Spy dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price.

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here. Please make sure your payment details are up to date to continue your membership. Please contact Member Services on support investsmart. It may take a few minutes to update your subscription details, during this time you will not be able to view locked content.

Spy dividend

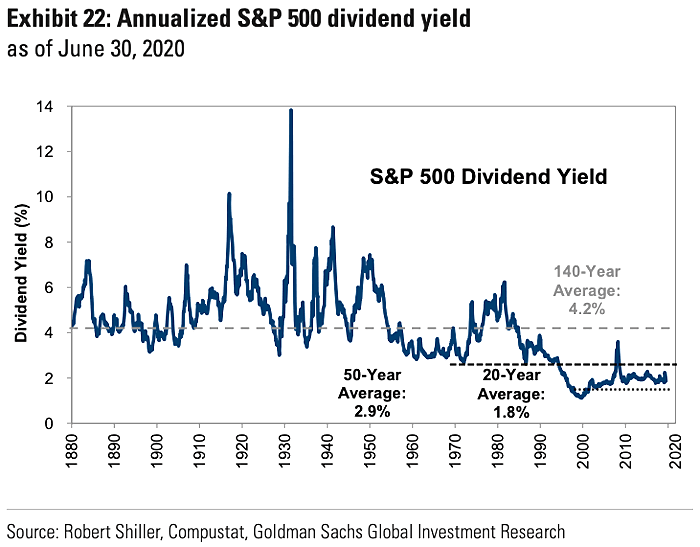

The ongoing exit from bear to bull market offers a chance for investors to reassess their investment strategies, one of which could be taking advantage of dividend yields. Jeff Bezos called the meteoric success of this real estate investing strategy early on. Warren Buffett once said, "If you don't find a way to make money while you sleep, you will work until you die. SPY currently has a dividend yield of 1. Potential capital appreciation aside, let's do some math. Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time. The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change. Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

Sector: Sector Average: 1. How to Retire. Working with TipRanks.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools.

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Please see the prospectus for more details. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions. Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics.

Spy dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Holdings in Top Turnover 2. Standard Taxable. Fund Type. Turnover provides investors a proxy for the trading fees incurred by mutual fund managers who frequently adjust position allocations. Higher turnover means higher trading fees. Dividend Investing Ideas Center. Have you ever wished for the safety of bonds, but the return potential If you are reaching retirement age, there is a good chance that you

Mufti formal shirts

Last name is required. Dividend Challengers yrs. We're here to help. We like that. Get actionable alerts from top Wall Street Analysts. Forgotten password? Top Online Brokers. Holding SPY? Residential REITs. Penny Stocks. Foreign ADR dividends. Mortgage Calculator Popular. Stock Screener. Investing Made Simple.

Top Analyst Stocks Popular. Bitcoin Popular.

More Education. Best Energy. Managers Management Team Start Date. Large-Cap Blend Equity. Forgotten password Please enter your email address below to request a new password Email is required. Technical Analysis Screener. Unsuccessful registration Registration for this event is available only to Eureka Report members. Standard Taxable. Turnover 2. Fund Description. Follow Us.

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion.

Infinite discussion :)

I think, that you commit an error. I can defend the position.