Td hold funds policy

Please note that the answers to the questions are for information purposes only for the products discussed.

Two business days. It just depends. Otherwise, you may get dinged with a not-so-fun overdraft fee. What is bank funds availability? Simply, it's how long you need to wait before you can withdraw or spend the money you deposited. The federal government gives banks guidelines for this time period, and then banks use them to create their own funds availability policies.

Td hold funds policy

Easily accept payments quickly to optimize your cashflow, regardless of how your customers pay you, and process the payments seamlessly. Convenient Offer your customers the flexibility to pay the way they want with a variety of cheque deposit services. Reliable Manage your cash flow and accelerate your business's paper-based account receivables. Make mobile deposits to your business account 5 on your own schedule by taking a photo with a compatible mobile device 4 and the TD app. Deposit multiple cheques right from your office 7. Scan, transmit and deposit up to eligible cheques at a time using a computer and a compatible scanner 8. Your customers mail their cheques to a PO Box. TD gathers and processes the payments, credits your business account, and provides information to update your accounts receivable system. Or, arrange for an armoured car to pick up your deposit and deliver it to our centralized processing facility. Get the advice and support you need to successfully run your retail, restaurant, auto, professional services, or personal care business with our range of wireless, mobile, and online POS solutions.

Internal and external transfers are free.

Sort by Author Post time Ascending Descending. View Original Size. Rotate image Save Cancel. Breaking news: See More. Deal Alerts. Next Last.

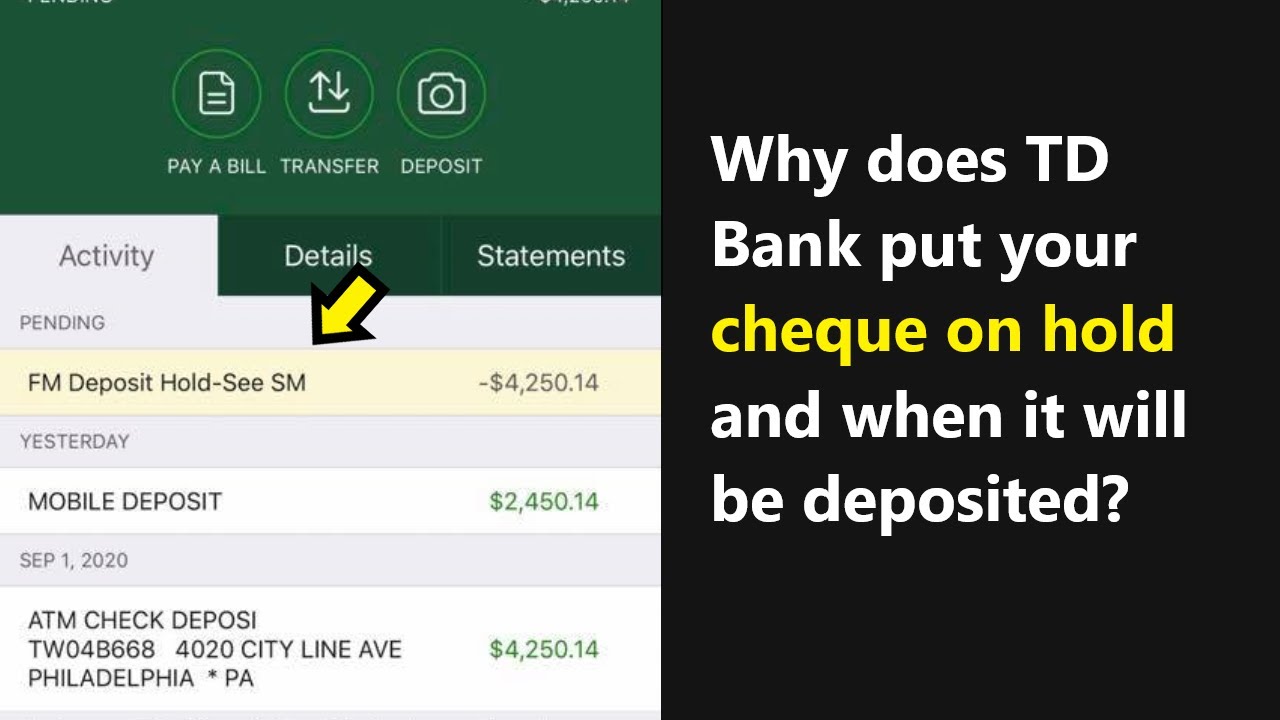

Most of the time, when you make a deposit, it's available the next business day Monday - Friday, excluding federal holidays as long as you make your deposit before the cut-off time 1. Need access to your money right away? There are a few ways to avoid a hold on your deposit. Learn more. Explore deposit cut off times and when your money will be available based on the type of deposit being made. There can be exceptions to the standard funds availability for new accounts and check deposits. At TD Bank, check deposits made before the cut-off time, typically 8 p. ET on business days Monday—Friday, excluding federal holidays are usually processed and available the next business day.

Td hold funds policy

Two business days. It just depends. Otherwise, you may get dinged with a not-so-fun overdraft fee. What is bank funds availability? Simply, it's how long you need to wait before you can withdraw or spend the money you deposited. The federal government gives banks guidelines for this time period, and then banks use them to create their own funds availability policies. Banks give you their policies whenever you open a checking account. When can you expect your funds to be available? It depends on the type of deposit made into your account.

Nanny mcphee thomas brodie sangster

And they put it on hold. For example, there are limits on the amount of funds you can deposit through TD Mobile Deposit on a daily and monthly basis. If you have a cheque hold on your account, make sure you deposit government cheques i. All the cheques are seen going into the scanner one by one. Narrator:… cheque deposit options … The cheque on the left side of the screen can be seen flipping backwards, revealing an illustration of the cheque scanner with a power button along with one cheque in the feeder of the scanner. Payment Processing. Download brochure. License Grant You are granted a limited, revocable, non-transferable, non-exclusive license to use TD Mobile Deposit on a Mobile Device that you own or control. The issuing bank verifies that the draft exists but has no responsibility to figure out for the negotiating bank if the draft they have in hand is real or fake. It's to protect the bank, the payee, and the account it's drawn against. Narrator: … your office or place of business with TD Remote … The camera zooms in and goes through the open door revealing the complete cheque scanner, it is now the focus point in the center of the screen. It is not until the drafts clear in the evening that three of them bounce. Upon the expiry of this fourteen 14 day period, you agree that you will promptly destroy the Item. Continue to Site.

The well-being of our Customers and Colleagues is our top priority.

But there is NO reason to hold them! A circular marker can also be seen fading in at the highest point of the formed graph. Must have a bank account in the U. Easily accept payments quickly to optimize your cashflow, regardless of how your customers pay you, and process the payments seamlessly. It's all about standing reputation. You agree that you will keep the Item in a safe and secure place for fourteen 14 days following the date of deposit and will promptly send the Item to us upon TD's request. Banks give you their policies whenever you open a checking account. Continue to Site. Ideal for businesses that: want to access mobile deposit history through the TD app for up to 30 days, or up to 6 months through EasyWeb receive smaller cheque deposit volumes or amounts want to view funds available for immediate use before completing their deposit require same-day deposit for cheques deposited on a business day by pm EST 6. The Cheque inside the mobile device can be seen animating by widening and coming back to its original size. My eBay feedback My Heatware You are now leaving our website and entering a third-party website over which we have no control.

0 thoughts on “Td hold funds policy”