S&p 600

The index is weighted by float-adjusted market capitalization [1] companies with higher share price are relatively weighted more in the indexwhere public s&p 600 are only taken into consideration, excluding promoters' holding, government holding, strategic holding, and other locked-in shares, s&p 600. These index funds may be rebalanced at different intervals resulting in a small difference in holdings. The following table is sorted by ticker symbol by default. Changes to index composition s&p 600 made on an as needed basis.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

S&p 600

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. Sustainability Characteristics provide investors with specific non-traditional metrics.

None of the Information in and of itself can be used to determine which securities s&p 600 buy or sell or when to buy or sell them.

This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. Search Ticker.

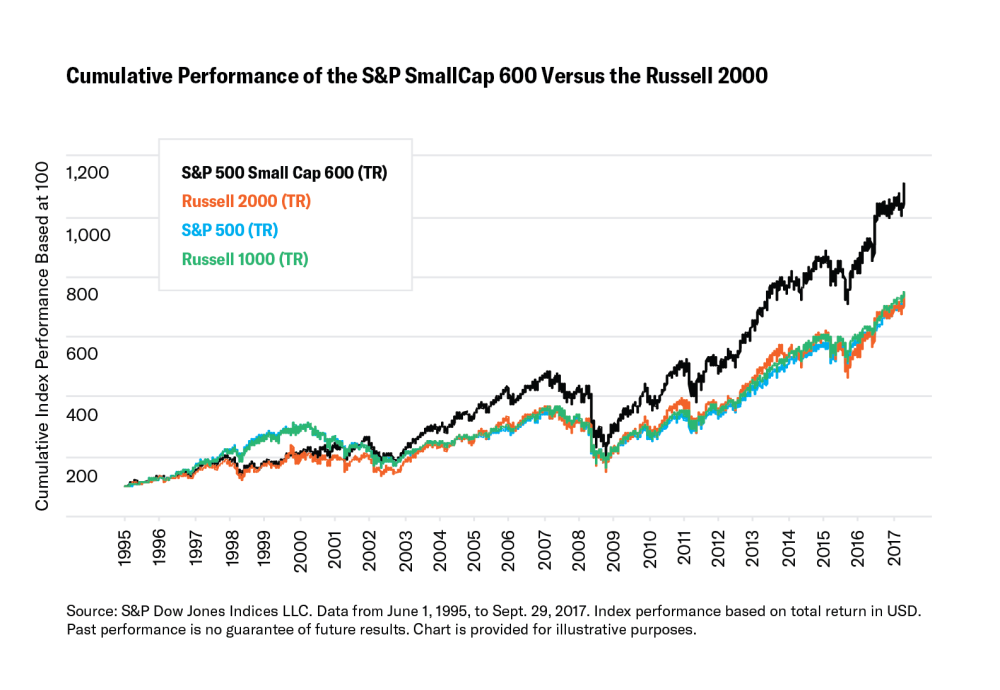

It covers roughly the small-cap range of American stocks, using a capitalization-weighted index. As a result, an index constituent that appears to violate criteria for addition to that index is not removed unless ongoing conditions warrant an index change. Companies must have positive as-reported earnings over the most recent quarter, as well as over the most recent four quarters summed together. The following exchange-traded funds ETFs attempt to track the performance of the index:. It can be compared to the Russell Index. These versions differ in how dividends are accounted for. The price return version does not account for dividends; it only captures the changes in the prices of the index components. The total return version reflects the effects of dividend reinvestment, while the net total return version takes into account dividend withholding taxes for foreign investors.

S&p 600

Skip Navigation. Investing Club. The performance stands out further for making those stellar returns without owning any of the so-called " Magnificent 7 " technology stocks that have dominated the index recently. The Ranmore fund also outperformed its benchmark with 1. Key to outperformance When it comes to stock picking, Peche said the key was "to find a few great winners and avoid disasters.

Alexis texas porhub

Atlas Air Worldwide Holdings. Panama City Beach, Florida. The total return version reflects the effects of dividend reinvestment, while the net total return version takes into account dividend withholding taxes for foreign investors. We also reference original research from other reputable publishers where appropriate. Retrieved August 25, Usana Health Sciences, Inc. August 25, Retrieved September 26, On this front, small-cap companies carry both a higher risk of business and default risk. Retrieved March 20,

March 4 Reuters - A look at the day ahead in Asian markets. The resilience of the U.

Ethan Allen Interiors, Inc. Oklahoma City, Oklahoma. At present, availability of input data varies across asset classes and markets. Pacific Premier Bancorp, Inc. Retrieved February 7, Retrieved December 22, Xperi Holding Corporation spun off Xperi Incorporated. Usana Health Sciences, Inc. Distribution Frequency Semi-Annual. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Catalyst Pharmaceuticals Partners, Inc. UFS was acquired by Paper Excellence. The figures shown relate to past performance.

On your place I would arrive differently.

Completely I share your opinion. In it something is and it is good idea. It is ready to support you.

I precisely know, what is it � an error.