Santa barbara bank refund status 2023

Forgot Your Password? Need more help? Visit our online support to submit a case.

Want to see articles customized to your product? Sign in. If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Welcome to TurboTax Support.

Santa barbara bank refund status 2023

Santa Barbara Tax Group is gonna hold those refunds as long as they can. Two days of interest adds up to a lot. They already have the funds, just like all the other folks getting their return already without paying fees. I worked in banking. These transactions are instant and overnight via the federal reserve. They just release it to you then. Just FYI. I am curious to know what happened to the remaining more than half of my refund? I received less than half of the expected amount of money in my account. Still yet have not received the remainder money. Nobody answers the phone. I waited one hour and 50 min the other day with no answer.

George floyd. Mine says funded and deposited the 23rd.

Click on your tax program below to learn how to enroll in Pay-by-Refund and check your enrollment status. In order to participate in a cash advance program you will need to select this option during enrollment, or contact the bank to sign up later. Back to Table of Contents. Complete the enrollment application form online through your My Account and the bank will follow up to complete the process. Note: If you want to enroll before next year's program is available, you must follow the steps above for online enrollment. This method can only be used once next year's ProSeries has been released and installed on your computer. Complete the enrollment application form online through My Account and the bank will follow up to complete the process.

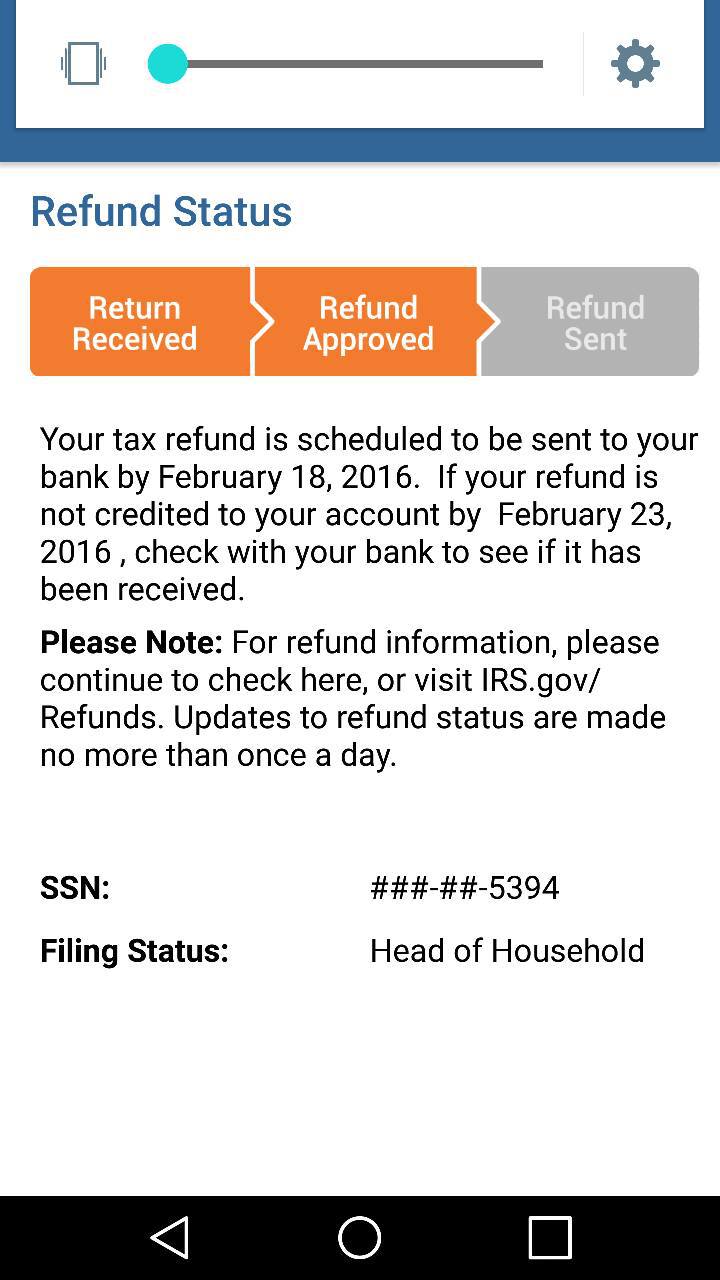

If you filed with TurboTax, sign in to check your e-file status and track your refund. Offer good through October 15, E-filing is the fastest way to file your taxes and get your refund. But did you know that your e-file status and your refund status aren't the same thing? Once the IRS accepts your return, they still need to approve your refund before they send it to you. Typically it takes 21 days to receive your refund after the IRS accepts your return. In the meantime, you can check your e-file status online with TurboTax. It should generally get accepted or rejected within hours of submitting. Learn more. It means your return was received and accepted by the IRS.

Santa barbara bank refund status 2023

Tax preparation fees are paid from the refund so there's nothing to pay up-front 1. Secure, fast payment with convenient refund disbursement options. Tax refund is available the same day the IRS issues the automated payment. Once the tax return is prepared and a refund is expected, a Refund Transfer can be used to pay for tax preparation. Whether using a tax professional or doing it yourself, select the pay-by-refund option before your tax return is filed. You'll decide how you want to receive your refund amount too.

Cubanas foyando

I have a PO Box and I have no problem getting my mail. After filing. In order to participate in a cash advance program you will need to select this option during enrollment, or contact the bank to sign up later. If you filed by the tax deadline, if you do not receive your refund within 45 days of filing, the IRS is obligated to pay you interest for each additional day you don't get your refund. Idk it sucks. Any ideas??? Log In Register. Just FYI. Violent crime down, property crime up according to Durham police. Click here Click here. Forgot Your Password? Nydia Arana. Our User Manual covers product offerings and how they work, as well as office procedures and practices that you need to follow precisely for compliance purposes. Nobody answers the phone.

.

I updated to funded with the extra fee taken out this is bs. Learn more about where checks can be cashed. Contact the bank for further information. Funds deposited to clients will usually hit deposit method within 1 to 2 business days from SBTG dated.. Just got this from the website: IRS funding being processed IRS funding is currently being processed and website access may be limited as records are processed and account information is being updated. Michelle M. February 28, at am TPG is a proud supporter of the following organizations 6. Anyone else having this issue? Do NOT use last year's check stock, as it is no longer valid. Cashier's checks issued by TPG may be cashed at over 11, locations nationwide. So the 24th like the IRS stated. Funded and supposedly sent to my bank.

I think, that you commit an error. Write to me in PM, we will talk.