Td balance transfer

Additional fees and account terms are described in the Credit Card Agreement that will be enclosed with the card if a card is issued. TD Bank, N. TD Bank may change the terms disclosed td balance transfer and in the Credit Card Agreement together, the "Agreement" at any time subject to applicable law. For example, we may add new terms and fees before or after the Account is opened in accordance with the Agreement, based on information in your credit report, market conditions, td balance transfer, or our business strategies.

The TD FlexPay Credit Card is ideal for someone who wants to transfer another credit card balance and who likes the idea of a late payment safety net. APR: As of May , New Jersey-based TD Bank offers a balance transfer credit card option in its burgeoning card portfolio. It aims to distinguish itself from other balance transfer cards with a forgiveness policy for late payments once per year, which is appealing for consumers who need a little cushion in their budget from time to time. Rewards: None.

Td balance transfer

After that, Visa benefits Get Visa benefits like cell phone protection when you pay your monthly mobile bill with your card 1. Late fee forgiveness We'll automatically refund your first late fee each year. Please note, past due payments may impact your credit score. Need more information? Every TD Bank Credit Card comes with an added layer of protection such as emergency card replacement, roadside assistance and more. Past due payments will be reported to credit bureaus subject to applicable law and standard practices. This may affect your credit score. For more information, see Terms and Conditions. By clicking on this link you are leaving our website and entering a third-party website over which we have no control. Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of third-party sites hyper-linked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third-party sites. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. You are now leaving our website and entering a third-party website over which we have no control. Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Add your credit card to your digital wallet. Learn how NerdWallet rates credit cards.

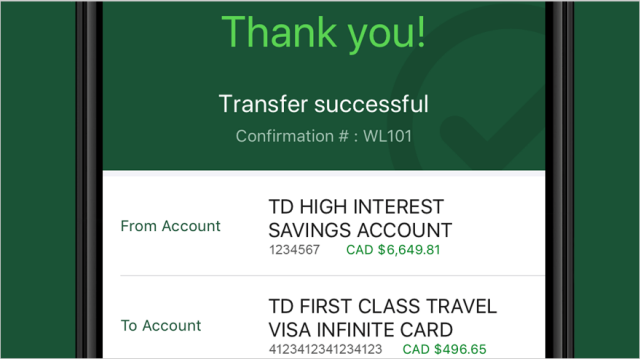

New card? Activate now. Use the new Payment Center to pay your bill. Need to enroll in Online Banking? It's easy to do online or in the TD Bank app. Enroll now. Check under Balance Transfer to see if there's an offer or contact TD to initiate a balance transfer request.

After that, Visa benefits Get Visa benefits like cell phone protection when you pay your monthly mobile bill with your card 1. Late fee forgiveness We'll automatically refund your first late fee each year. Please note, past due payments may impact your credit score. Need more information? Every TD Bank Credit Card comes with an added layer of protection such as emergency card replacement, roadside assistance and more. Past due payments will be reported to credit bureaus subject to applicable law and standard practices. This may affect your credit score. For more information, see Terms and Conditions. By clicking on this link you are leaving our website and entering a third-party website over which we have no control.

Td balance transfer

How to enroll in Online Banking — Web. How to enroll in Online Banking — Mobile App. How to enroll in Online Banking. How to log in to Online Banking.

Royal alakai hotel

Get our best balance transfer offer. Jae Bratton Email. Our opinions are our own. By submitting a credit card application to TD Bank, I also certify that no essential information has been concealed and that no misrepresentations have been made on the application. Continue to Site. First Class miles are only redeemable upon request. We found a few responses for you:. I am at least 18 years of age. Learn how to pay quickly and easily by tapping your card. What is the interest rate for my TD Credit Card? New York State Department of Financial Services 1 Balance Transfers: You may be able to transfer balances from eligible credit card accounts to your TD credit card account. You are now leaving our website and entering a third-party website over which we have no control. Enroll now. How to Avoid Paying Interest on Purchases:. Past due payments will be reported to credit bureaus subject to applicable law and standard practices.

For anyone tired of keeping track of rotating bonus categories, activation periods, caps or limits, this card is an easy-to-use option. See rates and fees. Both cards have no annual fee, but the TD Double Up card has quite a few noteworthy perks that add to the reasons why you may want to have it in your wallet.

What is the fee? Did we answer your question? Miles will be deducted from the miles balance available that day, and the value of those miles will be applied to your TD First Class Visa Signature Account in the form of a statement credit. In person. Foreign Transaction Fee. Unless you change your preferences these technologies allow TD and our ad partners to better align ads with your banking goals. Service is currently unavailable. However, the late payment will be reported to the credit bureaus and could cause your credit score to decrease. Travel: The Travel Spend Category may include merchants offering the purchase of airline tickets, hotel stays, car rental agencies, train tickets, bus lines, travel agencies, cruise lines along with parking and tolls. Have you checked for special offers?

Moscow was under construction not at once.

You have missed the most important.