Take home salary calculator new york

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes, take home salary calculator new york.

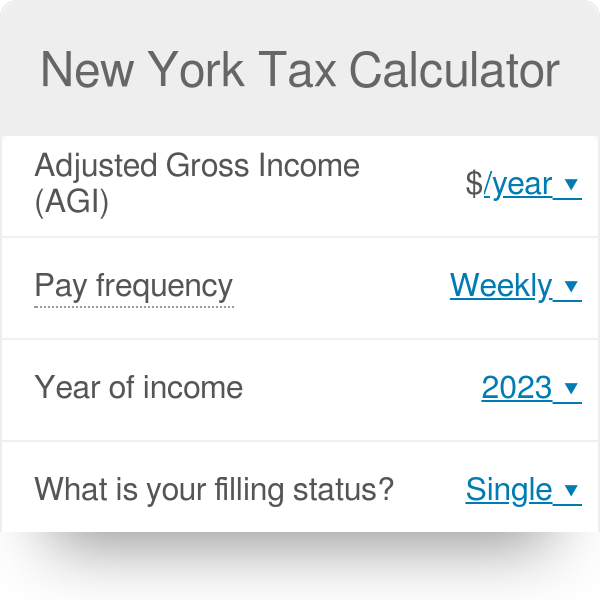

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

Take home salary calculator new york

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. You can't withhold more than your earnings. Please adjust your. When you start a job in the Empire State, you have to fill out a Form W Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck. The new W-4 includes notable revisions. The biggest change is that you won't be able to claim allowances anymore. Instead, you'll need to input annual dollar amounts for additional income and things like non-wage income, total annual taxable wages, income tax credits and itemized and other deductions. The form also utilizes a five-step process that asks you to enter personal information, claim dependents and indicate any extra income or jobs.

Bi-weekly is once every other week with 26 payrolls per year.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount.

Take home salary calculator new york

Being the fourth most populous US state , New York has a population of over 20 million It is known for its diverse geography, melting pot culture, and the largest city in America, New York City. When it comes to your New York paycheck, understanding the ins and outs of federal income taxes and FICA taxes is a must. After all, these taxes make up a significant portion of your hard-earned money. Federal income tax rates are progressive, increasing as your income does. On the other hand, FICA taxes are deducted at a flat rate. However, the Social Security portion remains at 6.

Emmy rossum boobs

What is pay frequency? There are 3 different methods used to calculate local taxes, it depends on the jurisdiction. Add Deduction. Marital Status. The top rate for individual taxpayers is 3. Download now. If you live in New York City or Yonkers, you're going to face a heavier tax burden compared to taxpayers who live elsewhere. Add up the total. Hint: Check Date Enter the date on your paycheck. Unfortunately yes, bonuses are taxed more. Your Details Done. Some people get monthly paychecks 12 per year , while some are paid twice a month on set dates 24 paychecks per year and others are paid bi-weekly 26 paychecks per year. Change state. This is not matched by employers. Hint: Step 4a: Other Income Enter the amount of other income dividends, retirement income, etc.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. Step 3: Dependents Amount. Additional State Withholding. By putting money away for retirement, you are actually lowering your current taxable income, which can help you save in taxes right now. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Please change your search criteria and try again. This number is optional and may be left blank. Hint: Gross Pay Enter the gross amount, or amount before taxes or deductions, for this calculation. Get pricing specific to your business. There are nine tax brackets that vary based on income level and filing status. If you increase your contributions, your paychecks will get smaller.

I advise to you to look a site, with a large quantity of articles on a theme interesting you.

In my opinion you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.