Suppose that a countrys inflation rate increases sharply

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

According to guidelines first 3 questions needs to be answered. Real income is defined as money income divided by prices. If inflation rises, real income declines as money income remains same. Inflation tax is not any tax paid to the government. Questions » Economics » Economics - Others » Suppose if the inflation rate of a country

Suppose that a countrys inflation rate increases sharply

Australia's inflation target is to keep annual consumer price inflation between 2 and 3 per cent. This is a suitable measure of inflation to target because it captures price changes for the goods and services that households buy, is independently produced by the Australian Bureau of Statistics, is publicly available and historical data for this series does not get revised. An inflation target provides a framework to guide a central bank's policy decisions and to ensure accountability in its management of the economy. The Reserve Bank adopted an inflation target in the early s, as did various central banks around the world, with other central banks following suit over the subsequent decade. In , the Reserve Bank and the Government agreed on the importance of the inflation target and formalised this agreement in the Statement on the Conduct of Monetary Policy which is typically updated following a change of government or Reserve Bank Governor. The Reserve Bank uses an inflation target to help achieve its goals of price stability, full employment, and prosperity and welfare of the Australian people. This is because price stability — which means low and stable inflation — contributes to sustainable economic growth. Targeting inflation of 2 to 3 per cent avoids the many costs to the economy from inflation that is too high or too low. A real value is a dollar value — also known as a nominal value — less the effects of inflation. The difference between real and nominal values can be shown using income as an example. The worker has received a 5 per cent increase in nominal income. Also suppose that the inflation rate is 2 per cent over the same period. If we subtract the rate of inflation from the growth in the worker's nominal income, then the worker's real or inflation-adjusted income has increased by 3 per cent.

Q: ent, ase A: A country's long-term economic growth is explained in the framework of the Neoclassical growth…. One of these differences — the formula used in its construction — means that RPI does not meet international statistical standards.

This Forecast in-depth page has been updated with information available at the time of the March Economic and fiscal outlook. The Government uses these measures in various ways. In terms of tax and spending, if the Government has not set another specific policy, CPI inflation is used in the income tax system to set the path for allowances and thresholds each year and in the social security system to uprate statutory payments for most working-age benefits. RPI inflation is used to set the path for most excise duty rates. RPI inflation also determines the amount of interest paid on index-linked government debt and interest charged on student loans.

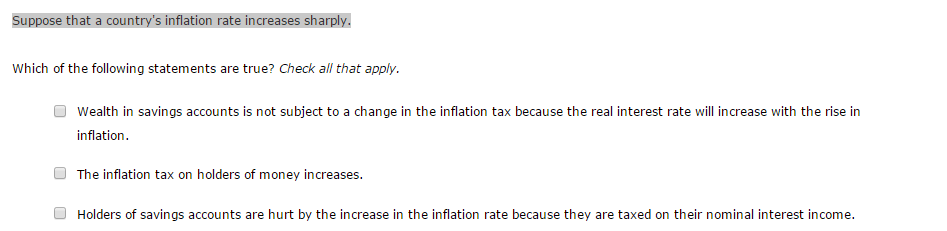

What happens to the inflation tax on the holders of money? Why is wealth that is held in savings accounts not subject to a change in the inflation tax? Can you think of any way holders of savings accounts are hurt by the increase in the inflation rate? Because capital is subject to diminishing returns, higher saving and investment do not lead to higher a. An efficient allocation of resources maximizes a. If a nation has high and persistent inflation, the most likely explanation is a. What happens to the inflation tax on

Suppose that a countrys inflation rate increases sharply

Q: Shade the entire area that represents where K is being added faster than it is wearing out Shade the A: The graph represents Solow model of economic growth. Q: What is the equal payment series for 6 years the first payment is given at the end of year 1 that A: Effective interest rate i can be calculated by using the following formula. Q: Which of the following would depict the logical order for preparing 1 a production budget, A: Economics is a branch of social science that describes and analyzes the behaviors and decisions econ Q: 3 choice questions please thank you.

Pakistani handsome boy image

Q: One last time, please work with data from the Isle of Woe, an admittedly-depressing nation. Why is wealth held in savings accounts not subject to a change in the inflation tax? A: A shock to the market is the event under which there is a disruption of the normal functioning of…. A: Monetary base, also known as high-powered money, is the total amount of currency in circulation and…. Q: Suppose a decrease in the world demand for desktop computers causes the price of desktop computers…. In this function, the output…. These cookies will be stored in your browser only with your consent. In our March Economic and fiscal outlook, we adjusted our forecast to account for the loosening of fiscal policy, including a temporary capital allowance. Consequently, the price of the basket of goods and services that they actually consume will increase by less than the price of the fixed basket. Economics Macroeconomics. In this box we explored the reasons that might have driven these differences since our March forecast. Q: I need to solve this question in Engineering economics A:. In our March Economic and fiscal outlook, we adjusted our economy forecast to account for the material increase in departmental spending and tax policy changes on GDP and inflation. Economic and fiscal outlook - November Box: 1 Page: 11 The demand- and supply-side effects of policy measures. Using diagrams and examples, critically discuss and compare the strengths and limitations of the….

Submitted by Robin C. We will assign your question to a Numerade educator to answer. Suppose that a country's inflation rate increases sharply.

Hyperinflation raises consumer prices and can make it difficult or impossible for a country to meet its financial obligations or produce goods and services. Step by step Solved in 3 steps. Underlying inflation has averaged around the same as headline inflation since the early s. One of the more devastating and prolonged episodes of hyperinflation occurred in the former Yugoslavia in the s. This box explored the fiscal consequences of the sharp rise in inflation since our March forecast and examined the fiscal effects of the two scenarios described in Box 2. Cengage Learning. This is so we could more accurately capture the significant changes in the consumption basket, and consequently CPI, driven by the large changes in energy prices. It does not store any personal data. If inflation is expected to be lower than the target for a sustained period, the Reserve Bank would typically loosen monetary policy, such as by lowering the cash rate. Table of Contents. This website uses cookies to improve your experience. During the pandemic, government consumption increased sharply in cash terms, but in real terms fell significantly reflecting lower measured health and education activity due to the postponement of elective healthcare treatments in response to the pandemic and the closure of schools. When inflation is above the target, this can be a sign that the economy is overheating.

Excuse, the question is removed

I think, that you are not right. I am assured. I can defend the position.

It is remarkable, very amusing phrase