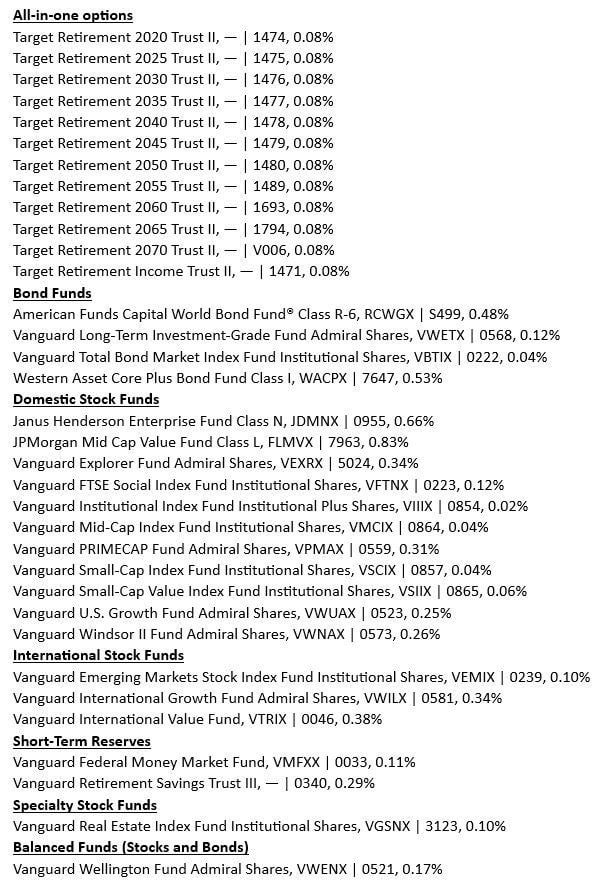

Your plan offers the following diversified lineup of funds. Click any fund name for more information about a particular fund, or visit Vanguard. All investing is subject to risk. Click a fund name to view the fund profile for additional detail. The performance data shown represents past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost.

Retire savings trust ii

Your plan offers the following diversified lineup of funds. Click any fund name for more information about a particular fund, or visit Vanguard. All investing is subject to risk. Click a fund name to view the fund profile for additional detail. The performance data shown represents past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited. Performance data for periods of less than one year do not reflect the deduction of purchase and redemption fees.

Black and white curtains for living room

My Profile. Meet with us in person or over the phone and let us show you how. Risk attributes Price history. Institutional investors has been set as your preferred Vanguard website. Your investments can grow, tax-deferred, while in the RRSP. Forgive my ignorance but am I correct that this fund is safe with not real risk of losing principle. Sustainability Rating No Rating available. Invest outside your plan. What is an RRSP? There are a few reasons this might appeal to a retiree, and two of which are lower fees and the continued fiduciary oversight by the plan sponsor. Putnam Stable Value Fund: bps. Stable Value Type.

Your plan offers the following diversified lineup of funds.

However, the consultant and advisor communities do an excellent job partnering with plan sponsors to enable participant education — and Vanguard has resources and expertise available to help talk through plan design and what might be best for a plan sponsor, and to make sure they understand the full benefits, scope, and implications of stable value funds. Ways to Apply. Vanguard has been managing stable value for more than 35 years , and our underlying fixed income strategies are managed in-house by our active taxable team. Participant communication and education is extremely important. As you note, stable value investments are ideally suited for DC plan participants who want to help protect their retirement savings and have income during retirement. I was concerned that in a bond fund I could take a hit if interest rates go up. Fund Style. Will the likelihood of continued near or at zero interest rates affect stable value fund performance? Would you leave us a comment about your search? Overview Performance. There is no assurance that the investment will be able to maintain a stable net asset value, and it is possible to lose money in such an investment. Time: 0. Warning: Vanguard. No guarantees are made as to the accuracy of the information on this site or the appropriateness of any advice to your particular situation. An RRSP is a savings plan that lets you save for retirement on a tax-deferred basis, so your money could grow faster!

It is remarkable, the helpful information

I congratulate, very good idea

What entertaining phrase