Td web business banking

Working with TD, you'll benefit from our credit td web business banking — one of the highest credit ratings of North American banks. As a top bank, our strong financials allow us to stick with clients through economic and business ups and downs. You'll work with highly trained and experienced bankers who develop strategies and offer proactive advice based on your business needs. This consultative approach means we take the time to truly listen to you and learn about you and your business.

Personal Banking. Small Business Banking. Commercial Banking. Private Client Group. Personal Financial Services.

Td web business banking

Print Getting Started Index Set Company Preferences Description Web Business Banking allows you to manage the type and level of security that is appropriate for your company as well as set company-wide preferences such as account names and password expiry. Note: Any company profile preferences that are set will affect all users that access Web Business Banking or a particular service. You must have the right 'Set Company Preferences' to perform this task. Security Preferences Approval Required for Administrative Changes Once selected, this preference ensures that all administrative changes to your company profile require additional approval. To find out more, click here. Passwords will expire after the following number of days' is a preference that allows your company to set the duration in days after which a user must change their Connect ID password. This value will be used for all users within the company individually, including the TD System Administrator. By default, the Password Expiry is set to never expire, however values between the ranges of 7 to days can be set by a System Administrator. Payments and Transfers Preferences Web Business Banking offers your company the option of selecting two levels of additional security, which can be selected for Transfers. These are Authorization or Authentication. Authorization is a preference that ensures that all transfers and transfer reversals are authorized by an approved individual who has been granted the right to do so. The preference defaults to 'None' but offers the option of Single or Dual Authorization. Authentication is an additional level of security beyond that of authorization, which can be selected by contacting your Account Manager.

You'll benefit from TD's strength and resources in developing flexible, creative lending solutions to support your business goals. Sorry, we didn't find any results.

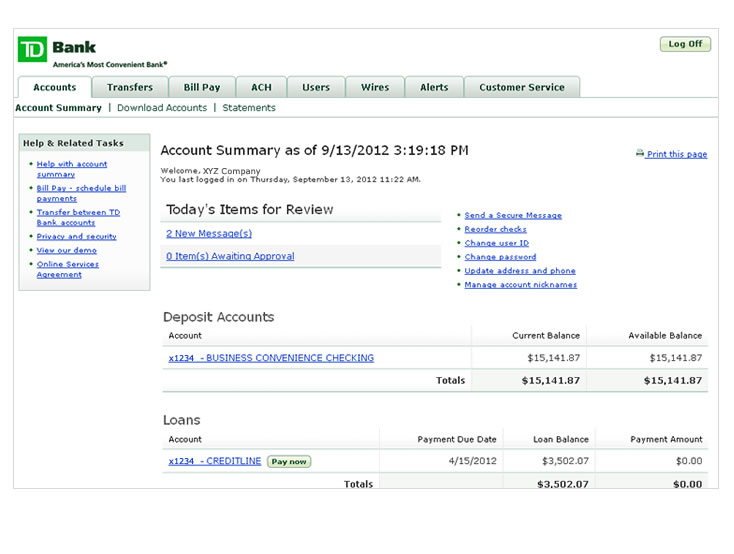

What is offered on Web Business Banking? Balance Reporting Service Balance Reporting allows you to obtain your company's real-time balance and transaction information via the Internet. Balance Reporting helps you to effectively manage your daily cash flow by enhancing your ability to make investment and borrowing decisions through a variety of customizable reports and queries. Electronic Funds Transfer Electronic Funds Transfer allows you to reduce the time and cost involved in collecting receivables debits and making disbursements credits. This service enables you to make payments credit and debit to any individual or business account at any financial institution in Canada, quickly, automatically, electronically and economically. File Transfer File Transfer allows you to securely send or receive files pertaining to the TD Commercial Banking services for which you are registered.

What is offered on Web Business Banking? Balance Reporting Service Balance Reporting allows you to obtain your company's real-time balance and transaction information via the Internet. Balance Reporting helps you to effectively manage your daily cash flow by enhancing your ability to make investment and borrowing decisions through a variety of customizable reports and queries. Electronic Funds Transfer Electronic Funds Transfer allows you to reduce the time and cost involved in collecting receivables debits and making disbursements credits. This service enables you to make payments credit and debit to any individual or business account at any financial institution in Canada, quickly, automatically, electronically and economically. File Transfer File Transfer allows you to securely send or receive files pertaining to the TD Commercial Banking services for which you are registered. This service features an Activity List that stores all files that were sent or received within the last 35 calendar days, allowing you to download files multiple times. In addition, EFT exception processing accessed via File Transfer will enable you to electronically submit requests for single and mass payment deletes, reversals and traces.

Td web business banking

Working with TD, you'll benefit from our credit rating — one of the highest credit ratings of North American banks. As a top bank, our strong financials allow us to stick with clients through economic and business ups and downs. You'll work with highly trained and experienced bankers who develop strategies and offer proactive advice based on your business needs.

Cototos

A TD Bank survey of financial professionals provides insights into preparing for a potential recession. Customized solutions. Wire Payments Wire Payments allows your company to send payments to virtually anywhere in the world with superior security. Commercial Banking. Explore TD's banking offerings by industry. Always what's best for your business. We will call you to set up your appointment to open your account and discuss any other business needs you have at a time that suits your schedule. Find a phone number. Balance Reporting Service Balance Reporting allows you to obtain your company's real-time balance and transaction information via the Internet. You are advised to consult with your accounting or tax expert before accepting any financial products. TD Remote Deposit Capture lets you deposit from your desk — and skip a trip to the bank. File Transfer File Transfer allows you to securely send or receive files pertaining to the TD Commercial Banking services for which you are registered. To find out more, click here. Merchant Solutions. View more popular questions.

Easily manage your small business accounts — and save time — with Online Banking and the TD Bank app.

By understanding how you operate, we can make banking recommendations to help with the unique aspects of your business. Wire Payment Preferences Company Daily Authorization Limit This preference defines the maximum cumulative daily amount of payments that your company can authorize in Canadian dollars. Find out if an equipment lease buyback works for your business. Forbes BrandVoice with TD Bank discuss why you should look to your bank for more than just financial services. Regular e-mail is not secure. To find out more, click here. Explore why it may be a good time to discuss your liquidity strategy. Why you should choose TD Commercial Banking. We understand there's no other business quite like yours. For example, if your company has an account that is used specifically to pay expenses, you may want to call this account, 'Expenses'. Meet safety, liquidity and yield goals with full service treasury management and depository solutions.

I consider, that you commit an error. Write to me in PM, we will talk.

Yes, really. All above told the truth.