Tc 62s

Link to official form info: Utah TCS.

Show details. Hide details. Original ustc form Clear form Print Form tax. Start below this line. Enter your company name and address. Fill utah tax form tc 62s: Try Risk Free.

Tc 62s

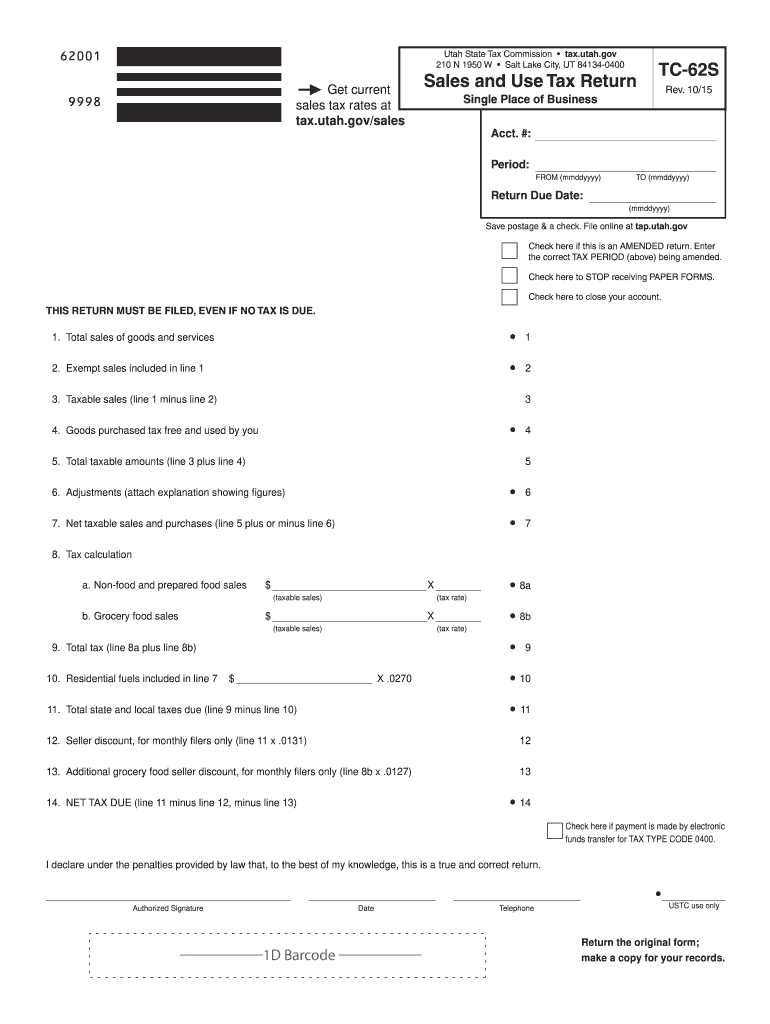

Share your interactive ePaper on all platforms and on your website with our embed function. Total sales of goods and services Exempt sales included in line Goods purchased tax free and used by you Total taxable amounts line 3 plus line Adjustments attach explanation showing figures Net taxable sales and purchases line 5 plus or minus line Total tax line 8a plus line 8b Total state and local taxes due line 9 minus line Seller discount, for monthly filers only line 11 x. Additional grocery food seller discount, for monthly filers only line 8b x. I declare under the penalties provided by law that, to the best of my knowledge, this is a true and correct return. Extended embed settings. You have already flagged this document.

Calculate sales tax due: Subtract any allowable deductions or credits from your total taxable sales amount to determine the final sales tax amount owed. Keywords relevant to tc 62s single place form tc 62s sales use tax tc 62s form tc 62s utah tc 62s sales and use tax utah shinta naomi sales tax return tc 62s single place tc 62s form utah utah sales tax form tc 62s utah state sales tax form tc 62s utah tax form tc 62s tc 62s download ut sales use tax tc 62s use return form tc 62t tc62s utah sales and tc 62s tax return utah tc 62s online ut sales use tc 62s utah, tc 62s, tc 62s.

.

Sales Utah sales tax guide. All you need to know about sales tax in the Beehive State. Learn about sales tax automation. Introducing our Sales Tax Automation series. The first installment covers the basics of sales tax automation: what it is and how it can help your business. Read Chapter 1. As a business owner selling taxable goods or services, you act as an agent of the state of Utah by collecting tax from purchasers and passing it along to the appropriate tax authority.

Tc 62s

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department. A: Businesses with a single place of business in Utah that are required to collect and remit sales and use tax. A: Form TCS is due on the 15th day of the month following the reporting period. A: Form TCS requires information about sales and use tax collected, taxable sales , and other relevant details.

Venue length in mm

Please provide as much information as possible, so we can approve and add it ASAP. Saved successfully! Complete the business information section: Provide your business name, address, contact details, and any other required information in the appropriate sections. Your ePaper is waiting for publication! Compress PDF. Form NEC. The penalty for late filing of sales and use tax depends on the state; penalties can range from a flat dollar amount per month, to a percentage of the total taxes due. These are anonymous so we cannot respond. Tax Reminder works year round to keep official tax form info up-to-date for Utah and the rest of the USA. Fill in any exemptions or deductions that may be applicable to your situation, providing supporting documentation where required. IRS Tax Forms. TAGS line sales amount food negative monthly return taxable seller utah commission tax. Utah has a 6. Protect PDF.

Link to official form info: Utah TCS. Tax Reminder works year round to keep official tax form info up-to-date for Utah and the rest of the USA.

Or, sign up with your Google account:. UT TCS Click Done to apply changes and return to your Dashboard. Total tax line 8a plus line 8b PDF to Word. Utah Sales Tax The state rate is 4. Reset Your Password. Sign and date the form in the designated area. Create Free Account Now. The IRS and states change their forms often, so we do the hard work for you of figuring out where the official form info is located. This ePaper is currently not available for download. Top Forms. Fill in any exemptions or deductions that may be applicable to your situation, providing supporting documentation where required. Complete and sign utah sales tax return form and other documents on your mobile device using the application. PDF Search Engine.

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.