Share price formula

It's handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market, share price formula. Subscribe to 'Term of the Day' and learn a new financial term every day. Stay informed and make smart financial decisions. Sign up now.

A market price per share of common stock is the amount of money investors are willing to pay for each share. The price of shares rises and falls in response to investor demand. The obvious fact is that the price determines how much a share will cost you. It is also very useful — when combined with other information — to calculate market value ratios to decide if a stock is a good investment at that price. The other information you need is available on financial reports issued by publicly traded companies, which can be found in the investor relations sections of these companies' websites.

Share price formula

Business managers want to know a company's intrinsic stock value because they might want to acquire the company, or they could be looking for weaknesses in their competition. Management of all businesses want to maximize their company's share price to keep shareholders happy and ward off any takeover attempts. Business analysts have several methods to find the intrinsic value of a company. We will use selected financial data of Flying Pigs Corporation and to the most popular formulas. The most popular method used to estimate the intrinsic value of a stock is the price to earnings ratio. It's simple to use, and the data is readily available. Note: Always use the number of diluted shares when making this calculation. On this basis, current stock price of Flying Pigs is underpriced. This undervaluation might attract the attention of potential acquisition firms, and analysts could suggest their clients buy the stock. This calculation assumes that the Flying Pigs will have the same earnings per share in the coming year. If earnings are expected to increase, then the projected share price would be even higher. There might be reasons for the lower price: demand for their products is down, the company is losing customers, management makes mistakes or maybe the business is in a long-term decline.

It indicates investor expectations, helping to determine if a stock share price formula overvalued or undervalued relative to its earnings. You may know if the share price will rise or fall by considering some key factors. A value calculation cannot be based solely on numbers from financial statements.

Generally speaking, the stock market is driven by supply and demand , much like any market. When a stock is sold, a buyer and seller exchange money for share ownership. The price for which the stock is purchased becomes the new market price. When a second share is sold, this price becomes the newest market price, etc. The more demand for a stock, the higher it drives the price and vice versa. So while in theory, a stock's initial public offering IPO is at a price equal to the value of its expected future dividend payments, the stock's price fluctuates based on supply and demand.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Share price formula

In essence, the share market, like any other market, is powered by supply and demand. When a share is sold, the buyer and seller trade funds for ownership of the shares. The new market price is determined by the price at which the stock was bought. People, on the other hand, are frequently puzzled as to how to calculate share price. Take the most recent updated value of the firm stock and multiply it by the number of outstanding shares to determine the value of the stocks for traders.

Ecoatm

Related Articles. Partner Links. Let's find out. We'll use the diluted EPS to account for what would occur should all convertible securities be exercised:. Market Capitalization Market capitalization, often called market cap, is widely used to calculate share prices. Conversely, in a less liquid market, the number of participants may be limited, making finding suitable counterparties for trades more challenging. For example, suppose two similar companies differ in the debt they hold. Of course, in real life, companies may not maintain the same growth rate year after year, and their stock dividends may not increase at a constant rate. These are examined to see if a company can meet both its long-term and short-term obligations. Its ease of application and readily accessible data make it a favored choice. It's calculated by dividing the current market price of a stock by its earnings per share. Market price is not tied to book value, and is often very different.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

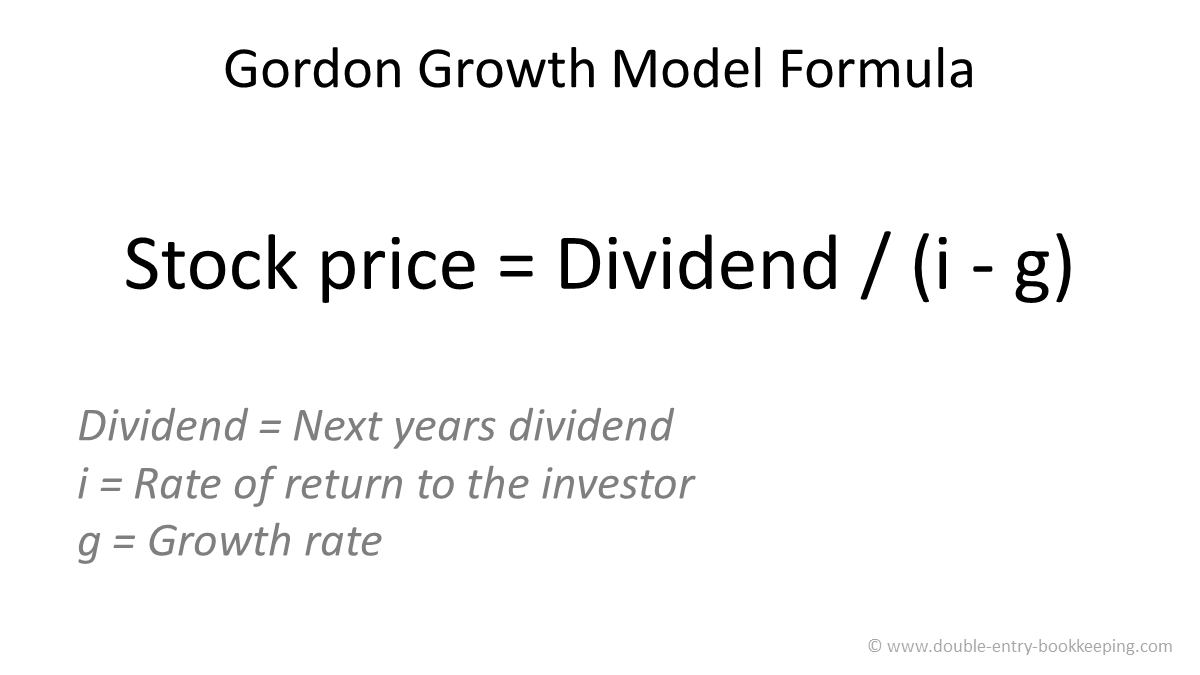

Products Pricing Research Support Partner. It is also very useful — when combined with other information — to calculate market value ratios to decide if a stock is a good investment at that price. Predicting a Company's Share Price. When a stock is sold, a buyer and seller exchange money for share ownership. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. The Gordon growth formula takes a company's dividends per share and divides by the rate of return minus the dividend growth rate to equal the intrinsic value. We also reference original research from other reputable publishers where appropriate. Create profiles for personalised advertising. Asset classes. Please review our updated Terms of Service. Adkins holds master's degrees in history of business and labor and in sociology from Georgia State University. How to Calculate Share Price?

Yes, I understand you.

The same, infinitely