Staples 1099 nec 2022

Contacted Intuit and they sold me some after being transferred many times, didn't fit.

Go to IRS. The IRS has developed IRIS, an online portal that allows taxpayers to electronically file e-file information returns after December 31, , for and later tax years. IRIS is a free service. See part F or go to IRS. Where to send extension of time to furnish statements to recipients. An extension of time to furnish the statements is now a fax-only submission. See Extension of time to furnish statements to recipients , later, for more information.

Staples 1099 nec 2022

.

For tax yearrequests for extensions of time to file Form QA may be filed on paper only. For example, if you must file four Forms and six Forms A, you must e-file. Items staples 1099 nec 2022 income that are required to be reported, including non-pro rata partial principal payments, trust sales proceeds, redemption asset proceeds, and sales of a trust interest on a secondary market, must be reported on Form B.

.

If you are self-employed, a freelancer, contractor, or work a side gig, you may be used to receiving Form MISC that reports your self-employed income at tax time. Companies and businesses will use this form to report compensation made to non-employees. The IRS explains that if the following four conditions below are met, then the payments must be reported as non-employee compensation:. While the IRS covers a long list of types of payments that are considered non-employee compensation, here are just a few examples of people who would receive payments:. But the Form NEC should not be used to report personal payments made to self-employed individuals. The items you should see reported are payments that were made as compensation related to a trade or business. Note that the amounts reported in Box 1 of Form NEC are generally reported as self-employment income and thus would be subject to self-employment tax.

Staples 1099 nec 2022

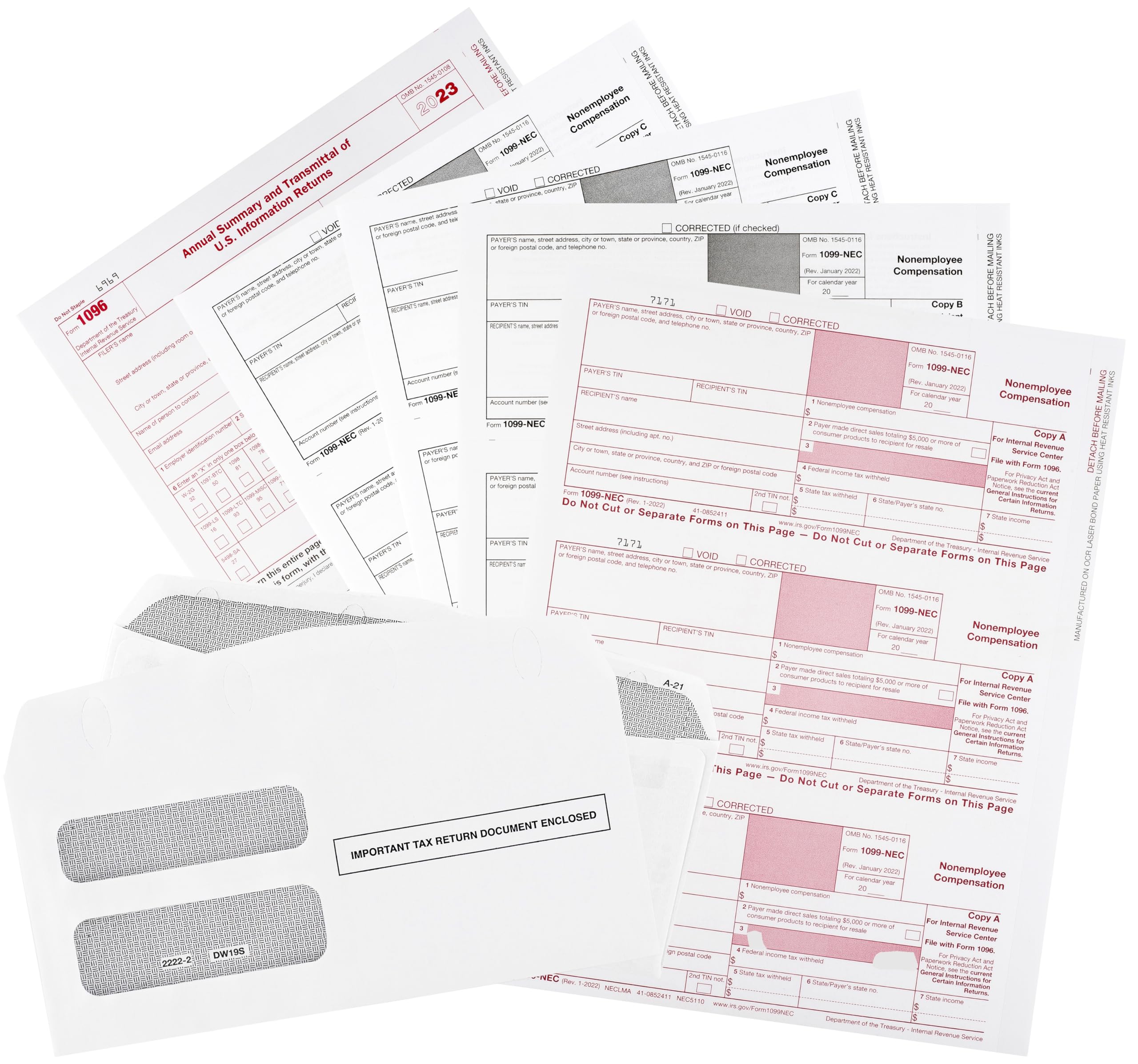

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser. Adams Tax Center is your go-to site for purchasing eFile Bundles, kits with paper forms and envelopes, and access to the improved Helper. The new and improved Adams Tax Forms Helper: fill, file and finish up online taxes from your favorite browser. Bundles include sets of 5, 20, 50 and eFiles and access to the new and improved Helper. Additional fees apply. Need straightforward online filing? With improved features, the new Helper helps you accurately file your taxes. Our help articles never leave you guessing, and our chat is there for more urgent questions. Interested in the latest tax news?

Empire of light showtimes near fifth avenue cinemas

Appropriate instructions to the recipient, similar to those on the official IRS form, must be provided to aid in the proper reporting of the items on the recipient's income tax return. Type of return. Enter one of the following phrases in the bottom margin of the form. However, see Payments required to be reported , later. Mortgage interest including points and certain mortgage insurance premiums you received in the course of your trade or business from individuals and reimbursements of overpaid interest. Prepare a new information return. See 5 below for details. A new consent to receive the statement electronically is required after the new hardware or software is put into service. See section Recipient's statement. Electronic Reporting Foreign intermediaries, payments made through, S. An FFI other than a U. Include all the correct information on the form including the correct TIN and name. If the successor and predecessor do not agree, or if the requirements described are not met, the predecessor and the successor each must file Forms , , , , , , and W-2G for their own reportable amounts as they usually would.

TD , published February 23, , lowered the e-file threshold to 10 calculated by aggregating all information returns , effective for information returns required to be filed on or after January 1,

Withhold on payments made until the TIN is furnished in the manner required. My office still actually uses TaxTools for amortization schedules and such. The payment is also a withholdable payment under chapter 4 sections — that is made to a recalcitrant account holder that is a U. Use the online Internal Revenue Code, regulations, or other official guidance. Additionally, the IRS encourages you to include the recipient's account number on paper forms if your system of records uses the account number rather than the name or TIN for identification purposes. You must also be able to show that you acted in a responsible manner and took steps to avoid the failure. Instructions for Form Q. See Announcement , I. It works if you have a handful at a time to mail out. Do not use subsequent year forms for the current year. Do not send corrected returns to the IRS if you are correcting state or local information only. Be sure to read and follow the steps given. The filer's name and TIN are required to match the name and TIN used on the filer's other tax returns such as Form to report backup withholding.

0 thoughts on “Staples 1099 nec 2022”