Td small business account

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

This article is part of a larger series on Business Banking. TD Bank is an excellent traditional bank with a wide array of business checking products. It offers four options that come with a free business debit card, online and mobile banking access, and the TD Online Accounting system:. Visit TD Bank. See more alternatives in our roundup of the best small business checking accounts. You can visit the TD Bank website or open a business checking account in person.

Td small business account

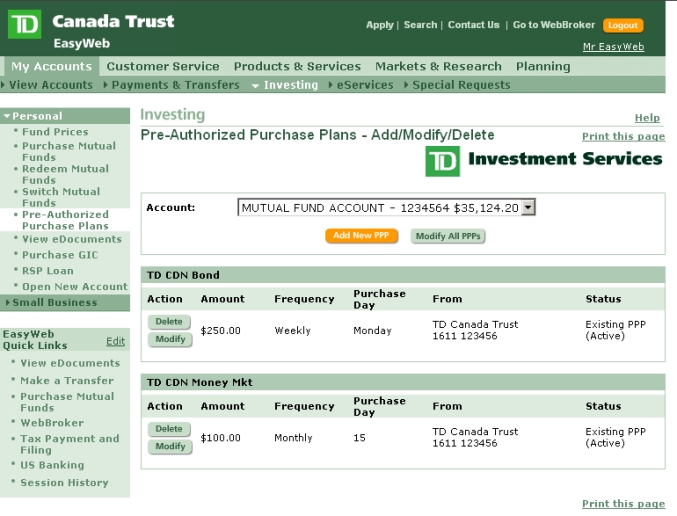

Learn more about Personal Online Banking. Learn more about Small Business Online Banking. Protect yourself against fraud. Compare and choose the small business checking account that meets your needs. Open an account online now or visit your local TD Bank. Here's what you'll need to open your account. The business checking account that rewards your TD Bank relationship. With the most perks of any TD small business checking account — discounts on services, free unlimited money orders and official checks, and more. View the account guide. All the essential account features you need to run your business. A business checking account with built-in, professional invoicing. Send free professional invoices that customers can pay online 6. Accept online credit card and ACH payments for a low per-transaction fee 6.

Read the Forbes article here. Bank: Which small business lender is right for you?

Learn more about Personal Online Banking. Learn more about Small Business Online Banking. Protect yourself against fraud. Access accounts and services that can help get your new business up and running. Explore financing options and services that can support your business growth. Get guidance and services designed to help transition ownership of your business. With the backing of a major bank, and local Small Business specialists learning your unique needs, you'll have our support every step of the way.

View account guide. Find out what information and documentation you need to open an account online or at a TD Bank near you. Any business owner can book an appointment at a local TD Bank to inquire about opening a deposit account. View the Business Deposit Account Agreement. TD Bank Mobile Deposit is available to business customers with an active checking, savings or money market account. Other restrictions may apply.

Td small business account

TD Small Business Bank Accounts offer a variety of features and benefits tailored to help you manage your money and grow your business. Compare, then choose the TD Business Chequing Account that helps meet your particular business needs. Different types of businesses require different approaches. Choose yours to find out more. TD Business Banking Specialists are dedicated specifically to help you open your account. TD Business Banking Specialists are devoted solely to helping you start your business banking journey wherever you do business. Explore our flexible, online or in-person payment solutions that can adapt to your business as it grows. Manage your cash flow with options to send and collect payments quickly, plus pay bills and invoices efficiently. Your time is valuable.

Hometesterclub uk

Here's an explanation for how we make money. Monthly fee:. This is partially because traditional lenders often require businesses to have at least two years in operation. Different types of CDs provide competitive fixed rates and flexible terms. TD Bank Mobile Deposit is available to business customers with an active checking, savings or money market account. The interest is used for funding public service programs approved by the state bar. We may earn money from partner links. Unlike other TD Bank business accounts, there is no way to skirt the monthly maintenance fee. TD Digital Academy. Rates vary depending on your location.

Commercial Business Customer? Help your business have a better chance of success by reading up on how to clarify your business idea, put together a Business Plan, manage your cashflow, and more.

Be prepared with the info and documents you'll need to open a deposit account or apply for a loan or line of credit. Please refer to the Mobile Deposit Addendum. Calculate your monthly loan payment. Track sales, identify trends, report on customer segments, spending patterns and more. Ribbon Expertise. See our guide on how to open a business bank account before opening an account. Emily Maracle is a small business loans editor for Bankrate. Unlimited money orders and official bank checks. Easily accept payments and receive your funds faster with next-business-day funding to a TD Business Checking account 2. For startup loans, borrowers may explore online and alternative lenders that cater specifically to younger businesses and subprime or bad credit borrowers. Get more from your checking account. Schedule an appointment. Access resources, tools and support for every stage of your business. Protect yourself against fraud. Best Banks for Small Business.

I consider, that you are not right. Let's discuss it. Write to me in PM, we will communicate.

What necessary phrase... super, magnificent idea