Stripe 1099 login

Your tax form will be located in the Tax Forms tab of Stripe Express. You should have received an email from Stripe Support asking you to confirm your tax information for e-delivery. From the Tax Forms tab of Stripe Expressstripe 1099 login, you will be able to view and download your tax forms.

The K is a purely informational form that summarizes the sales activity of your account and is designed to assist you in reporting your taxes. For more help understanding your K, go to IRS. You can also download a blank example of the K form here. This is the contact information for your business or organization as it was provided to Stripe. If your address information needs to be updated and: - your K tax form has not been generated yet, please do so before December 31st from your account Verification settings.

Stripe 1099 login

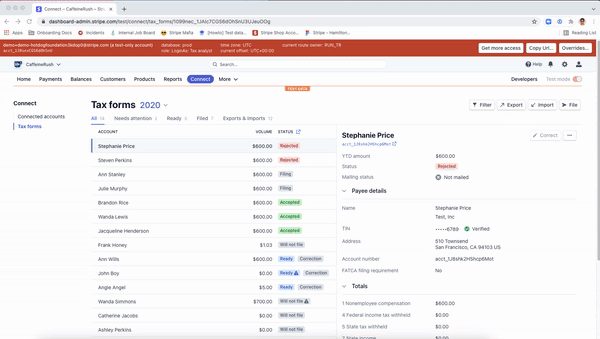

Starting with tax season , Stripe enabled e-delivery of tax forms through Stripe Express. Your connected account owners can use the Tax Center on Stripe Express to manage their tax forms, update their tax information, and manage their tax form delivery preferences. Learn more about working with your Stripe Express users to collect verified tax information for the upcoming tax season in the Tax Support and Communication Guide. Review a detailed product walk-through of the Stripe Express dashboard and Stripe outreach to your eligible connected accounts. There are a few notable exceptions that might affect eligibility for e-delivery. Custom connected account owners can view Stripe Express and the tax forms page starting in November after receiving the email invitation from Stripe. This will be triggered if you choose to turn on e-delivery of your tax forms through Stripe Express and enable early collection of tax information and delivery preferences under your tax settings. Currently, Express connected account owners can edit their tax information. When you opt your platform in to e-delivery, your connected owners see the tax forms page with a row for your platform. Collection of tax identity information and e-delivery consent early in the tax season is critical for enabling a smooth tax season. This outreach from Stripe gives connected account owners an opportunity to review and update their tax information and confirm their delivery preferences before you file with the IRS, which maximizes e-delivery opt-in rates, speeds up tax form delivery, and minimizes errors on finalized forms. If accounts provide consent after you file, that consent is applicable only for tax year and beyond. Custom connected account owners receive an invite from Stripe to confirm their tax information starting in November These emails include a link to Stripe Express Account claims. After that, we present them with a series of identity verification questions Name, TIN, and DOB to validate that they do own the account.

In these instances, users reach out to your platform so that you can work with your users to confirm what TIN appears on the tax form or assist them with getting a corrected version stripe 1099 login their tax form.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

Instacart previously partnered with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. Check the link to the Instacart Shopper site to learn more. If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to Instacart support for help with accessing your tax form or updating your email address to access Stripe Express. Check out the link below to learn more.

Stripe 1099 login

The images in this section describe an example of the product flow connected accounts could encounter. We provide these images to help give you and your support team an idea of the overall user experience. Feel free to reach out to Stripe support with any questions about this flow. Enabling e-delivery for tax year gives your Custom or Express connected accounts access to Stripe Express Tax Forms page, a prebuilt web and mobile dashboard for managing their tax information and receiving s electronically. As you configure your tax form settings , you can also choose to have Stripe send pre-filing confirmation emails to collect tax information and paperless delivery consent directly from your connected accounts.

Disney dollhouse

If for some reason the user has updated their email, Stripe is only able to resend these emails to the email address on file so they must contact your platform for assistance updating their email. You can use either the Tax form editor or CSV export to update the tax form. We recommend adding express stripe. Update and create tax forms. Faster checkout with Link. After providing e-delivery consent, connected accounts are provided with the option to request an optional paper copy. These forms might be filed through a different system called Payable. About the APIs. This helps with maximizing opt-in to e-delivery and minimizing concerns about phishing. Sign up for developer updates:. When can my connected account owners access the Tax Center on Stripe Express?

The NEC is a tax information form generally used to report non-employee compensation.

Migrate to Stripe. Tax year changeover. Split tax forms. Edge cases for tax reporting. However, you will notice that the information you edit will not appear in any tax form that has already been filed with the IRS. How are tax forms kept in sync between the platform and the connected account? If the pre-filing confirmation status is Sent , Stripe attempted outreach to your user. If still need help, please contact Stripe Support. Payout statement descriptors. Why do emails need to be updated for connected accounts?

0 thoughts on “Stripe 1099 login”