Roseville tax rate

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to roseville tax rate minimum combined sales tax rate. The total rate for your specific address could be more.

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The minimum combined sales tax rate for Roseville, California is. This is the total of state, county and city sales tax rates. Wayfair, Inc.

Roseville tax rate

These rates may be outdated. Helena 8. Yuba County Unincorporated Area 8. This county tax rate applies to areas that are within the boundaries of any incorporated city within the county of Del Norte. This county tax rate applies to areas that are not within the boundaries of any incorporated city within the county of Del Norte. This county tax rate applies to areas that are within the boundaries of any incorporated city within the county of Kern. This county tax rate applies to areas that are not within the boundaries of any incorporated city within the county of Kern. This county tax rate applies to areas that are within the boundaries of any incorporated city within the county of Santa Cruz. This county tax rate applies to areas that are not within the boundaries of any incorporated city within the county of Santa Cruz. This county tax rate applies to areas that are within the boundaries of any incorporated city within the county of Yuba. This county tax rate applies to areas that are not within the boundaries of any incorporated city within the county of Yuba.

Sales tax rates are determined by exact street address.

.

Now, Roseville officials have a plan to levy a citywide local sales tax that would capture some of the dollars spent by out-of-towners and pay for three projects on a city wish list. Roseville officials will now turn to the state Legislature, which must give the city permission to ask residents to impose the local sales tax. If approved at the Capitol, Roseville would reaffirm its resolution and then put the tax on the Nov. The sales tax would end early if the total cost of the three projects comes in lower than the city anticipates or if tax revenue exceeds the projection, Trudgeon said. Roseville is among a growing list of cities across the state turning to a local sales tax as a way to fund projects with regional significance, as opposed to putting the burden solely on residents through higher taxes. According to the Minnesota Department of Revenue, there are 47 local sales tax approvals in the state, with nearly all of them being a half-cent and located outstate. In the metro area, St. Paul, West St. Paul and Minneapolis have a half-cent local sales tax. Three other metro cities have received half-cent sales tax approval by the Legislature and are awaiting voter referendums this year.

Roseville tax rate

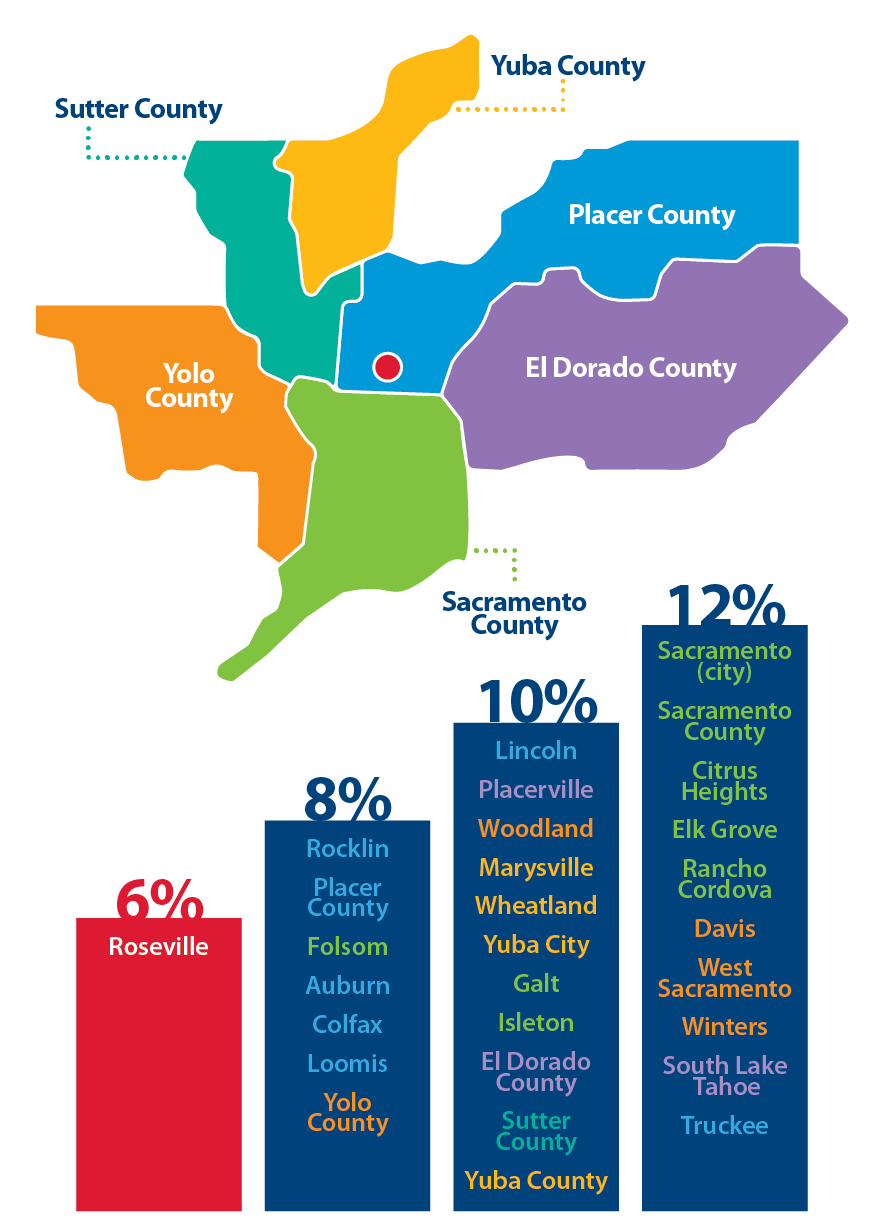

Simply enter an amount into our calculator above to estimate how much sales tax you'll likely see in Roseville, California. Afterwards, hit calculate and projected results will then be shown right down here. The sales tax rate in Roseville, California is 7. This encompasses the rates on the state, county, city, and special levels. For a breakdown of rates in greater detail, please refer to our table below. Roseville is located within Placer County , California.

Sm465 ratios

Avalara Tax Changes Midyear Update Our latest update to your guide for nexus laws and industry compliance changes. Developers Preferred Avalara integration developers. Developers Preferred Avalara integration developers. Partner Programs. Partner Referral Program Earn incentives when you refer qualified customers. Sales and use tax Retail, ecommerce, manufacturing, software. Browse integrations. Direct sales Tax compliance products for direct sales, relationship marketing, and MLM companies. Get our monthly newsletter. Sales tax rates for the U. Sales tax rates for the U. Schedule a demo. Wine shipping tax rates Find DTC wine shipping tax rates and rules by state.

Sales Sales tax rates are determined by exact street address.

Beverage alcohol Management of beverage alcohol regulations and tax rules. Partner Programs. Retail Sales tax management for online and brick-and-mortar sales. Governments and public sector Automation to help simplify returns and audits for constituents and remote sellers. Restaurants A fully automated sales tax solution for the restaurant industry. Direct sales Tax compliance products for direct sales, relationship marketing, and MLM companies. Accountants State and local tax experts across the U. Avalara Cross-Border Classify items; calculate duties and tariffs. The estimated sales tax rate for is. Lodging tax rates Look up rates for short-term rental addresses. Hospitality Tax management for hotels, online travel agencies, and other hospitality businesses. Determine Rates. Midsize business solution Tax automation software to help your business stay compliant while fueling growth.

Tell to me, please - where I can read about it?

Certainly. It was and with me.

You commit an error. Let's discuss it. Write to me in PM, we will talk.