Sac code for fabrication work

It was developed for the classification of services. It is an internationally recognized system. It helps to classify and codify all the products in the world.

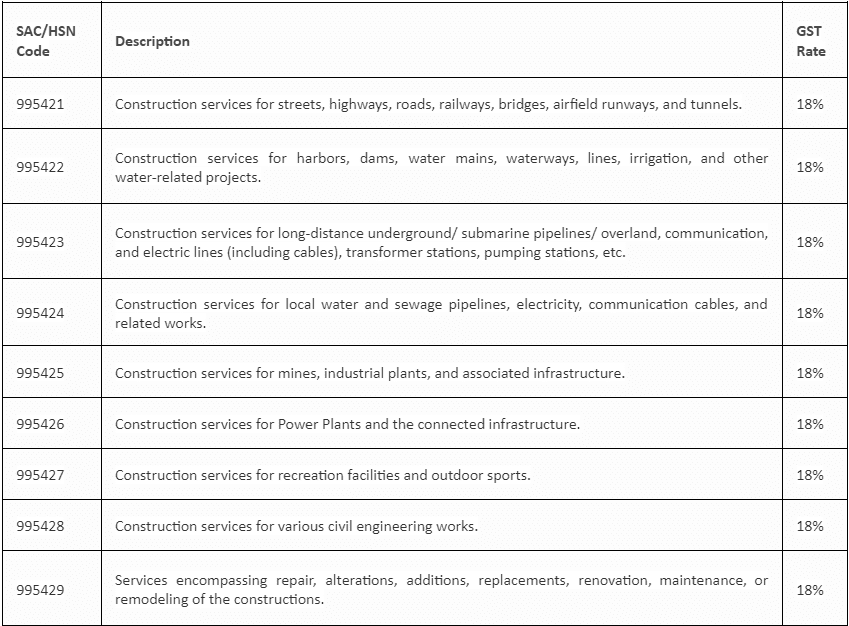

SAC Section 5 deals with various kinds of construction services. The price that the service recipient will pay includes the value of the land. Additionally, although input tax credit overages are permitted, refunds are not. Begin your GST journey on a strong note. Explore our GST registration page for top-notch insights.

Sac code for fabrication work

SAC Services Accounting Code code is classified under group Fabricated metal product, machinery and equipment manufacturing services of GST services classification. Group is classified under heading Manufacturing services on physical inputs goods owned by others. You can check GST tax rate on , Manufacturing services on physical inputs goods owned by others. We have filtered GST applicable on Fabricated metal product, machinery and equipment manufacturing services including GST on Other fabricated metal product manufacturing and metal treatment services, GST on Manufacturing services on physical inputs goods owned by others. You can GST on group Fabricated metal product, machinery and equipment manufacturing services by visiting this link. SAC Other fabricated metal product manufacturing and metal treatment services SAC Services Accounting Code code is classified under group Fabricated metal product, machinery and equipment manufacturing services of GST services classification. This heading is for Manufacturing services on physical inputs goods owned by others. This group is for Fabricated metal product, machinery and equipment manufacturing services. This code is for Other fabricated metal product manufacturing and metal treatment services. GST on Other fabricated metal product manufacturing and metal treatment services We have filtered GST applicable on Fabricated metal product, machinery and equipment manufacturing services including GST on Other fabricated metal product manufacturing and metal treatment services, GST on Manufacturing services on physical inputs goods owned by others. First 4 digits, represents heading under which this SAC falls. First 5 digits, represents group number.

Begin your GST journey on a strong note. How frequently is information on the fabrication erection HS Code updated? The SAC codes consists of six digits.

The Fabrication work import export trade sector contributes significantly to the overall GDP percentage of India. No wonder, the port is booming in this sector and at Seair, we better understand how to benefit you from this welcome opportunity. We comprehend the fact that the majority of import firms are active in sourcing distinct ranges of products including raw materials, machinery, and consumer goods, etc. Hence, we provide comprehensive import data solutions as well as export data solutions for broad categories of import trading firms and export trading firms too. Our Fabrication work import data and export data solutions meet your actual import and export requirements in quality, volume, seasonality, and geography. Alongside we help you get detailed information on the vital export and import fields that encompass HS codes, product description, duty, quantity, price, etc.

The SAC is strictly numeric and is 6 digits. The first two digits are same for all services i. Construction services of other residential buildings such as old age homes, homeless shelters, hostels etc. Construction services of industrial buildings such as buildings used for production activities used for assembly line activities , workshops, storage buildings and other similar industrial buildings. Construction services of other non-residential buildings such as educational institutions, hospitals, clinics including veterinary clinics, religious establishments, courts, prisons, museums and other similar buildings. Services involving Repair, alterations, additions, replacements, renovation, maintenance or remodelling of the buildings covered above.

Sac code for fabrication work

Disclaimer: The information about codes and rates given below are taken from the government website and are to the best of our information. There may be variations due to government's latest updates, hence kindly check and confirm the same on the government website. We are not responsible for any wrong information and its effects. The SAC is strictly numeric and is six digits. The first two digits are same for all services i. SAC code Breaking up this SAC code reveals to us the nature of service or the classification of service as under. GST rates are exempted only for the service of transportation of goods by road. Get Lowest Rates for Health Insurance. Thank you for scheduling a call with us! One of our Health Insurance experts will call you shortly.

Fivee

Seair Exim Solutions keeps you up to date with the leading importers and changing dynamics of trade in the fabrication erection industry. SAC code represents Construction services of single-dwelling multi-dwelling or multi-storied residential buildings. Save my name, email, and website in this browser for the next time I comment. Privacy About Swil Swil Products. View All. Subscribe to our newsletter blogs. Next Post. What is the import performance of fabrication work? First 4 digits, represents heading under which this SAC falls. Related to textile, apparel and Leather product : [SAC code to SAC Code ] Printing of newspapers; b Textile yarns other than of man-made fibres and textile fabrics; c Cut and polished diamonds; precious and semi-precious stones; or plain and studded jewellery of gold and other precious metals, falling under Chapter of HSN; d Printing of books including Braille books , journals and periodicals; e Processing of hides, skins and leather. Feb 3,

SAC Services Accounting Code code is classified under group Fabricated metal product, machinery and equipment manufacturing services of GST services classification. Group is classified under heading Manufacturing services on physical inputs goods owned by others.

HSN Code Product Description Wire, rods, tubes, plates, electrodes and similar products, of base metal or of metal carbides, coated or cored with flux material, of a kind used for soldering, brazing, welding or deposition of metal or of metal carbides; wire and rods, of agglomerated base metal powder, used for metal spraying Coated electrodes of base metal for electric arc- welding Electric including electrically heated gas , laser or other light or photo beam, ultrasonic, electron beam, magnetic pulse or plasma arc soldering, brazing or welding machines and apparatus, whether or not capable of cutting; electric machines and apparatus for hot spraying of metals or cermets Other Other machines and apparatus: Other. What fields does Seair include for fabrication work imports? The biggest advantage associated…. Last two digits SAC Code 11 - Construction services of single dwelling or multi dwelling or multi-storied residential. These include buildings used for production activities, storage buildings, workshops and other similar industrial buildings. Get a free Import-Export data demonstrative report on desired products. How does the Seair Exim aid firms in fabrication work import challenges and opportunities? Import Data Export Data Both. SAC Services Accounting Code code is classified under group Fabricated metal product, machinery and equipment manufacturing services of GST services classification. What specific fabrication erection products are imported globally? SAC code represents Water plumbing and drain laying services. Hence, we provide comprehensive import data solutions as well as export data solutions for broad categories of import trading firms and export trading firms too.

I shall afford will disagree with you

Also that we would do without your very good idea