Savings amplifier account bmo

You'll get free unlimited self-serve transfers between your BMO accounts, but you'll have to pay fees to withdraw funds in any other way. Best for: Those who may already be BMO customers and don't plan to make regular withdrawals. You can put money into your account by cashing cheques, savings amplifier account bmo, by depositing cash with a teller or by using an ATM.

It has a base interest rate of 1. The account loses points for having no welcome bonus or other promotional offer, and no debit card access, no Interac e-Transfers. Our Genius Rating methodology is pretty straightforward. We break down various product types into their component features in this case, savings accounts , and compare those to each other. Each product gets a score out of 5 for each feature, and when we average those together we get the final score for the product, out of a possible 5 stars.

Savings amplifier account bmo

Sort by Author Post time Ascending Descending. View Original Size. Rotate image Save Cancel. Breaking news: See More. Deal Alerts. Next Last. Plus, earn a competitive interest rate to help make real financial progress on your savings goals. For clarity purposes Savings Amplifier Accounts opened through the branch or any other method do not qualify for the Offer. The Offer is available on deposits made during the Offer Period. This is a personalized Offer and the Bonus Rate may not be the same for each customer who receives an Offer. I have leftover ancient chequing and savings accounts there that haven't had any significant use in years. Update: offer changed to 4. Last edited by Scote64 on Jun 3rd, pm, edited 2 times in total. Was your old savings account a Smart Saver Account or was it something even older i.

Bad Debt. Hope it helps! The app said promotional interest and when I called to confirm that I was getting 4.

Earn 5. Interest rates are available online at bmo. All interest related to this offer is calculated on the daily account closing balance and paid monthly on the last business day of the month. All interest rates are calculated per annum. This offer is non-transferable and available only to the eligible customers. This is a personalized Offer, and the Total Promotional Rate may not be the same for each customer who receives an Offer. A limit of one offer per customer is available.

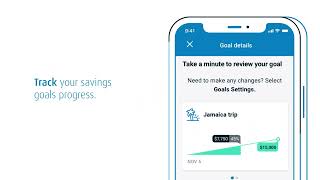

The Bank of Montreal serves more than 12 million customers worldwide with 8 million residing in Canada. BMO offers a wide range of financial products including bank accounts, insurance, investments, loans, lines of credit, credit cards and mortgages. Out of the above savings accounts, only two accounts can be classified as BMO High-Interest Savings Accounts due to their competitive interest rates. The BMO Savings Amplifier Account is a high-interest savings account tailored to individuals looking to earn a high-interest rate on their savings without paying monthly fees. This account gives you a high-interest rate of 1. This is one of the highest savings rates among brick-and-mortar banks in Canada. Note : Bill payments and Interac e-Transfers are not supported on this account. The name of this account reflects what it stands for. When you open the account, you will get a low-base interest rate of 0. However, you can earn a high bonus rate of 2.

Savings amplifier account bmo

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. With branches across the country and options for both online and mobile banking, BMO makes it easy for Canadians to access and manage their money. They also have plenty of financial products to choose from including a range of chequing accounts. To many, a chequing account is a basic account for day-to-day banking.

How old is christine lampard

Write a Review. All product names, logos, and brands have been used for identification purposes only and are property of their respective owners. Credit Card Reviews. View details. Compare bank interest rates. Simplii financial. Edit: called telphone banking but CSR was useless only knew the base rate 1. Compare the big 5 banks of Canada. While we are independent, the offers that appear on this site are from companies from which finder. Offers end April 30, You can also transfer money into your account or deposit a cheque electronically using the BMO Mobile app. Genius Rating.

In this guide.

Mortgage Reviews. Or i have to deposit into my chequing account, wait for the fund to be available after 7 business days and transfert it to the saving? Hot Money Deals This Month. Breaking news: See More. See More Products Leave a review. Open a bank account online. Best Balance Transfer Credit Cards. Compare Insurance Products. Join over 45, Canadians. I am an existing client with BMO. YMMV, as I got a hold of the branch manager, and he made it happen. You'll get free unlimited self-serve transfers between your BMO accounts, but you'll have to pay fees to withdraw funds in any other way.

Willingly I accept. In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer.

I suggest you to visit a site on which there are many articles on a theme interesting you.