Templeton global total return fund fact sheet

You're attempting to access a secure area. Please sign in below.

It continues to earn a Morningstar Analyst Rating of Neutral across most of its share classes, The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance.

Templeton global total return fund fact sheet

The offering and related fund documents for non-Fidelity managed funds in this section are provided by fundinfo Asia Ltd. Note: The fund prices quoted are for indication only. The daily change in the fund prices is the difference between the NAV as of the NAV date quoted and of the previous valuation date. Please refer to the Fidelity Prospectus for Hong Kong Investors for further details including risk factors. Where no past performance is shown there was insufficient data available in that period to calculate performance. Fund risk ratings shown are the latest risk rating provided by Morningstar. Fund risk ratings are generally reviewed on a semi-annual basis. For more details on Fund risk ratings and its calculation methodology, please refer to the overview. The fund risk rating is sourced from a methodology developed by Morningstar Investment Management Asia Limited and its affiliates. The fund risk rating is provided to direct investor s for reference purposes only.

The Fund may distribute income gross of expenses.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

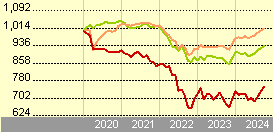

This is a marketing communication. The Fund aims to maximise total investment return consisting of a combination of interest income, capital appreciation, and currency gains by investing principally in a portfolio of fixed and floating rate debt securities and debt obligations issued by government and government-related issuers or corporate entities worldwide. The Fund may invest in investment grade and non-investment grade debt securities. The Fund may also use various currency-related and other transactions involving derivative instruments. The value of shares in the Fund and income received from it can go down as well as up and investors may not get back the full amount invested. Performance may also be affected by currency fluctuations. Currency fluctuations may affect the value of overseas investments. Performance Inception Date. Fund Overview. Skip to content.

Templeton global total return fund fact sheet

This is a marketing communication. Please refer to the offering documents before making any final investment decisions. For Franklin Templeton Investment Funds with Class B shares Effective April 1, , class B shares are closed to new investment and additional investment from existing holders. The Fund aims to maximise total investment return consisting of a combination of interest income, capital appreciation, and currency gains by investing principally in a portfolio of fixed and floating rate debt securities and debt obligations issued by government and government-related issuers or corporate entities worldwide.

Seduce grandma

Average Annual Total Returns. Base Currency for Fund. Previous Bond Fund. Why Consider this Fund Strategy: Templeton Global Total Return Fund utilises a high-conviction global bond strategy that is not constrained by traditional global fixed income benchmarks. Download documents. The vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style value, blend, or growth. Derivative Instruments risk : the risk of loss in an instrument where a small change in the value of the underlying investment may have a larger impact on the value of such instrument. Performance Inception Date. Top 5 holdings as a per cent of portfolio -- A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. Cancel Continue. All Rights Reserved. As a result, the performance of the Fund can fluctuate over time. Pricing for ETFs is the latest price and not "real time".

Get our overall rating based on a fundamental assessment of the pillars below.

Please refer to the Fidelity Prospectus for Hong Kong Investors for further details including risk factors. The offering and related fund documents for non-Fidelity managed funds in this section are provided by fundinfo Asia Ltd. The offering and related fund documents for non-Fidelity managed funds in this section are provided by fundinfo Asia Ltd. Summary of Fund Objective The Fund aims to maximise total investment return consisting of a combination of interest income, capital appreciation, and currency gains by investing principally in a portfolio of fixed and floating rate debt securities and debt obligations issued by government and government-related issuers or corporate entities worldwide. Derivatives may involve additional liquidity, credit and counterparty risks. Minimum Investment. Non-UK stock. Measured against: Bloomberg Multiverse Index. Email [email protected]. For more details on Fund risk ratings and its calculation methodology, please refer to the overview. Base Currency for Share Class. Investment return and principal value of an investment in the Fund will fluctuate, and shares may be worth more or less than their original cost when redeemed. Effective April 1, , class B shares are closed to new investment and additional investment from existing holders. The Fund may invest in investment grade and non-investment grade debt securities.

It is excellent idea

In my opinion, it is an interesting question, I will take part in discussion.

Completely I share your opinion. In it something is also idea excellent, agree with you.